- India’s PET demand dropped during its recent lockdown.

- As a result, producers slashed operating rates and imports slumped.

- Demand is now set to rebound as restrictions are lifted, hopefully at a manageable rate.

Indian PET Demand Slumped with Recent COVID Wave

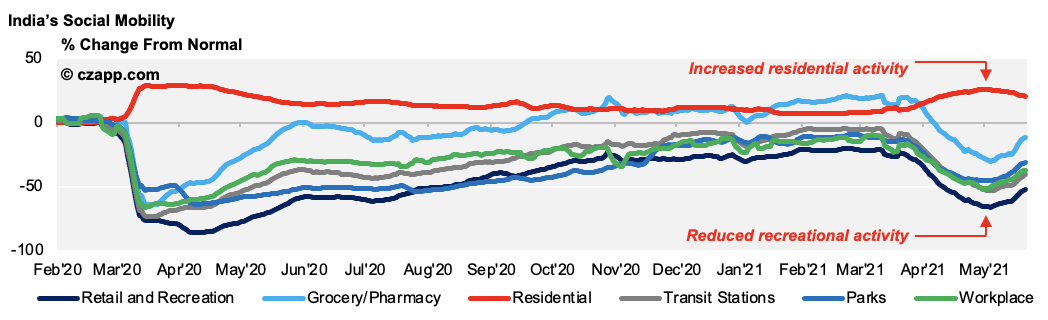

- India’s recent spike in COVID cases meant strict curfews and lockdowns were implemented in major cities.Public spaces, shopping malls, entertainment venues and restaurants were among the swathe of businesses forced to close.

- With this, consumer confidence slumped to an all-time low in May, and household spending fell sharply.

- Restrictions on social mobility also led to a steep decline in demand for on-the-go beverages, such as carbonated soft drinks.

- As a result, India’s PET resin producers reduced operating rates by around 20-30% in May; stock levels increased marginally by around 3-4 days.

- India’s PET producers also pivoted greater supply to the key export markets of Africa and the Middle East.

- However, between deadly cyclones and a volatile freight market, this move has not been without its own challenges.

PET Imports Dipped As a Result

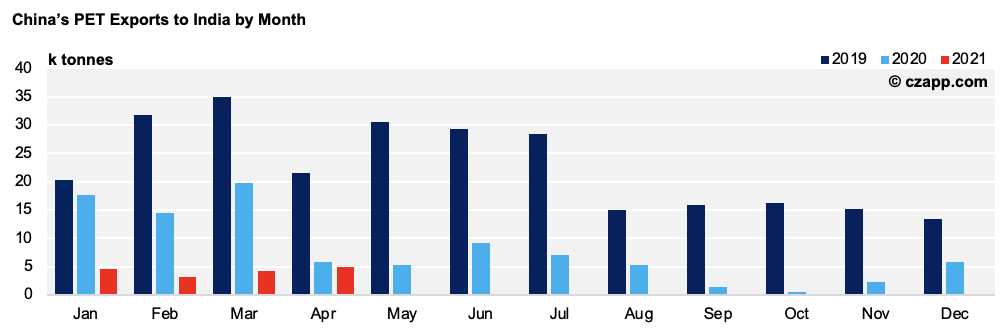

- China is India’s largest PET resin supplier.

- On average, China exported 15.4k tonnes to India per month in 2019 and 2020.

- However, volatile freight rates, geopolitical tensions, antidumping proposals, and the latest COVID lockdowns mean exports have slumped.

- China’s exports to India in the first four months of 2021 were down more than 70% year-on-year, and 84% versus the same period in 2019.

- However, with COVID cases falling, Indian PET demand should now rebound, as was the case after its 2020 lockdown.

- The initial signs are certainly positive as major cities are already easing restrictions, allowing many businesses to reopen.

- In Delhi, easing restrictions brought heavy traffic as workers started returning to offices.

- Government data also suggests around 800,000 people are now set to return to cities after an earlier exodus to rural villages.

- One immediate concern voiced by producers is that if demand rebounds too sharply, the supply chain could come under immense pressure.

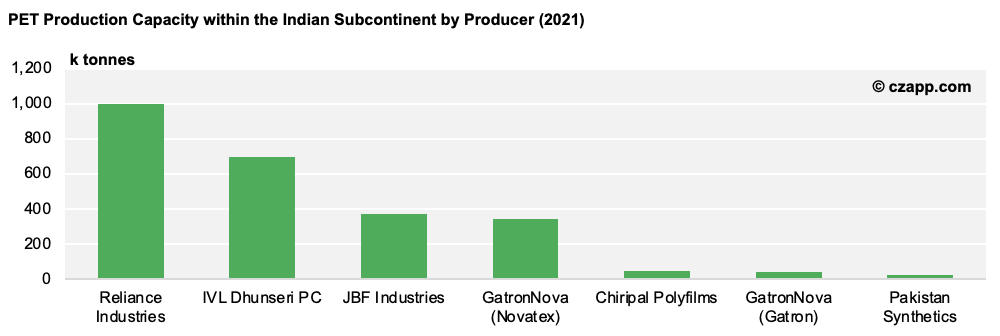

Indian PET Producers Brace for Future Growth

- Despite facing a devastating pandemic, India’s soft drink consumption should continue to grow.

- PepsiCo India’s bottling partner, Varun Beverages, reported a staggering 33% year-on-year growth in Q1’21.

- Beyond the expected near-term rebound, PET producers have been gearing up for the long-term.

- Both Indorama and Reliance, India’s two largest PET resin producers, have announced planned investments:

- In May, Indorama Ventures announced it will spend around $82M upgrading and adding capacity to its manufacturing site in Nagpur, India. Part of the plan will include a new PET facility, with a capacity of 700 tons per day, which should be operational by Q2’22.

- Reliance, one of India’s largest recyclers of post-consumer PET waste, should more than double its recycling capacity, from 2 billion bottles to more than 5 billion bottles, within the next 18 months.

- With the Indian government focused on transitioning to the circular economy, India should see a wave of new investment within the recycling and waste management space.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…