The US Department of Agriculture has flagged that India’s wheat stocks are falling to very low levels. India’s government prioritises food security. Might imports be on the horizon?

Markets Feel Pressure

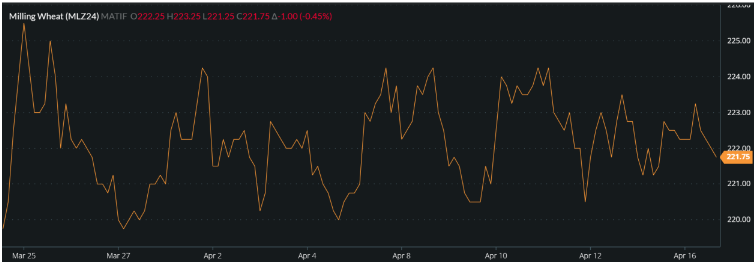

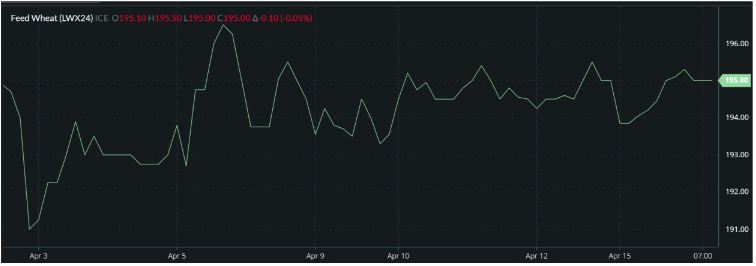

The charts below demonstrate the pressures being felt by the markets in both directions, from the bears one minute and the bulls the next.

Funds are maintaining their large short positions, while daily news headlines range from adverse weather events, conflict in Ukraine, the escalation in the Middle East and other notable geopolitical wrangles.

The market will find its direction in time, possibly remaining rangebound, but more likely, something will give the bulls or the bears adequate conviction to drive it one way or the other.

Chart 1 Paris Milling Wheat Dec’ 24

Chart 2 London Feed Wheat Nov’ 24

Chart 3 Kansas Hard Red Wheat Dec’ 24

Source: Barchart Commodityview

The WASDE and India

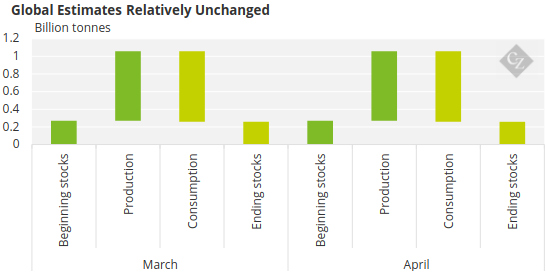

There wasn’t much excitement on the wheat markets following Friday’s monthly WASDE report.

In comparison to last month’s report, on a global scale for 2023/24:

- Production saw a small increase from 786.7 million tonnes to 787.36 million tonnes.

- Demand was raised from 798.98 million tonnes to 800.10 million tonnes.

- World end stocks were thus left marginally smaller at 258.27 million tonnes, down from 258.83 million tonnes.

Source: USDA

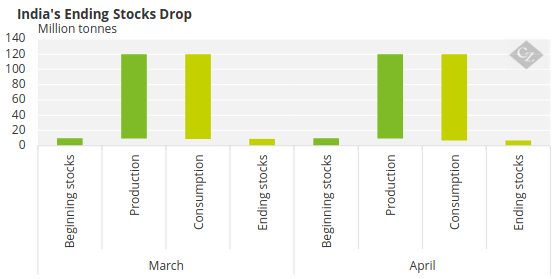

These headline numbers gave little for the market to run with, although the numbers from India were, in contrast, very interesting:

- Production remained stable at 110.55 million tonnes.

- Demand was increased from 111 million tonnes to 112.97 million tonnes.

- India’s end stocks are predicted to fall to a mere 6.90 million tonnes, down from 9 million tonnes last month.

Source: USDA

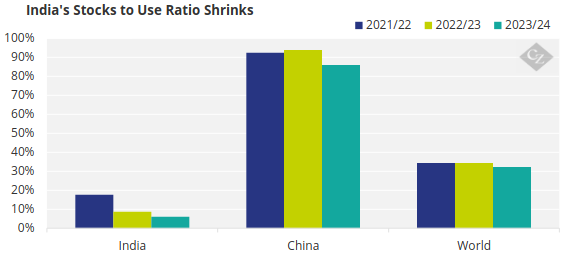

Noting that India’s 2021/22 end stocks were 19.5 million tonnes, this is a major decline, especially when considered in terms of stocks to use ratio. This is now a very poor 6.1% compared with the global 32.2% or the Chinese number of 86%!!

Source: USDA

This unease is compounded if some recently published production estimates are true. Indian flour mills for instance believe they will produce 105 million tonnes. This would essentially wipe out the anticipated year end stocks.

The expectations are that India’s demand will grow next year and this will lead to a need for either a record harvest or potentially imports. It was only a few months ago that we mentioned India discussing the potential for up to 10 million tonnes of mainly Russian imports.

Conclusions

- Weather will continue to pull and push wheat prices on a daily basis depending upon crop predictions for the upcoming 2024 harvests.

- Funds are likely to provide some bullish sentiment over the coming months as and when they close out their hefty short positions.

- Conflicts escalating or calming, together with any major political issues will have the ability to significantly alter the world stage.

- A close eye should most certainly be kept on India. It has arguably the largest population on Earth, political elections and an absolute need for food security.

- Any large-scale need for imports in India, most likely from Russia, will unquestionably excite the market bulls across the world……watch this space!