Insight Focus

India’s recent urea tender fell short. The country is expected to re-enter the market soon as prices rise globally. Processed phosphate activity remains limited, with key tenders drawing attention, while potash prices are increasing in key regions. Ammonia prices have softened slightly.

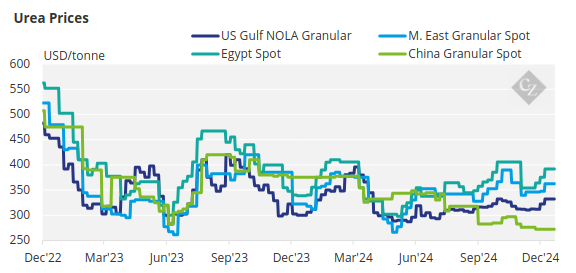

India Tender Shortfall Pushes Up Prices

The urea market for 2024 ended with a big disappointment for India’s tender closing on December 19, securing only 187,000 tonnes with an L1 price of USD 369.75/tonne for delivery to the west coast. The east coast offer was withdrawn, as it appeared to have been submitted in error at USD 299/tonne CFR.

Despite the lacklustre India results, urea prices appear to be increasing, with the latest report of a Middle East sale by SIUCI for February shipment at USD 375/tonne FOB. This is about USD 15/tonne higher than the netback on the latest India tender.

Brazil prices are bid at USD 370/tonne CFR with offers closer to USD 380/tonne CFR. Iranian producers are suffering from gas cutbacks, with apparently only one factory up and running. The latest official FOB price is set at USD 331/tonne.

Southeast Asia producers are busy fulfilling contracts agreed on late in 2024, with FOB prices ranging from the mid USD 350s to as high as USD 370/tonne FOB.

The outlook for urea prices is bullish, with India expected to re-enter the market with another tender.

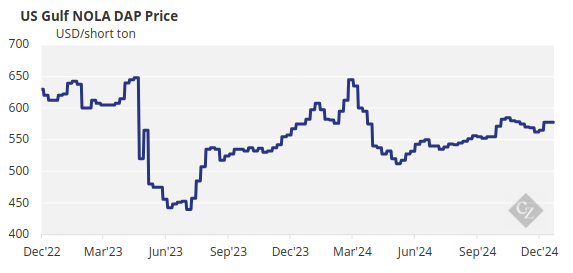

China Restricts Phosphate Exports

Little activity has taken place in the processed phosphate market. Of note is the 611,158-tonne DAP tender in Ethiopia, with EABC having countered at USD 639/tonne FOB bagged.

The Indian government has extended the special subsidy of USD 42/tonne as of January 1, 2025, at a total cost of USD 780 million since April 2024. DAP prices in India are holding at USD 633-634/tonne CFR.

The Chinese government is restricting exports of processed phosphates with domestic DAP/MAP production between January-November of 27.94 million tonnes compared to 25.09 million tonnes last year. Chinese exports of DAP/MAP are down 6% at 6.22 million tonnes. As a result, domestic prices of processed phosphates are falling.

The outlook for the processed phosphate prices is stable to firm, with limited availability.

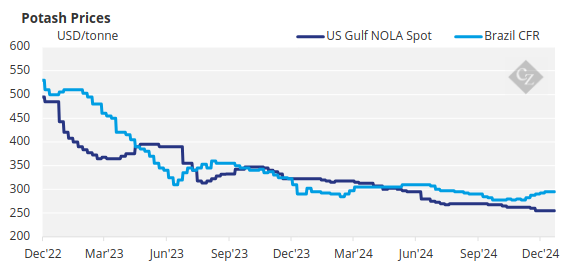

Potash Market Remains Bullish Into 2025

Heading into 2025, the Brazilian and Southeast Asian markets paved the way for higher potash prices this week, despite sluggish demand entering the New Year. The global potash market was subdued, with many market players still easing back into activity after the holiday period.

The market sentiment for the upcoming year remained somewhat bullish, with producers preparing to push for firmer prices. However, with ample product and high stocks in some major import markets, the upside may be limited.

Favourable affordability and seasonal demand are expected to support sales in Q1 2025. Brazil’s potash prices increased to USD 305-310/tonne CFR, with offers for advanced sales now reaching USD 310/tonne CFR and above.

Seasonal demand has yet to fully return following a pause during the Christmas break, and the rising price trend may be hindered by high stock turnovers and the persistent weakness of the Brazilian Real.

In Southeast Asia, standard MOP prices firmed USD 10/tonne to an average of USD 300/tonne CFR, the highest level since April 2024. The majority of producers now seek prices above USD 300/tonne CFR heading into the New Year. Market players indicate a tightening of sMOP material in recent months, as China and India continue to import large volumes, which may support prices in the week ahead.

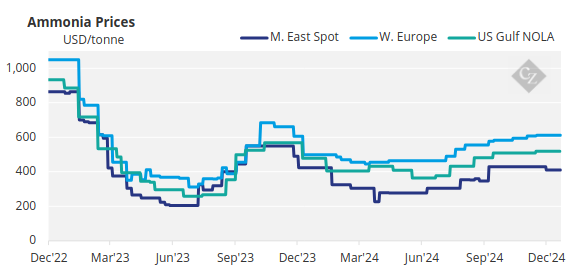

Ammonia Prices Stable as Supply Rises

Ammonia prices were largely unchanged in the first week of the New Year, with many key participants not yet back at their desks. Most in the market expect higher supply to begin to weigh on values in the weeks ahead, and the Tampa settlement for January appears to be leading the way, down USD 32/tonne to USD 538/tonne CFR.