- The global picture is looking brighter than it did at the end of 2020.

- Multiple COVID-19 vaccines are now being rolled out, commodity markets have picked up, equities and cryptocurrencies continue to rise.

- The molasses market, in this context, has been slightly more stable too.

India Remains a Key Cane Molasses Supplier

India is proving pivotal in terms of global molasses supply; it should export around 1m tonnes of cane molasses this season. This will cover exports from December 2020 through to the middle of 2021. These exports will be broadly split between European and Asian destinations; Indian cane molasses are required in Asia to replace Thai supply, which has disappeared following another poor cane crop.

The cane molasses supply from Central America’s current crops has been strong, with North American and European demand supporting regular exports. The supply has held up, despite a few headwinds. At the end of 2020, the region was hit by large hurricanes, but the sugar crops seem to have survived unscathed. As the global macroeconomic picture has improved in recent months, ethanol demand has increased, which has resulted in increased molasses demand in the region.

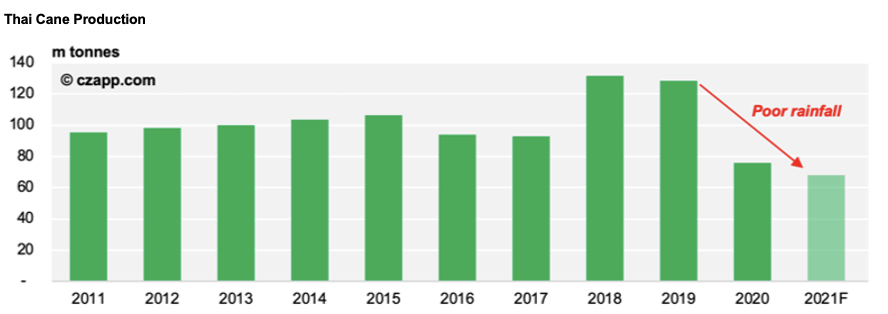

Thailand is the main downside in terms of cane molasses supply; its cane crop looks set to fall below 70m tonnes. If this materializes, it will be a almost a 50% decline from just two years ago. In our last report, we mentioned that Thailand had already started to import cane molasses and this trend has continued; Thailand will be a net-importer of cane molasses this year.

So far, we’ve noted that India is important in balancing out the shortfall in Thai supply. The focus will switch to Indonesia, with its new sugar crop set to begin in May. We think around 450k tonnes of cane molasses will be available from Indonesia, but the main question will be whether this is enough to keep the market supplied at a price which supports Thai and Philippine demand.

Demand: Divergence Between the Industrial and Feed Markets

Thailand and the Philippines’ import requirements stand in contrast to the other large Asia-Pacific markets of South Korea, Japan and New Zealand, as they are predominantly for industrial use (fuel and potable ethanol). The other markets are primarily for animal feed.

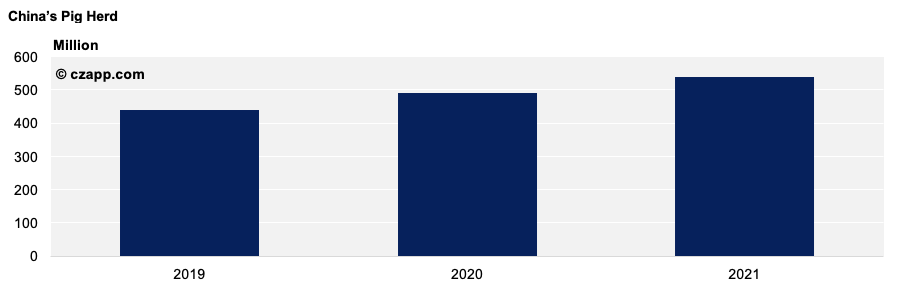

The global feed markets are currently witnessing higher prices across the board for commodities; corn, wheat, and soya prices have all increased since the middle of 2020. The main drivers have been a combination of the improving COVID-19 situation, China reestablishing its pig herd, and the continuous supply of money from central banks.

