Insight Focus

India’s silence on a urea tender caused prices to tumble this week. Processed phosphate prices remain firm due to limited supply, with Brazil’s MAP price reaching its highest level since March 2023. Potash prices are sluggish in Brazil and Southeast Asia, while Chinese domestic prices are increasing.

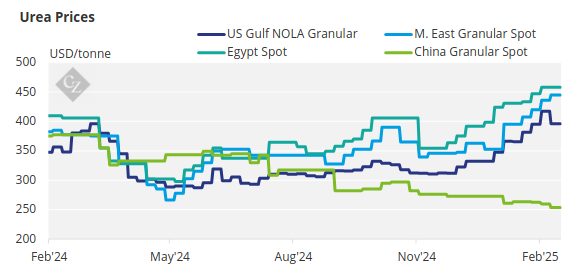

US and Middle East Urea Prices Slide

The international urea market is being spooked by India’s radio silence regarding an expected urea purchase tender. India can afford to wait since March and April are low-consumption months, meaning domestic production will exceed demand. Combined with muted demand in the US, Europe and Brazil, global urea prices are decreasing across the board, with significant downward movement in US/NOLA.

Physical barge prices have dropped into the mid-USD 370s FOB/short ton for April and into the mid-USD 380s FOB/short ton for April. March-April Egypt paper traded multiple times at USD 405/tonne FOB, but Egyptian producers continue to indicate physicals at USD 460/tonne FOB, evidently with little, if any, traction.

Middle East pricing appears to be all over the place, with lows reported by traders at USD 400/tonne FOB and highs indicated by producers reaching up to USD 440/tonne FOB. Baltic prilled and granular urea prices have declined by an average of USD 10-15/tonne over the past week due to lower prices in Latin South America and increased freight rates.

Iranian urea producers reportedly sold two 30,000-tonne parcels of granular urea at USD 383.50/tonne FOB, with one cargo said to be destined for Thailand. Operating rates in Iran have been low- to non-existent due to gas curtailments for the fertilizer industry, prioritizing heating homes and other industrial uses.

In Indonesia, a urea tender held by Pupuk Indonesia for 45,000 tonnes of granular urea for March shipment has apparently been passed on, with the highest bid around USD 410/tonne FOB versus the producer’s floor price, estimated at approximately USD 430/tonne FOB.

India has yet to announce a urea tender, but the market anticipates an announcement in early March for shipments from the second half of March onwardsBrazil’s Potash Market Remains Sluggish. Chinese producers remain affected by the government’s strict export rules and regulations, though the market expects China to resume exports sometime in April.

However, this could extend until the conclusion of Chinese spring and summer demand in June. On the demand side, Australian farmers face difficult choices, and their buying could be deferred for a few weeks into May. Similarly, Thailand’s purchasing activity will resume after the annual water festival in mid-April.

Major buying in Brazil is still months away, with the current indicated CFR price at approximately USD 420-425/tonne CFR. The outlook for urea prices is bearish, and with every week India delays its tender announcement, pressure on prices will intensify, with producers in denial.

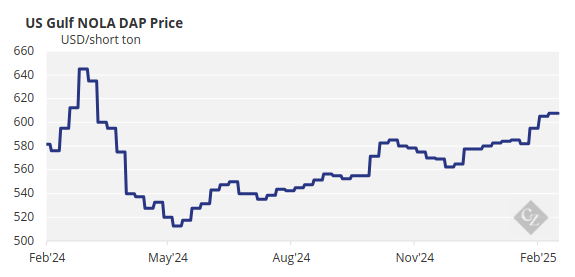

Russian MAP Hits Highest Price Since March 2023

On the processed phosphate side, Brazil has come alive, with MAP prices firming by USD 5/tonne after months of stability at USD 630-635/tonne CFR. A cargo of Russian MAP is said to have been sold in the range of USD 635-641/tonne CFR, marking the highest assessed price since early March 2023.

