Insight Focus

Domestic sugar prices traded lower over the past month. Raw sugar and refined sugar export margins are positive. The Indian government has not authorised any sugar exports for the 2024/25 season.

Introduction

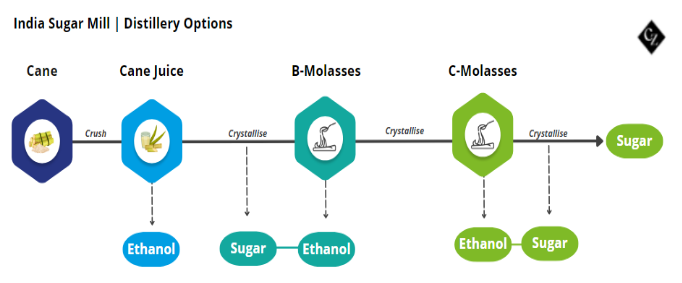

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

Maharashtra Sugar Imports/Exports

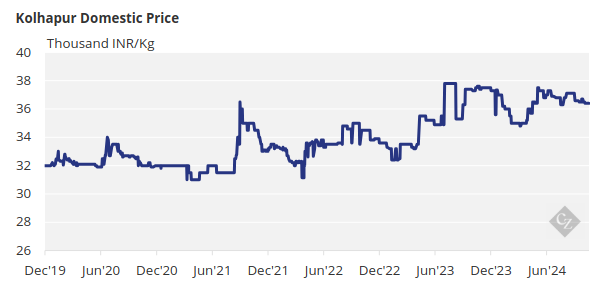

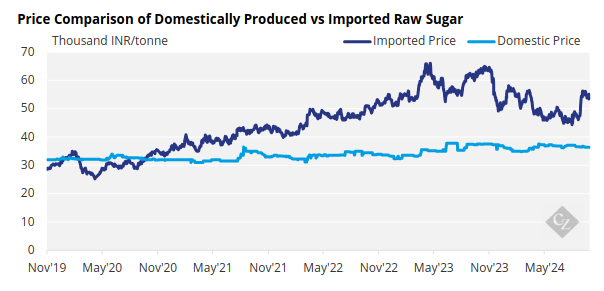

Domestic sugar prices are trading slightly lower than last month at INR 36,400/tonne.

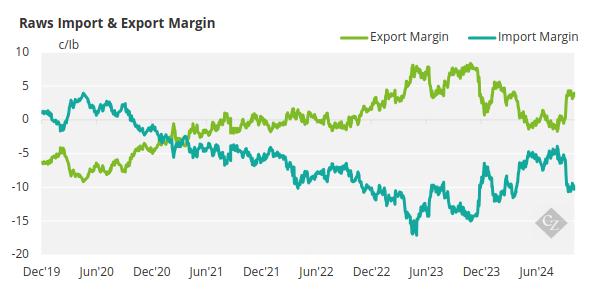

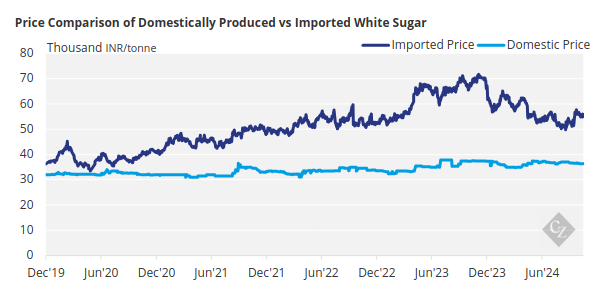

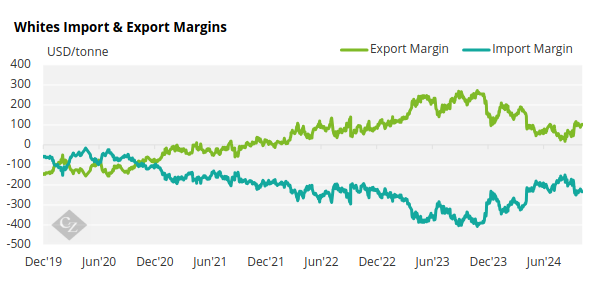

Not much else has changed since our last update. Export margins remain positive since our last report, and if mills were able to export at today’s prices, they would earn 3.3c/lb over the domestic market.

Refined sugar margins are also still positive as mills would earn USD 60/mt, if they were able to export today.

The government hasn’t authorised sugar exports for the upcoming 2024/25 production season. Therefore, the above discussion remains theoretical.

All feedstock restrictions for ethanol production were lifted in August, and the government has strongly hinted at potentially raising the ethanol price, but this has not been confirmed yet. The government will likely not authorise any exports until it has a better idea of sugar stock levels to ensure there is enough supply for domestic consumption.

Ethanol vs Sugar

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies. Ethanol blending in petrol has reached 15.9% in September.

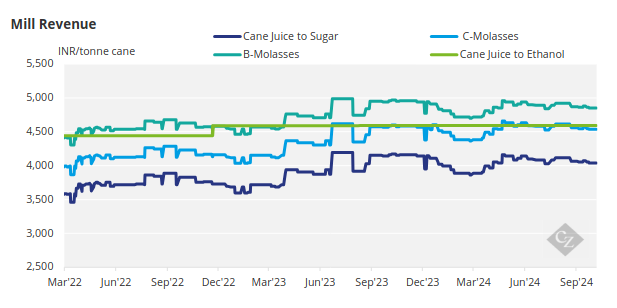

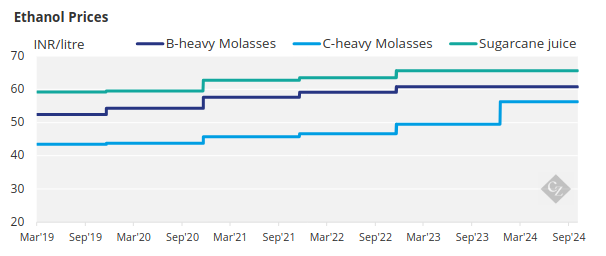

Earlier in the year mills were incentivised to use C-molasses instead of B-molasses and cane juice. All feedstock restrictions have now been lifted meaning; mills can produce ethanol from any cane feedstock. The revenue generated by the mills based on the type of feedstock used can be seen in the chart below:

Here are the current prices paid for ethanol by feedstock:

Appendix