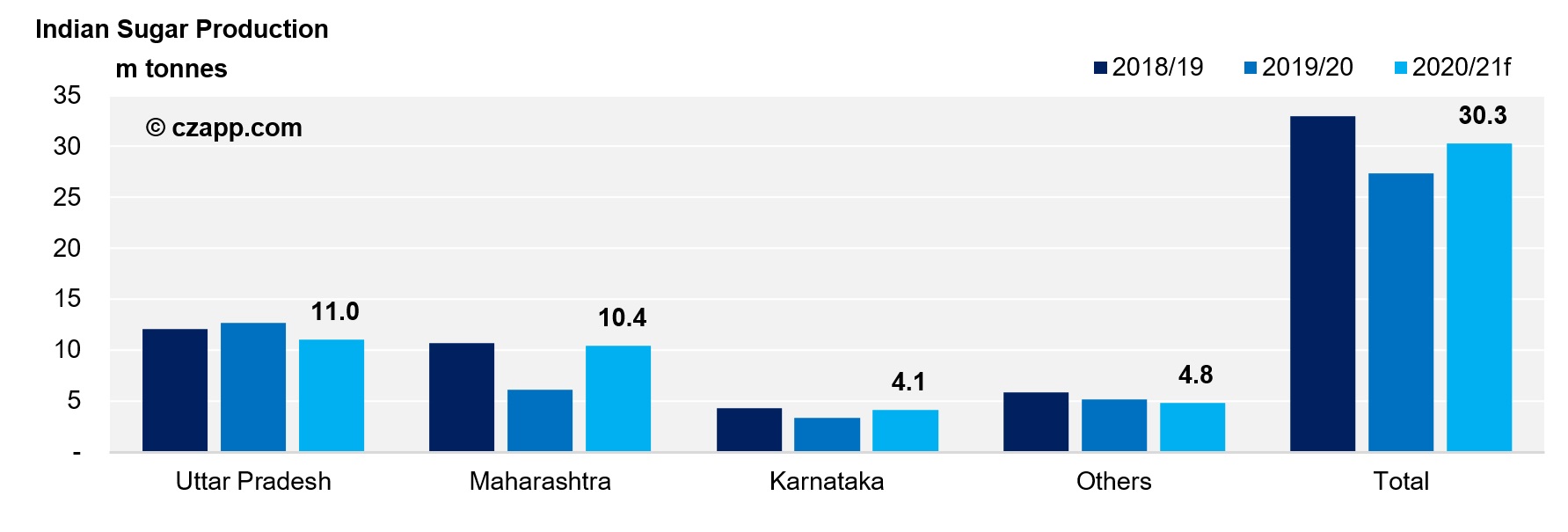

- India’s mills should produce between 30-30.5m tonnes of sugar this season, down from our original expectation of 31.5m tonnes.

- The mills have diverted more sucrose to ethanol production than we’d expected.

- In December to March, Indian ethanol blending in gasoline reached a record level of 7.2%.

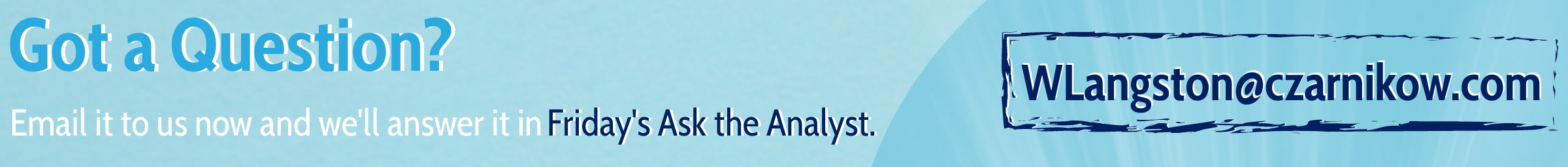

Uttar Pradesh: Sugar Production Down as Ethanol Diversion Increases

- Uttar Pradesh has produced 9.4m tonnes of sugar so far this season, down 350k tonnes year on year (YoY).

