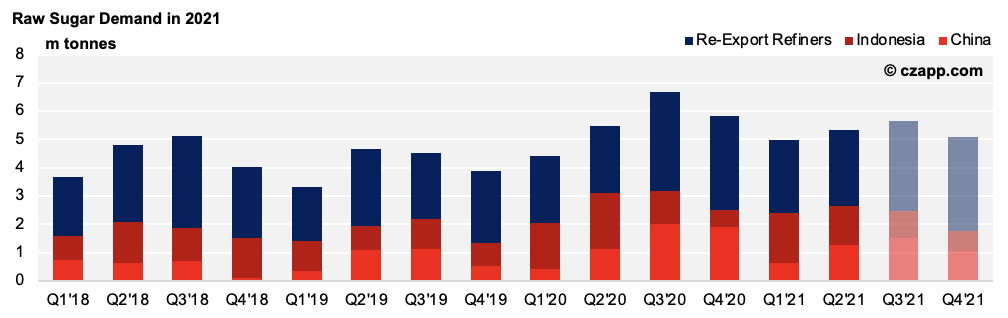

- We think Indonesia will import 4.8m tonnes of raw sugar in 2021.

- This would make it the world’s largest raws importer, knocking China into second place.

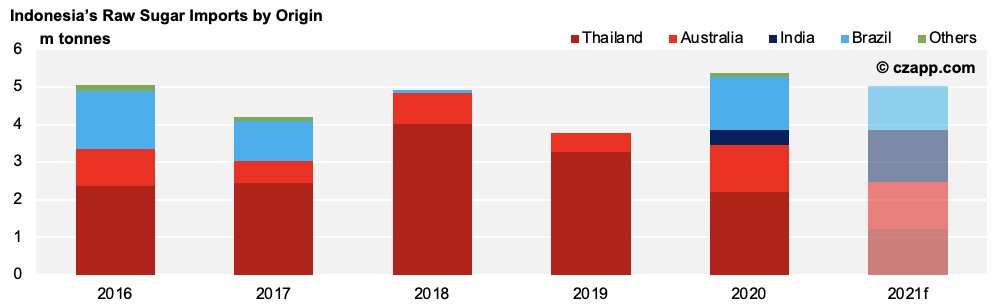

- An increasing amount of this sugar has come from India.

The World’s Largest Raw Sugar Importer in 2021?

- We think Indonesia will be the world’s largest raw sugar importer in 2021.

- The final quantity will depend on how many import permits are released in early December, but we currently think it’ll import up to 5m tonnes.

- At least 1.4m tonnes of this sugar should come from India, since Indonesia’s policy change last April now allows 600 ICUMSA raws to enter (formerly 1200).Already, since the policy change, India has exported 1m tonnes of raw sugar to Indonesia.

- Historically, Thailand and Australia were key suppliers, as their close proximity lowered freight costs and preferential tariff rates meant their exports incurred less duty than the likes of Brazil.

- However, so far this year, just 602k tonnes of Thai and Australian raws have entered Indonesia, down 1.4m tonnes year-on-year.

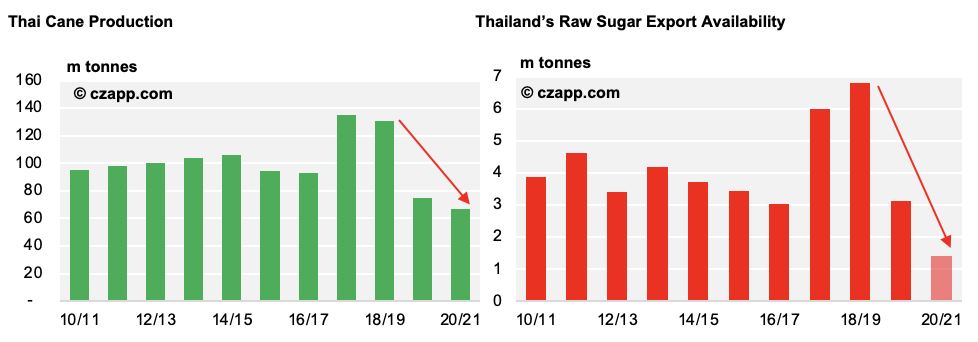

- This is largely because Thailand’s poor cane crop means its raws export availability totals just 1.4m tonnes, the lowest it’s been for at least a decade.

- However, Thailand shouldn’t export very much raw sugar to Vietnam this year as its shipments are now subject to heavy anti-dumping duties (33.88% for raws and 48.88% for whites).

- This means it’ll have more raws available to export to Indonesia; we think it’ll ship 1.2m tonnes there in total.

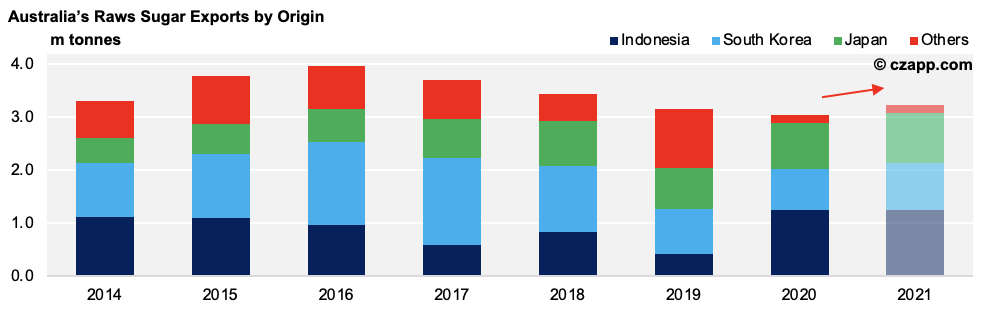

- In Australia’s case, it’s more profitable to export their raw sugar to the likes of Korea and Japan.

