419 words / 2 minute reading time

- The WTO has said its investigation into India’s sugar subsidies won’t be complete until this time next year at the earliest.

- India can, therefore, continue to subsidise sugar exports in 2021.

- India has already subsidised the export of 3m tonnes sugar this season, with at least a further 2m tonnes to come.

Indian Sugar Industry in Complicated Situation

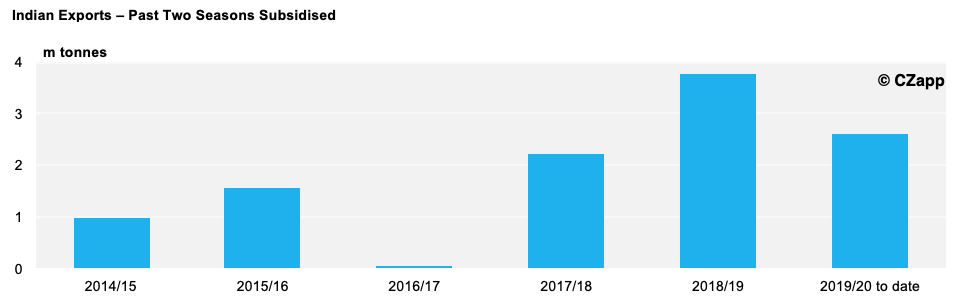

The World Trade Organisation’s investigation into how India supports its sugar sector has run into difficulty. It has announced the case is unusually complicated and so will not be completed until the middle of 2021 at the earliest. India has subsidised sugar exports to the world market for the past two seasons.

It has also provided its sugar sector a host of other support measures over recent years, including minimum domestic prices, stock support and subsidised loans.

The cane price paid to farmers is also set by the Government, irrespective of domestic or world market sugar returns.

In 2019, Brazil, Australia and Guatemala have complained that India’s sugar subsidies to farmers violate world trade rules, leading to sugar overproduction and lower world market prices.

India has issued a robust defence of its right to support cane farmers livelihoods.

Once the WTO has completed its report, the losing side can appeal to the WTO’s appellate body, which would normally provide a final ruling.

However, this body is unable to act at the moment because it doesn’t have enough sitting members.

The USA has been blocking new appellate appointments to protest against what it sees as WTO over-reach.

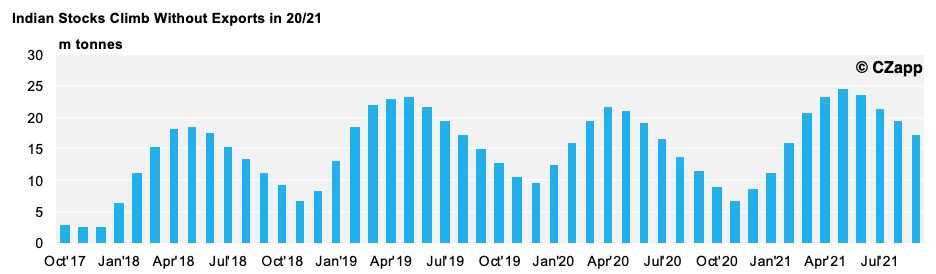

So, legal challenges against India’s sugar export subsidy will probably grind to a halt in H2’21. This leaves the path open for the Indian government to continue to subsidise sugar exports next season. This will be necessary; we think sugar stocks will climb to unmanageable levels again in the next 12 months.

Firstly, Indian sugar consumption has also been hit by the coronavirus lockdown; some estimates forecast lost consumption at 2m tonnes this year!

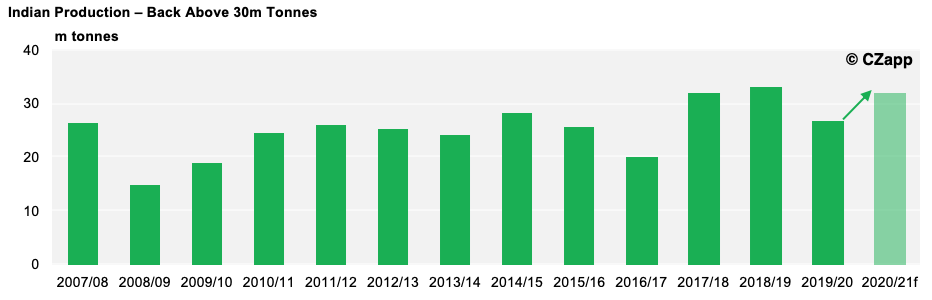

Secondly, India will produce too much sugar again next season. We expect India to produce 32m tonnes of sugar in 2020/21, up from 26.6m tonnes this year. This would mean India produces around 5.5 tonnes excess sugar next season.

However, the Government has fixed the domestic sugar price at $410/mt ex-mill, versus world market refined sugar prices currently trading at $315/mt FOB.

Export subsidies are inevitable!