China is now expected to enter the market in April/May with export quantities of DAP/MAP, with the current price indication at USD 650/tonne FOB for DAP. However, while this price may be achieved in Southeast Asia for smaller volumes, major markets requiring large cargoes anticipate prices around USD 620-630/tonne.

EABC of Ethiopia has yet to counter participants in the February 20 purchasing tender for up to 540,390 tonnes of DAP for March-May loading, and expectations are that EABC will re-tender for several of the lots.

Both India and Pakistan appear to be holding back on DAP purchases—Pakistan due to unfavourable weather and agricultural economics, with traders unable to secure margins at current international prices.

The outlook for processed phosphate prices remains neutral to firm on the back of limited supplies.

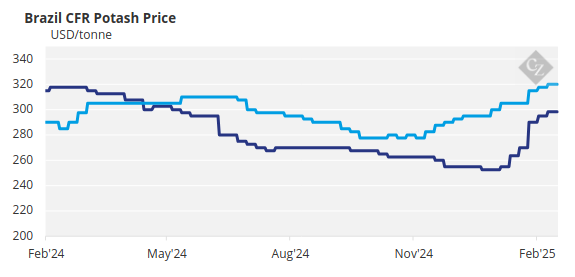

Brazil’s Potash Market Remains Sluggish

Potash prices increased in China and northwest Europe this week, while Southeast Asian and Brazilian markets remain sluggish, and Russia considers export quotas.

In China, domestic potash prices rose to an average of RMB 3,200/tonne (USD 441/tonne) FCA, the highest since May 2023. Strong spring application demand and limited fresh shipments have supported these price increases, raising government concerns.

With prices climbing faster than expected, Chinese importers may need to settle 2025 potash contracts earlier than anticipated. Meanwhile, the three largest importers were instructed to release potash reserves on February 24.

The Southeast Asian market was in waiting mode this week, as Pupuk Indonesia has yet to award its gMOP and sMOP tenders. Both tenders received offers last week, but no awards have been confirmed. Suppliers are waiting for price levels to emerge before proceeding with sales, hoping higher offers will support the market in the coming months.

Standard prices held steady at around USD 310/tonne CFR, with gMOP at USD 335/tonne CFR. The Brazilian market remained slow this week, with prices steady at USD 320/tonne CFR and limited spot transactions.

April offers rose to USD 325-340/tonne CFR, but sales are slow as producers and buyers wait for price increases, with some expecting USD 360/tonne CFR by June. Still, demand in the region is expected to remain quiet in the coming weeks. In other news, Russia is considering non-tariff restrictions on potash exports starting in Q2 2025, with plans for export quotas to ensure sufficient domestic supply for complex fertilizer production.

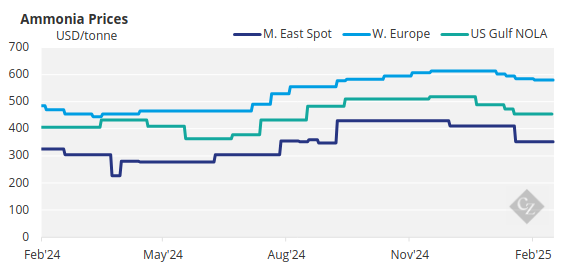

Ammonia Prices Weaken Further East of Suez

Support for ammonia prices in markets east of Suez continued to erode this week, with very little upside seen during February. The ongoing bubble of support seen in Northwest Europe remained intact, though news of further declines at Tampa for March and slumping natural gas prices should begin to erode any remaining stability in the West.

Yara and Mosaic have agreed on the Tampa contract for March ammonia loadings at USD 460/tonne CFR, down USD 40/tonne from the previous month’s settlement of USD 500/tonne CFR. The Tampa price has now declined by USD 110/tonne since December 2024, when the settlement was USD 570/tonne CFR.

Prices look set to come under further pressure moving into March, particularly east of Suez. Prices in the West—specifically Northwest Europe—enjoyed a partial degree of support through February, though this appears unlikely to hold much longer.