- Indian mills and refiners have exported 5.6m tonnes of sugar out of a 6m tonne export quota this season.

- Mills exported 148k tonnes in August, down from July’s 321k tonne exports.

- Everyone is now waiting for next season’s quota and export subsidy to be announced.

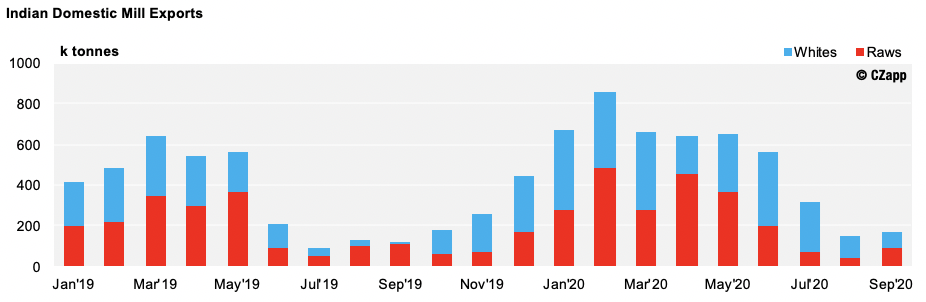

Domestic Mill Exports

- India’s mills exported 148k tonnes of raw and white sugar in August, down 321k tonnes from July.

- Note: August’s export data is based on preliminary figures.

- Mill exports tend to be of a cyclical nature; export momentum builds across the duration of the crush season.

- This tapers down during the monsoon season partly due to logistical constraints, reduced stock and cane arrears pressure compared to middle of the season.

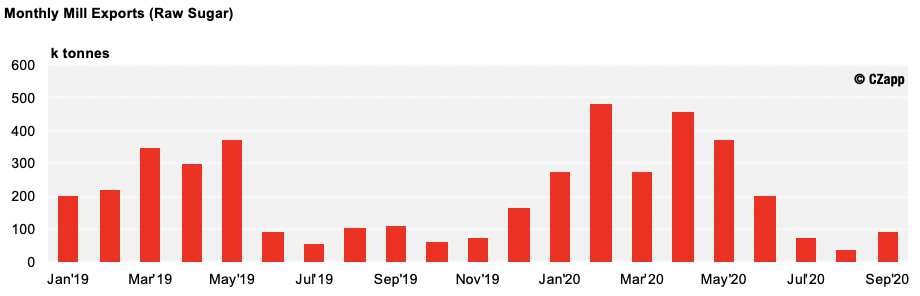

- The mills exported 37k tonnes of raw sugar in August, down 73k tonnes from July.

- 91k tonnes are in the line-up so far in September with 32k to Indonesia, 21k destined for India’s coastal refineries, 20k Malaysia and 18k to Iran.

- With two weeks to go to the end of 2019/20 season, Indian mills have already exported 2.6m tonnes of raw sugar.

- This is compared to 1.9m tonnes raw sugar exported in 2018/19 season.

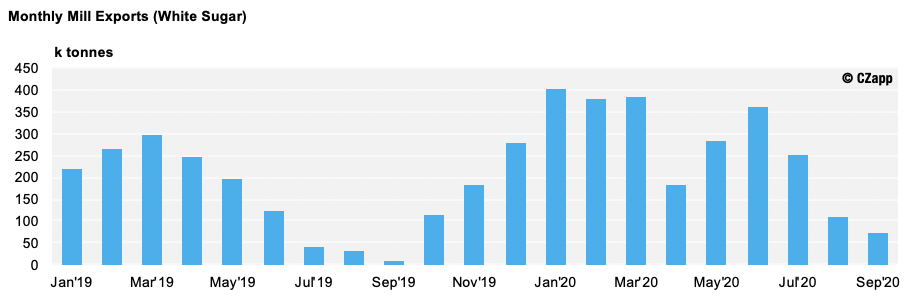

- The mills’ white sugar exports dropped to 110k tonnes in August, from 249k tonnes in July.

- This is due to huge reduced offtake in UAE, Sri Lanka, Afghanistan, Somalia and Sudan, which accounts for a large majority of the drop.

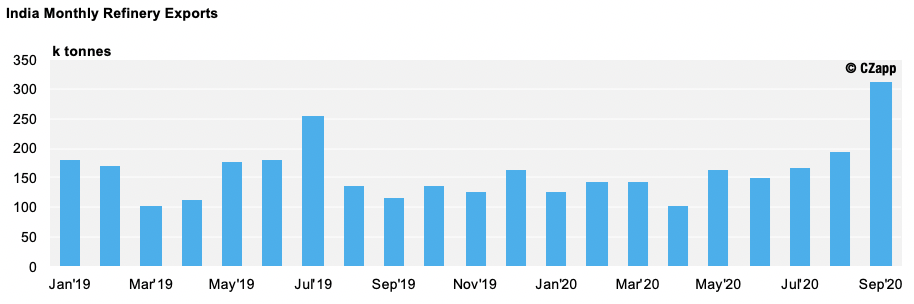

Coastal Refinery Exports

- India’s coastal refineries exported 195k tonnes of sugar in August, up from 167k in July.

- There is already 313k tonnes in the September line-up; a 60% increase from August.

- A huge volume of 211k tonnes is destined for Sudan, 79k tonnes for Djibouti and 23k tonnes for Somalia.

- We think a strong flow should continue with Thai refined availability dwindling at this time of the year and Renuka’s Haldia sugar refinery restarting operations.

Other Opinions You May Be Interested In…