- For the last year India has been trying to develop new export markets for its raw sugar.

- Indonesia has now reduced the import duty Indian raws must pay from $39/mt to 5% ($15/mt at current prices).

- However, Indian raw sugar exports are not competitive without a subsidy and don’t meet Indonesia’s colour requirements.

Indonesian Duty Change

- Indonesian import duty for most raw sugar origins is IDR 550/kg, equalling $39/mt.

- However for preferential origins such as Thailand it is 5% of the CFR price, which is around $15 at current values.

- India has now joined this lower duty rate and so can in theory compete with Thai mills once new crop sugar is available at the end of the year.

So Apart from the Import Duty, What’s Changing?

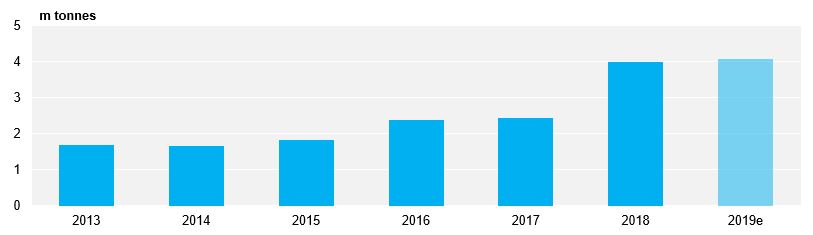

- Indonesia imports around 4m tonnes raw sugar per year, and Thailand is the dominant supplier.

Thai Exports to Indonesia

- Despite the change in import duty for India, Thailand will probably continue to be the dominant supplier in the near future.

- This is because Indonesia requires raw sugar imports to be above 1,200 ICUMSA; Indian raws are usually below 1,000.

- Further, Indian sugars are uncompetitive onto the world market without an export subsidy as domestic prices are fixed at close to $440/mt.

- We are therefore two steps away from seeing Indian sugar displacing Thai sugar into Indonesia, which is probably for the best given the large surplus of Thai sugar in the market this year.