China’s demand for feed commodities has picked up, but in the end, it was not nearly enough to satisfy former President Trump’s Phase 1 Trade Agreement. The demand increase may appear modest in percentage terms, but in absolute terms, it represents a large number in the global context, with a pig population of over 400 million.

The continuing easy monetary environment, supported by central banks around the world, has continued to see larger pools of cash chasing ever diminishing returns. Jerome Powell has suggested the Federal Reserve would like to see a period of above 2% inflation, which implies the money taps will not be turned off in the short term. Commodity markets will continue to be supported and investors seem to be turning to more unconventional assets; will Elon Musk be proven right as cryptocurrencies enter the mainstream of investment markets?

The higher price of most other feed commodities has seen demand for molasses in feed markets increase, with European cane demand benefitting from a 10% increase compared to the middle of 2020. The other main feed markets for imported cane molasses should see increased demand as well; this includes the US, South Korea, New Zealand and Japan.

Demand in the industrial markets is more complicated and the elasticity of it is far greater. In Thailand, demand is mainly for fuel ethanol production and there’s a clear price level based on the local ethanol price where molasses demand can be switched on and off. The picture is somewhat similar in the Philippines, although the demand is for potable ethanol production. This contrasts with the feed markets, which have a much more gradual tapering up and down of demand.

Looking ahead to the next few months, the trajectory of cane molasses prices will be key in determining demand and import requirements in Asia. At the moment, industrial imports are supported by the India’s strong molasses availability and a continued supply of available vessels. If either of these factors change, demand may quickly drop.

This will also be of critical importance when Indonesia starts pricing its new-crop molasses. Prices need to sit at a level that won’t switch off demand in Thailand and the Philippines. If prices trade at a similar level to last year, demand from the industrial customer base will disappear instantly.

As noted above, feed markets seem to be facing a more positive situation, with higher prices for other feed commodities supporting demand.

Beet Molasses: Reduced Supply from the Black Sea

The beet molasses market suffered from reduced Black Sea supply in Q4’20 and this has continued into 2021, with new-crop Egyptian not available until the end of March.

The Russian sugar crop was much lower than the previous year meaning beet molasses exports fell by around 50%. The primary destinations for Russian beet molasses have been Turkey and Spain in recent years. The Spanish market has switched to cane molasses to make up for the shortfall; Turkey has increased its domestic supply, although not by enough to cancel out the Russian shortfall.

The European crop has been trending just below the five-year average. There have, however, been some variations on a country-by-country basis, with the UK and France facing the largest falls. Denmark and Sweden, on the other hand, have benefitted from higher production.

A growing number of EU countries have now authorised the continued use of neonicotinoid pesticides on sugar beet seed after the agreement to ban their use in the EU in 2018. This may support sugar production in the following crop and reduce the effect of Beet Yellow Virus.

The focus is now on the Egyptian sugar beet crop and its subsequent exports. There will be at least 300k tonnes of beet molasses available for export from March 2021. Within the Mediterranean markets, the main competition will surround imports of cane molasses from India, which have replaced some Russian beet molasses supply in recent months. We think Turkish demand will be higher than it has been in recent years as importers look to rebuild lower stocks.

Overall, the beet market has seen a narrowing of the price between cane and beet molasses. In Asia, the beet molasses price now sits above the cane price. In Europe, we’re at parity and there’s consequently more demand for cane in Europe, which has replaced beet molasses in some of the feed markets. This trend should continue, especially if the new-crop Egyptian prices exceed current expectations.

Summary

So far, we’ve made the case that things look quite positive in the molasses market, with higher commodity prices supporting demand, and supply looking strong. However; we are about to face an important moment in the market with prices and supply for the next few quarters likely to be set. In focus will be the new sugar crops and molasses supply from Indonesia and Egypt.

Price will be key to how demand unfolds over the next six months and the industrial markets will be particularly sensitive to price. Any substantial increase in Indian cane prices, or if new crop Indonesian prices are not kept in check, it could result in a rapid decline in cane molasses demand in Asia. The feed markets are not likely to be as sensitive to price as the industrial markets as the trajectory of competing feed commodity prices will be just as important as the molasses price.

Other Opinions You Might Be Interested In…