- The mills have diverted more sucrose towards ethanol to hit the state’s 1.3b litre production target, up 300m litres YoY.

- All in all, we think Uttar Pradesh will produce 11m tonnes of sugar this season, down 1.5m tonnes from last season’s record.

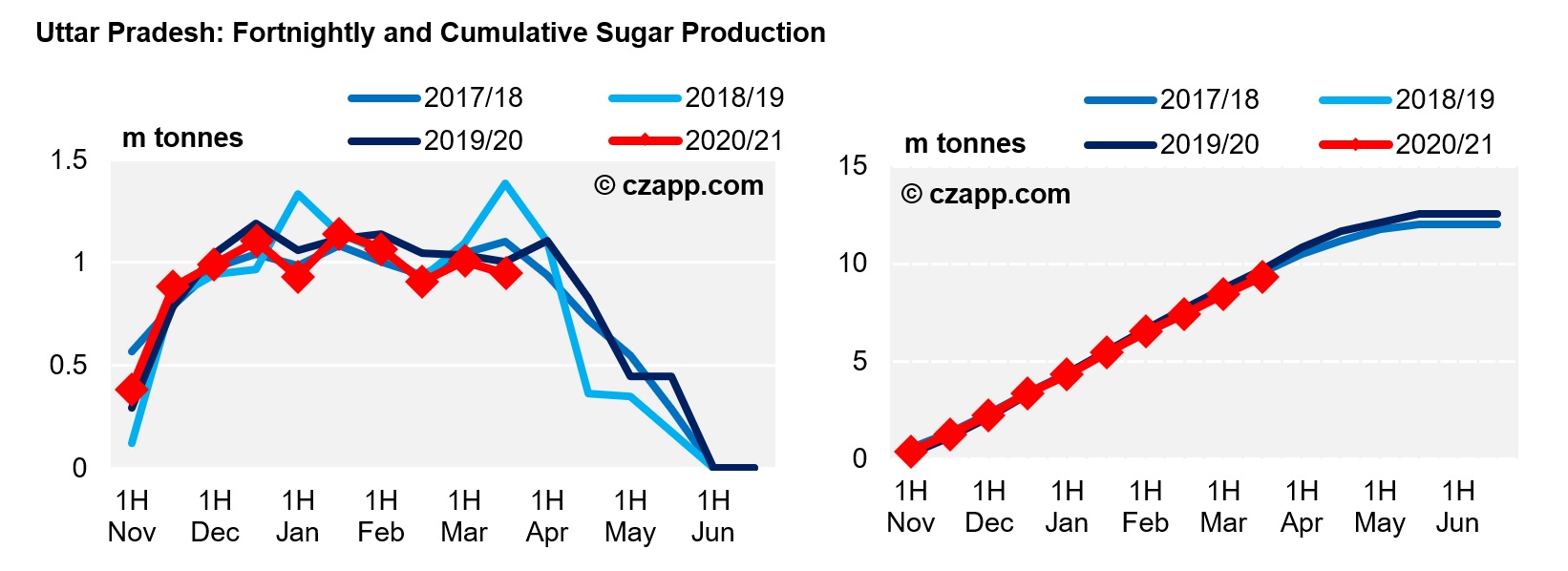

Maharashtra: Sugar Production Crosses 10M Mark

- Maharashtra has produced 10.05m tonnes of sugar so far this season, up 4.2m tonnes YoY.

- Only 75 of its 188 mills are still crushing whereas, last year, just 28 of its 146 mills remained active.

- We think Maharashtra will produce 10.5m tonnes in total, up 4.3m tonnes YoY, yet still 250k tonnes shy of the 2018/19 record.

- It seems unlikely that Maharashtra will top the 2018/19 record this season, as it strives to hit its 1.1b litre ethanol production target, having produced just 279m litres last season.