- Already this year, Australia has exported 193k tonnes of sugar to Korea and 181k tonnes to Japan, up 67k tonnes and 134k tonnes respectively year-on-year.

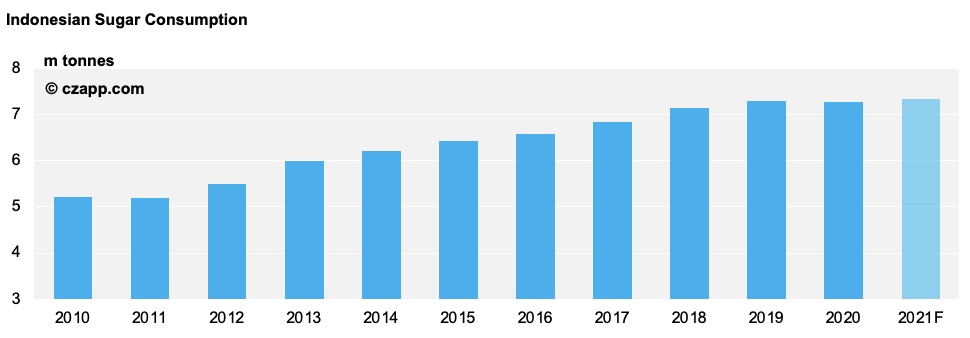

Indonesia’s Sugar Consumption Going Strong

- Indonesian sugar consumption should recover to 7.3m tonnes (up 1%) after flat growth last year.

- Strong industrial output from the food and beverage (F&B) sector had cushioned the sugar consumption fall.

- Home consumption of processed products (such as beverages) has increased, leading to a 3% expansion of the Indonesian F&B sector in 2020.

- The F&B sector should grow by between 5 and 7% this year.

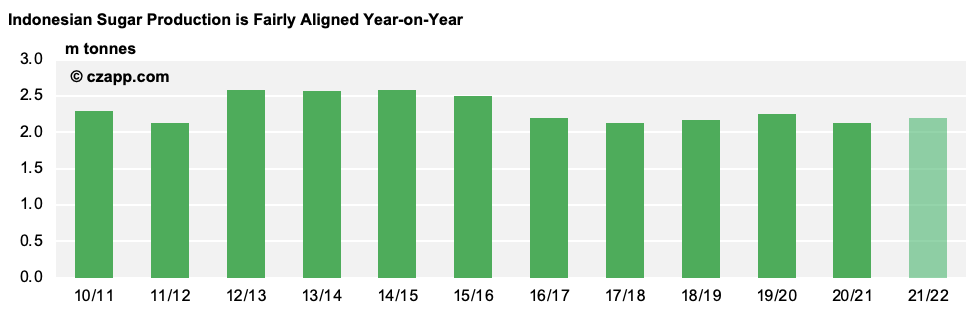

- Indonesia’s 2021/22 production season starts this month.

- It should produce 2.2m tonnes of sugar, up 3% year-on-year.This is because rainfall has been better, which is favourable for cane during its growth phase.

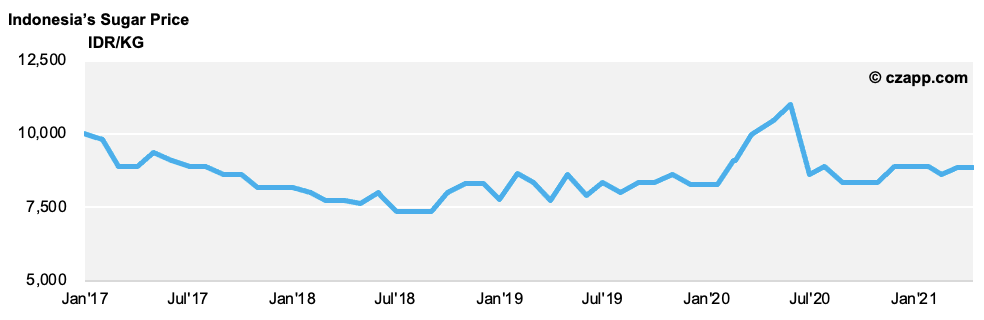

- Indonesia’s sugar price rocketed to 11,000 IDR/kg (748 USD/mt) last year due to COVID’s impact on supply chains.

- It’s since stabilized at 8,800 IDR/kg (607 USD/mt).

- To understand more about the Indonesian Sugar Industry, please read this Explainer.

Other Opinions You Might Be Interested In…

Other Explainers You Might Be Interested In…

- Czapp Explains: The Indonesian Sugar Industry

- Czapp Explains: The Sugar Industry in Uttar Pradesh

- Czapp Explains: The Sugar Industry in Maharashtra and Karnataka