Insight Focus

Urea prices have been falling daily due to India’s market absence. Processed phosphate prices are rising due to strong demand and limited Chinese supply. Potash remains stable with expectations of an increase, while ammonia faces a bearish outlook despite strong European demand.

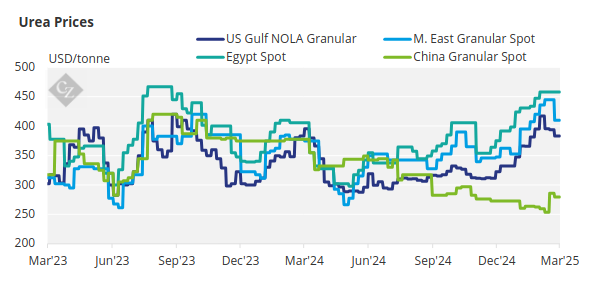

India’s Absence Pressures Urea Prices

India continues to spook the market by not announcing its expected urea tender, causing international urea prices to fall across the board daily. Whether this is a deliberate strategy or simply a lack of urgency—given that March and April are quiet months for domestic demand—remains uncertain. However, according to official inventory reports, levels are nearly 20% below the five-year average.

Additionally, demand for urea in Europe remains sluggish at best, with offers from Egyptian producers at USD 440-445 CFR being met with a cold shoulder, while indications hover around USD 430/tonne CFR. In Brazil, prices continue to decline, driven by demand primarily for southern winter crops. Current indications are now at 380 USD/tonne CFR.

Urea values in NOLA/US are also declining, though in smaller volumes, now at the low USD 380s/short ton (344.7 tonnes) FOB. March urea arrivals to NOLA/US are estimated at 700,000 tonnes, while April volumes remain uncertain. Iranian producers, with a combined annual output of around 9 million tonnes, have re-entered the market, setting an official export FOB price of USD 388/tonne—expected to be revised lower to compete with North African and Middle Eastern producers. The resurgence of Iranian exports has reinforced bearish market sentiment.

Middle Eastern producers are now struggling to maintain prices at USD 400/tonne FOB, with the latest indications around USD 390/tonne FOB. Meanwhile, Chinese producers remain on the sidelines, with daily urea production declining to 192,000 tonnes, down by 6,000 tonnes earlier this week.

The outlook for urea prices remains bearish as the market awaits positive news from India.

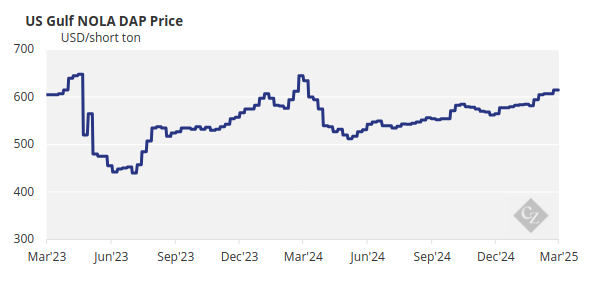

Phosphate Prices Expected to Remain Firm

The processed phosphate market west of Suez is experiencing modest price increases for Moroccan products, driven by strong import demand and the continued absence of Chinese producers. China is expected to re-enter the market sometime in April or May. Prices are anticipated to remain firm in the short term, but with May approaching, demand for DAP in the US, Europe, Ethiopia and Australia will likely taper off.

However, India remains significantly short on DAP, with the latest rumours suggesting prices have climbed to USD 650-660/tonne, up from the long-standing USD 636/tonne CFR. Brazil’s MAP prices have stabilised at around USD 640+/tonne CFR, with new offers reaching USD 650-660/tonne CFR due to limited supply now that lower-cost stocks have been depleted.

EABC in Ethiopia has floated a fresh tender for 466,358 tonnes of DAP, aiming for better prices than the previous tender, which was scrapped. Demand from Pakistan remains absent, with the latest bid-offer range at USD 645-648/tonne CFR.

Last year, China lifted export restrictions in mid-March, but this year is a different story with no certainty and speculation about when exports will resume.

The outlook for processed phosphate prices is firm for the next couple of months, however prices are expected to decline with China coming into the market, and with fewer export options.

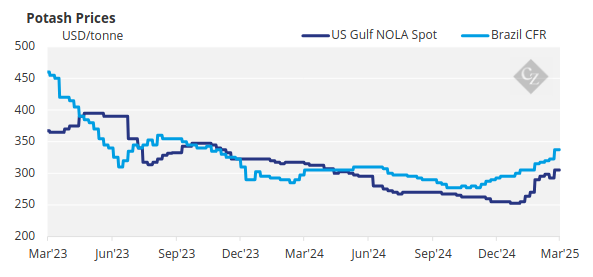

Potash Prices Hold with Bullish Outlook

Global potash benchmarks hinted at an increase this week, though unconfirmed, as limited spot availability—particularly in Southeast Asia—is expected to support prices. Standard MOP prices remained steady at USD 300-320/tonne CFR in Southeast Asia, but market speculation suggests they could rise to USD 320-330/tonne CFR.

Fundamentals in the region have turned more bullish due to a tighter supply outlook for Q2, limited producer offerings, strong palm oil prices, firm domestic prices in China and stable domestic pricing across the region. While these higher prices have not yet been confirmed, an increase is anticipated in the near term.

Meanwhile, Pupuk Indonesia has yet to award its MOP tender due to a price mismatch between supplier offers and the importer’s target, with expectations that the tender will be scrapped. The main tender is now likely to be floated in April after Eid.

In the US, the market is adjusting to the announced 25% tariffs on Canadian imports, which have been delayed. With farmers largely covered for the spring season, immediate concerns remain minimal. Potash prices in New Orleans increased by an average of USD 6/short ton, while other US benchmarks remained largely unchanged.

In Brazil, spot prices rose to USD 335-337/tonne CFR following a sale, as most suppliers are now sold out for April. Producers have shifted to May shipments, with USD 340/tonne CFR already confirmed. May offers range from USD 335-350/tonne CFR, while June prices are set at USD 350/tonne.

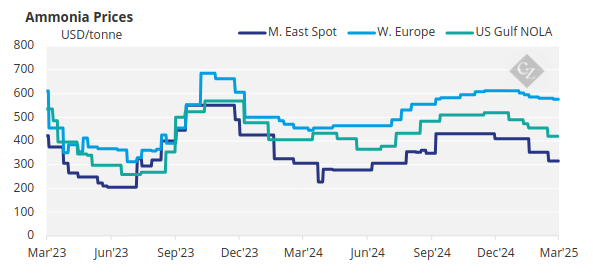

Ammonia Remains Soft Amid Weak Demand

The ammonia market remains soft, with producers operating at full capacity but there is sluggish demand in India and Northeast Asia, where industrial consumption is minimal.

Following the March settlement in Tampa at USD 460/tonne CFR, prices are expected to hold in the short term, with only the European market showing activity due to production curtailments driven by high gas prices.