Insight Focus

There has been little change as the cane crush winds down and elections are in full swing.

Introduction

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

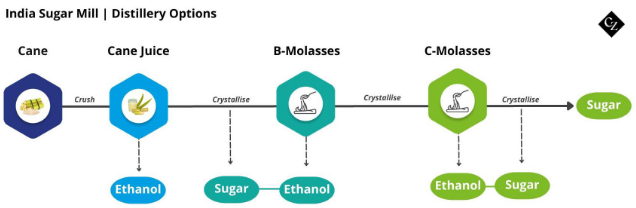

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

Maharashtra Sugar Imports/Exports

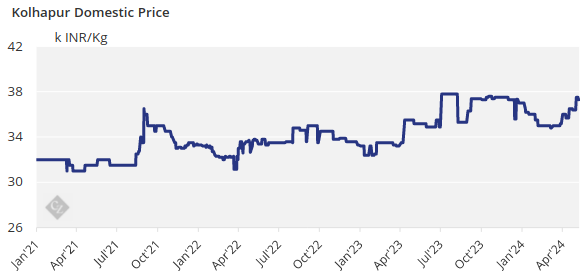

Domestic sugar prices have strengthened to 37.3k INR/kg.

There has been little change since our last update, and not much can be expected until the ongoing elections finish on the 1st of June. The government has further ruled out the possibility of allowing sugar to be exported for the time being, despite the pleas of the industry.

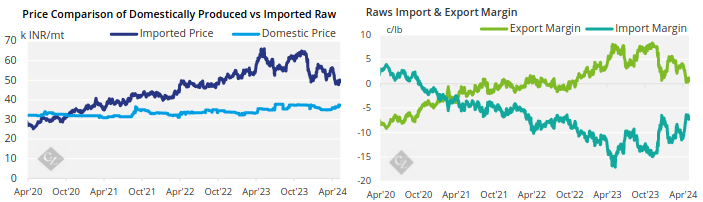

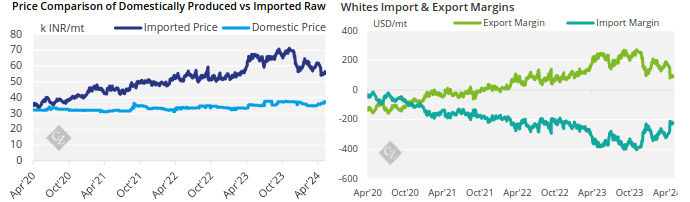

Imports continue to be unviable and production is better than initially expected making imports unnecessary.

That being said, the monsoon is also due to start next month. India is long overdue a good season of rainfall.

Should rain be better this season, we can expect higher agricultural yields which could lead to potential exports and a higher diversion rate of sugarcane to ethanol.

Ethanol vs Sugar

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

Sugarcane continues to be diverted for ethanol but is capped at 1.7m tonnes. It is unlikely that the government will increase the ethanol diversion for the current season but expect to hear more after the elections.

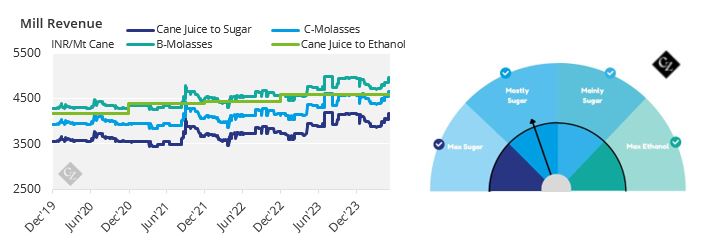

Mills are still being incentivised to use C-molasses instead of B-molasses and cane juice. The amount of sugar produced from C-molasses vastly outweighs ethanol production compared to using B-molasses and cane juice, resulting in less revenue generated by the mills as seen in the chart below:

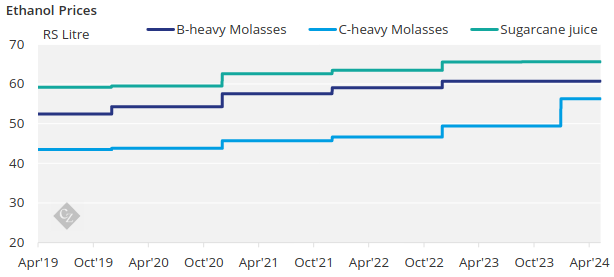

Here are the current prices paid for ethanol by feedstock:

Appendix