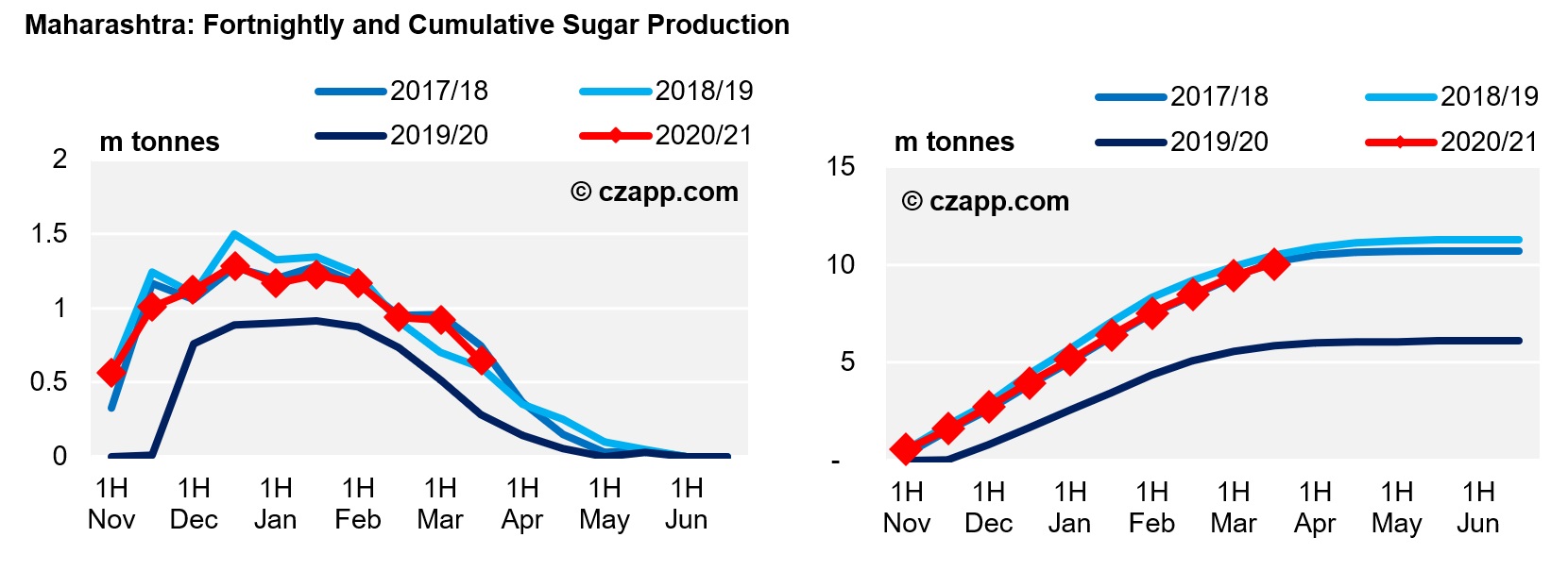

Karnataka: Almost to the End With One Mill Left

- Karnataka has produced 4.1m tonnes of sugar so far this season, up 800k tonnes YoY.

- With just 1 mill still operational, we think Karnataka will produce 4.1m tonnes of sugar in total, up 800k tonnes year-on-year, and just 100k tonnes off the 2018/19 record.

- Karnataka has also increased cane acreage, agricultural and sucrose yields following last year’s well-timed monsoon.

- However, its ethanol production must jump this year, from 206 to 379m litres, if it’s to hit its target set by the Government.

- This means it too will need to divert more cane and molasses towards ethanol, falling 100k tonnes short of the 4.3m tonne record set in 2018/19.

A Recap of Our Indian Sugar Production Estimates for 2020/21

- 1.2m tonnes of sugar will be diverted to ethanol, up from 800k in the previous season.

