Note: The February and March shipment stats are preliminary at this stage.

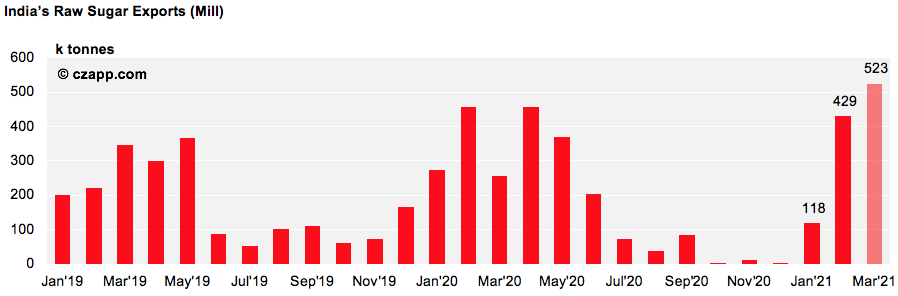

- India’s mills exported 671k tonnes of raw and white sugar in February, up 183k tonnes month-on-month.

- They have now exported 2.3m tonnes of sugar so far this season.

- With raws exports picking up, we think India will export at least 5m tonnes in 2020/21.

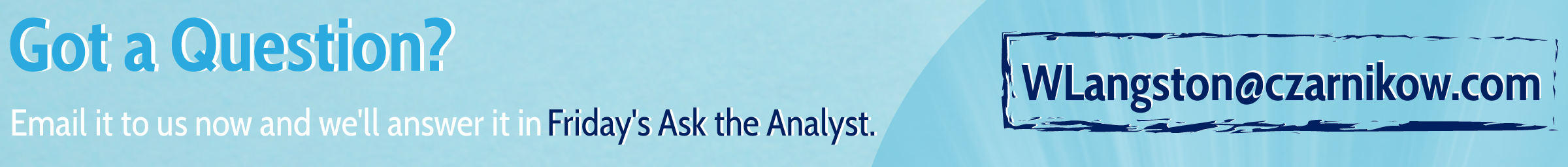

India’s Whites Exports Decline Once Again

- India exported 242k tonnes of white sugar in February, down 128k tonnes month-on-month.

- A large chunk of this went to Somalia (62k tonnes), Sri Lanka (56k tonnes) and Afghanistan (44k tonnes).

- We think India’s white sugar exports will retain a similar pace in March, as the ongoing container shortage continues to strain its ability to move white sugar.

- However, some Indian sugars are now being exported in bulk vessels, as they’re easier to get hold of, but this is tricky as a lot of consumers don’t buy enough to fill a breakbulk vessel.

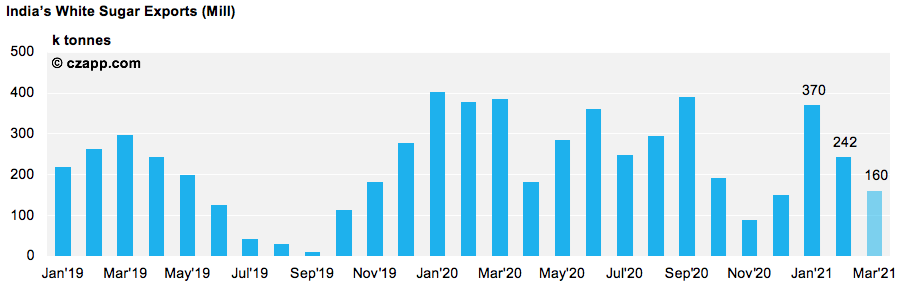

India’s Raw Sugar Exports Ease the Losses

- India’s mills exported 429k tonnes of raw sugar in February, up 311k tonnes month-on-month.

- This is because Indian raws are more competitive than Brazilians into Far-East destinations, such as Indonesia.

- India therefore exported 286k tonnes of raws to Indonesia last month, up 199k tonnes from January.

- This strong pace should continue, with 523k tonnes of raw sugar already nominated for shipment in March; we think 360k tonnes of this will go to Indonesia.

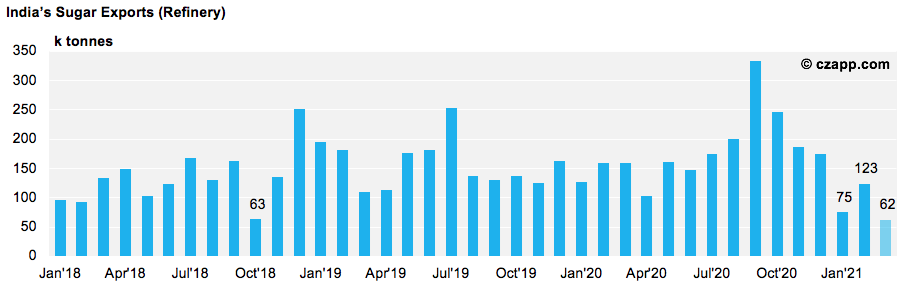

The Refineries Pick Up the Pace

- India’s refineries exported 123k tonnes of refined sugar in February, up 48k tonnes month-on-month.

- Sudan was the top buyer, taking 104k tonnes; the rest of the destinations only imported 19k tonnes in February, as the scramble for shipping containers continued.

- The refineries’ exports should improve in March, as long as they are able to switch to bulk vessel shipment.

- However, only a limited number of destinations such as Sudan, Somalia, Ethiopia are used to taking bulk refined shipment at present.

Our Final Thoughts

- We now think India will export at least 5m tonnes of sugar in 2020/21.

- Its exports should remain strong for the duration of 1H’21; the monsoon season, which runs between July and September, will then make shipping more challenging, due to the fierce winds and rains it brings.

- The container shortage means India could export more raws than whites this season; we initially thought we’d see 3m tonnes of both raw and white sugar exported.

Here’s Another Opinion You Might Be Interested In…