Insight Focus

India secured a 1-million-tonne urea tender, but prices remain uncertain. Phosphate prices have held due to limited Chinese exports. Potash prices rose slightly, while Brazil remains steady. Ammonia prices are firm in the West and bearish in the East.

India’s Urea Tender Influences Prices

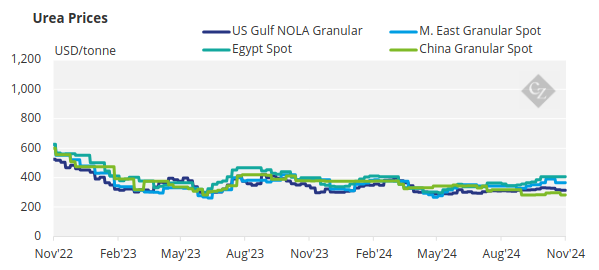

India’s government agency IPL secured just over 1 million tonnes in its urea import tender, which closed on November 11. Supplies to the west coast of India are scheduled by December 25 at a price of USD 362/tonne CFR. This time, the urea will come from the Middle East, with smaller amounts from Russia, Nigeria and Malaysia.

It is expected that some of the urea could originate from sanctioned Iran, as in previous Indian tenders, particularly now that FOB prices have come under pressure due to lack of sales and the need to export.

Prices are anticipated to be in the USD 290s/tonne FOB range at best, compared to the official price of USD 311/tonne FOB. Iran’s January–October urea exports totalled 4.84 million tonnes, up 17% (696,000 tonnes) compared to the same period last year. Turkey remains the largest recipient with 1.96 million tonnes, while another 1 million tonnes was exported to Brazil. Transshipments via Oman are said to be close to 600,000 tonnes.

Internationally, prices appeared to rise immediately following the conclusion of the Indian tender. Egyptian producers became active and reportedly sold 100,000 tonnes over the past few days at prices jumping from the USD 337–343/tonne FOB range to between USD 350–366/tonne FOB, with one 10,000-tonne December loading parcel at the higher level. This represents an increase of about USD 29/tonne since the start of the week.

In other markets, prices have retracted due to a lack of demand from Brazil, which already has a urea lineup through December of more than 1.5 million tonnes. Additionally, an armada of ships carrying ammonium sulphate is en route from China.

Brazil is being offered urea at around USD 350/tonne CFR, but there is little interest. Southeast Asian markets remain quiet, and Pupuk Indonesia is said to have scrapped its latest urea tender, which had a minimum price of USD 370/tonne and the highest bid at USD 340/tonne FOB. Rumours suggest a small 6,000-tonne granular urea cargo was committed at USD 358/tonne FOB, but this has not been confirmed.

In the US, imports are significantly reduced, with net imports from July to date only 474,000 tonnes compared to 1.3 million tonnes in the same period last year. This represents a 45% reduction compared to the lowest supply volume recorded.

The urea price is expected to remain uncertain in December unless major markets like the US come into play. As always, India alone cannot sustain urea prices, and other markets need to contribute for prices to hold.

Phosphate Market Mixed

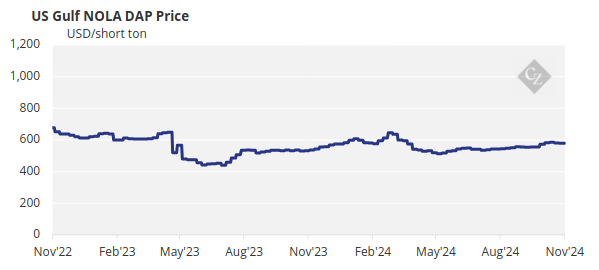

On the processed phosphate side, Brazil’s MAP prices remain flat at around USD 635/tonne CFR. This price has persisted for the past four months due to limited affordability and supply constraints. Brazil’s combined phosphate fertilizer imports of DAP/MAP/NP/NPK/TSP/SSP increased by 5.1% in the January–October period compared to the same period last year, totalling 11.2 million tonnes. MAP/DAP imports declined during this period, while other products saw substantial increases.

DAP prices from China firmed slightly this week, rising by around USD 2–3/tonne FOB to levels between USD 605–620/tonne, driven by limited availability due to sales to Ethiopia, Iran, India and further prospects for Ethiopia. Pakistan’s imports have been mostly muted over the past few months, with prices assessed at around USD 640/tonne CFR. This muted activity is attributed to relatively low domestic prices compared to import prices.

Bangladesh, on the other hand, has become active, floating another tender closing on November 18 for 200,000 tonnes of DAP, in addition to the 200,000 tonnes DAP/TSP tender that closed on November 10. The Islamic Trade Finance Corporation is said to be providing USD 1 billion in support for the 2025 fertilizer year.

Global phosphate fertilizer production costs have risen in recent months due to higher prices of ammonia, sulphur, sulphuric acid and phosphoric acid. In India, production costs for non-integrated DAP/MAP producers increased by USD 25–60/tonne in the past two months to October, with further increases in November. The outlook for processed phosphate prices remains bearish, with some correction expected in the coming weeks.

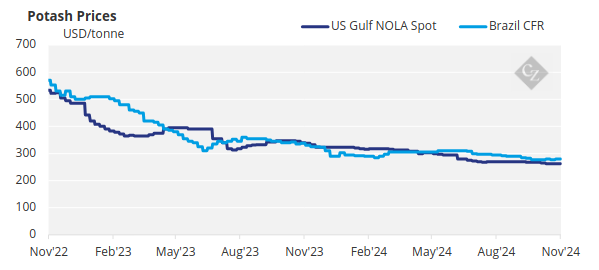

Potash Market Stable

Potash benchmarks were largely flat outside China and the Far East. Pupuk Indonesia awarded its long-awaited standard MOP tender at USD 302/tonne CFR, a USD 2/tonne increase from last week. Standard MOP prices are now assessed at USD 280–302/tonne CFR.

Brazil’s prices held at an average of USD 285/tonne CFR, with market activity shifting towards the upcoming Safrinha season. Indian MOP markets remained quiet as players assessed their needs ahead of the Rabi season.

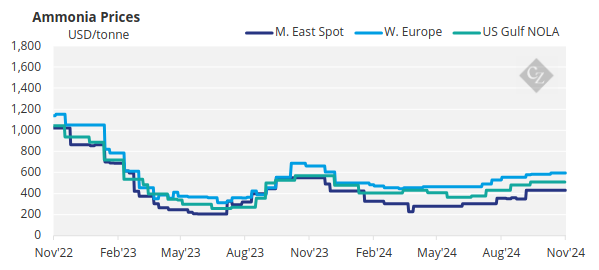

Algeria Shutdowns Support Ammonia

The ammonia market was active this week, with traders securing volumes to satisfy term requirements. Downward pressure was expected both east and west of Suez. However, shutdowns in Algeria and rising natural gas prices in Europe—driven by concerns over Russian supplies—mitigated bearish sentiment.

In the East, plants are running well in the Middle East and Southeast Asia, but subdued industrial demand is expected to lead to price declines.