- Most distilleries will use C and B molasses as feedstocks compared to cane juice due to better returns.

- This means the sugar diversion may not will not be as large as industry expectations of 2m tonnes this season.

Poor Sugar Sales As COVID Hits Consumptions

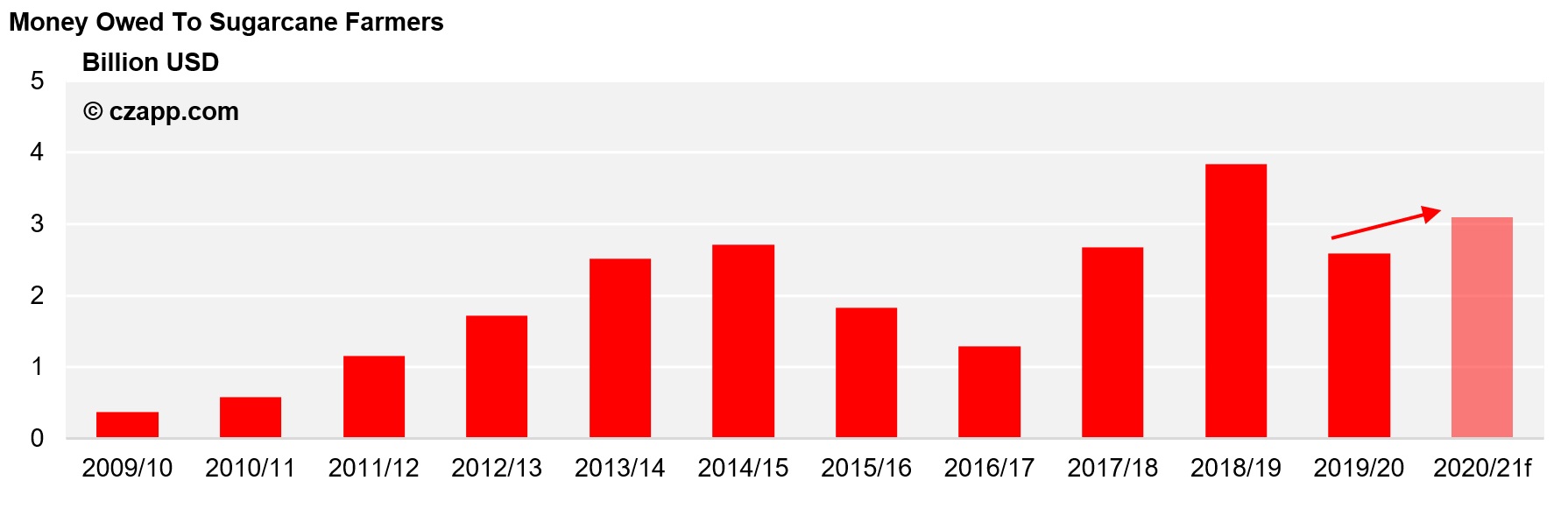

- Cane dues to sugarcane farmers have crossed USD 3 billion (INR 292 billion); 19% higher YoY.

- Mills are lobbying for the Government to increase the minimum selling price from INR 31/kg to INR 33/KG to increase mills’ revenue and liquidity.

- Sales have been affected as COVID has hit sugar consumption.

- This has impacted the mills liquidity, despite the Government’s 2.2m tonnes of domestic sales quota issuance this month, up 400k YoY

- Sugar mills need domestic sales quota in order to sell sugar domestically,

- Sugar consumption has been hit again by a renewed surge in COVID cases.

- Consumption in hotels and restaurants has taken a hit, as social activities such as wedding banquets and celebrations were trimmed down to a maximum cap of 200 guests in open-air venues and 100 guests for enclosed areas.

- The mills’ sugar sales have been also been hit, weakening their liquidity and ability to pay sugarcane farmers.

Here’s Another Opinion You Might Be Interested In…