Insight Focus

Speculation over India’s urea tender drove price increases. Processed phosphate prices are steady despite limited supply, with China suspending exports in December. Potash prices rose in Brazil, while other regions saw stable prices. Ammonia markets remain subdued with falling prices expected.

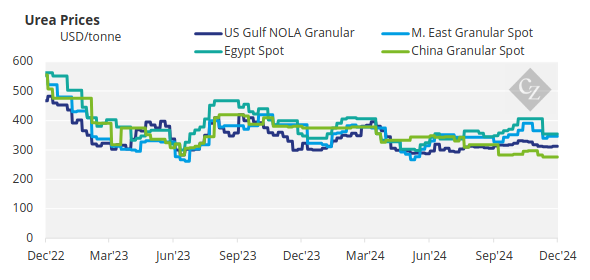

India Tender Rumours Drive Urea Volatility

Once again, India finds itself at the centre of rumours regarding an imminent urea tender set to close on December 19, with full shipments expected by January 2025. This speculation has boosted producer confidence and driven up prices.

India has conducted six urea tenders this year, purchasing a total of 4.2 million tonnes, compared to five tenders in 2023, which resulted in 5.6 million tonnes bought. Global urea prices had been on a downward trend since mid-October, influenced by poor affordability and seasonal downturns. However, the anticipated announcement from India has invigorated the market, with North African urea prices surging by USD 12/tonne within 24 hours.

New sales exceeding 100,000 tonnes have been reported for European and Turkish markets, with Egypt’s latest price reaching USD 371/tonne. In addition to the speculation about India, rising gas prices in Europe have increased production costs, prompting some producers to shut down operations entirely in an effort to weather the situation.

In response to the anticipated India tender, one cargo of SIUCI Oman urea has been placed at USD 345-350/tonne FOB, up from the previous Middle East spot prices of USD 335-340/tonne FOB. FOB prices in Southeast Asia are reported to be in the USD 335-340/tonne range, with one 30,000-tonne urea cargo placed for Australia. Offers to Brazil were withdrawn at USD 320/tonne CFR, with sales reaching as high as USD 335/tonne CFR.

Iranian producers appear to be facing difficulties in securing buyers, with prices as low as USD 285/tonne FOB noted, with official offers assessed at USD 295/tonne FOB, USD 10/tonne higher.

In a surprising move, the Vietnamese government has introduced a 5% import tax on fertilizers to protect its domestic industry. Vietnam’s urea production capacity stands at 2.4 million tonnes, compared to domestic consumption of 1.8 million tonnes, leaving room for exports.

In Indonesia, subsidised urea sales have reached 3.36 million tonnes out of a total fertilizer disbursement of 7.54 million tonnes, accounting for 87.7% of the Ministry of Agriculture’s allowance of 9.5 million tonnes. Domestic fertilizer use is projected to grow, with plans to expand rice cultivation by 3 million hectares.

Given that the fundamentals of the urea market remain unchanged aside from the India speculation, the key question is whether the recent price increases are sustainable or merely a temporary response to the India rumour.

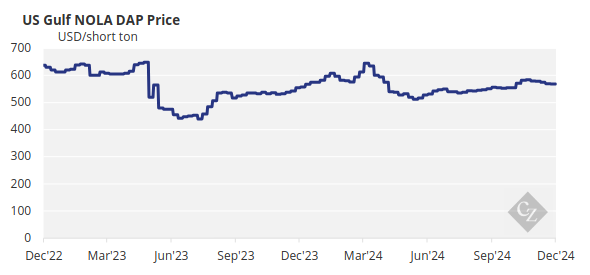

China Phosphate Export Ban Disrupts Market

China’s processed phosphate export policy remains a moving target. The initial policy set an export quota of 5 million tonnes for DAP and approximately 2 million tonnes for MAP, effective from March 15, 2024, to April 30, 2025, and divided into three phases: January 1 to April 1, 2024; May 1 to September 30, 2024; and October 1, 2024, to April 30, 2025. Cumulatively, DAP exports between January and October reached 3.75 million tonnes, while MAP exports for the same period was 1.66 million tonnes.

