389 words / 2.5 minute reading time

- India exported 489k tonnes of sugar in January, slightly less than Dec’19 shipments.

- February shipments six days in have shown a strong pace, however, with 281k tonnes already nominated.

- January saw the strongest flow of exports from domestic mills we have seen so far this season.

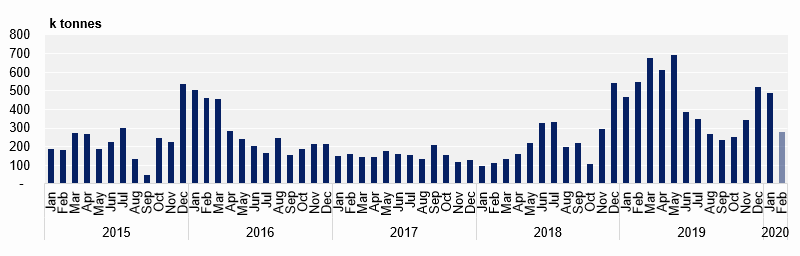

Total Exports

- India exported 489k tonnes onto the world market in Jan’20, up from 468k tonnes year-on-year (YoY).

- February’s line up is already promising with 280k tonnes having been committed in the first week of the month.

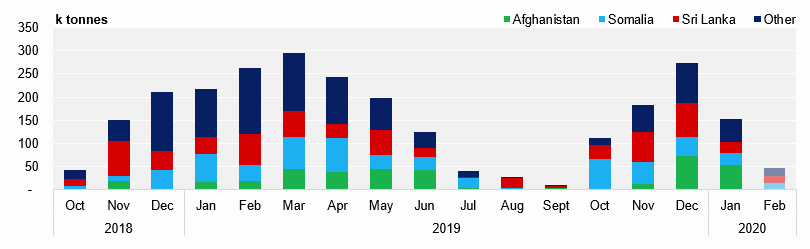

India Monthly Exports – Steady Pace Holds

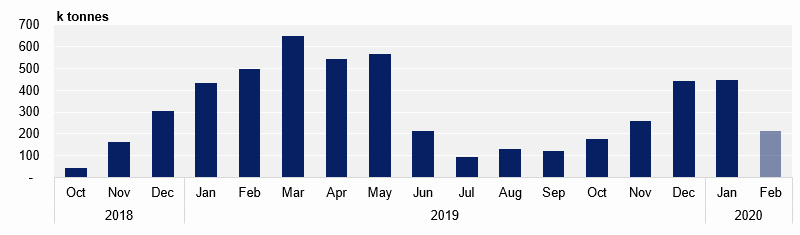

Mill Exports

- 444k tonnes of raw and white sugar were exported from Indian mills last month.

- February’s exports have started very well with 213k tonnes in the line-up already.

- So far this season, the domestic mills have shipped 1.5m tonnes of subsidised sugar, up 50% on last year.

Indian Domestic Mill Exports

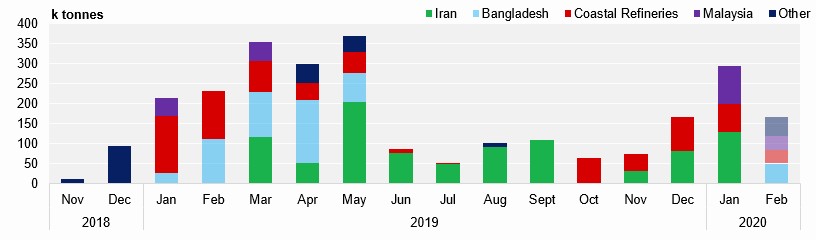

- January saw 293k tonnes of raw sugar ‘exported’ almost exclusively to Iran, Malaysia and coastal refineries, up from 166k tonnes in December.

- February already has 166k tonnes contracted, bringing this season’s raws exports up to 765k tonnes.

- February also sees the first shipments this season to Bangladesh, after taking 480k tonnes of Indian sugar last season they are inline to take 51k tonnes in February.

Monthly Mill Exports (Raw Sugar)

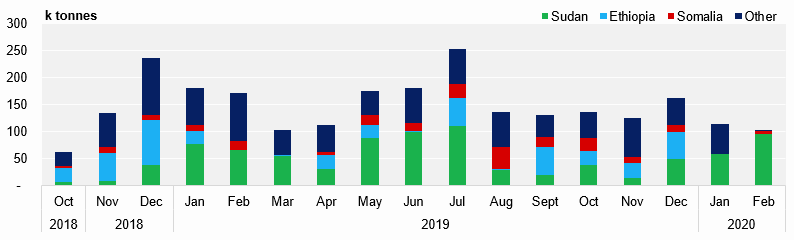

- Mill exports of white sugar in Jan’20 were slower than they were in the same period last season, down 65k YoY.

- After a busy November and December, exports to Sri Lanka in Jan’20 slowed down to four-month lows (23k tonnes from 72k tonnes MoM).

- Exports to Somalia have more than doubled YoY to 134k tonnes.

- With world market prices having rallied sharply in the New Year, we would these export flows to increase even further.

Monthly Mill Exports (White Sugar)

Refinery Exports

- Indian coastal refineries have exported at a slower pace in Jan’20 than they did in the same period last year.

- They only exported 114k tonnes, compared to 180k tonnes; this is a YoY decrease of 36%.

- Shipments to Djibouti have been slow this season compared to the average flows seen in 18/19.

- Sudan’s offtake has increased rapidly in 2020, January saw the highest offtake this season and February has already surpassed that with 96k having already been exported there.

- Flows to Ethiopia have also increased recently with 150k tonnes having sailed since September.

Monthly Refinery Exports