Exports of processed phosphates from China have been abruptly banned for the period from December 1 to December 31, with no clarity on what will follow. Additionally, there is uncertainty about whether previously agreed contracts and export permissions will be honoured. It goes without saying that exporting processed phosphates from China is nearly impossible, as there is no certainty about the export program.

China’s inconsistent “in-and-out” policy has created significant opportunities for other processed phosphate producers. Consequently, it will be very challenging for Chinese products to regain the market share they have lost, benefiting producers in Morocco and Saudi Arabia in particular.

Morocco’s exports from January to October totalled 10.2 million tonnes, a 16% increase from 8.8 million tonnes during the same period last year. With OCP forecast to boost exports and expand capacity to 15 million tonnes by 2024, the company is projected to produce approximately 12.8 million tonnes of fertilizers next year, with exports estimated at 12.3 million tonnes.

Meanwhile, Russian shipments of MAP to Brazil are expected to be slightly lower this year, driven by reduced affordability and Brazilian farmers substituting MAP with TSP and SSP. The current MAP price in Brazil remains steady at USD 635-640/tonne CFR, up from USD 560-565/tonne CFR at the start of 2024. Prices have been stable since July, with limited upside or downside.

Tight supply continues to offset weak demand and affordability concerns. However, many market participants anticipate a slight downward correction, as phosphate prices remain high relative to downstream agricultural commodities and other fertilizer nutrients.

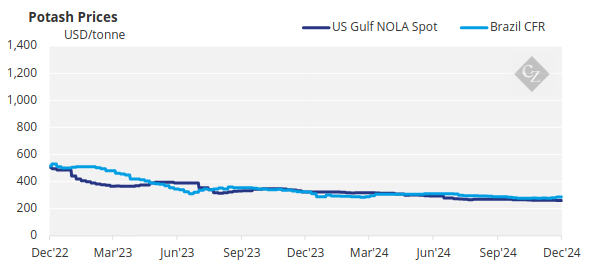

Potash Prices Rise to Steady Market

Potash spot prices continued their widely anticipated rise in Brazil, while other key global markets remained steady due to limited prompt demand. The MOP spot market was relatively quiet worldwide, with most participants now focusing on prospects for the New Year. Market sentiment remains cautiously optimistic, with some producers hesitating to sell, hoping for higher prices in the coming weeks.

In Brazil, MOP prices maintained their upward trend, now at USD 290-295/tonne CFR for prompt shipments, reflecting a 4% increase from the November 10 low of USD 283/tonne CFR. The market remains firm heading into 2025, with Q1 shipment offers ranging from USD 290-315/tonne CFR.

In Southeast Asia, prices were mostly stable after last week’s USD 8/tonne increase at the high end of the standard MOP price range. Malaysian prices continue to lag behind other Southeast Asian countries as older stock is being sold at discounted rates. Nonetheless, sellers maintain a positive outlook despite the lower prices in Malaysia.

Global potash spot prices are projected to rise over the next six months, although significant upside is limited.

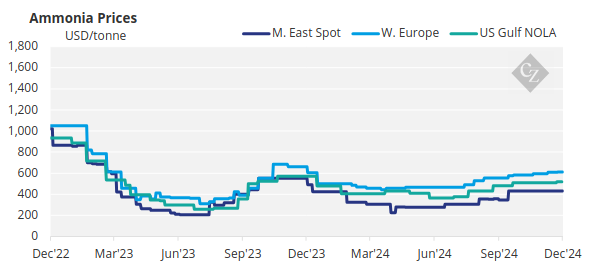

Ammonia Price Declines Expected

It was another subdued week for the ammonia market, with prices on both sides of the Suez remaining unchanged. However, indications suggest that improving supply and limited demand across many regions could trigger price declines in the final weeks of 2024.

A steadily improving supply outlook, coupled with stagnant demand, is likely to impose downward pressure on prices moving into the final weeks of the calendar year.