Insight Focus

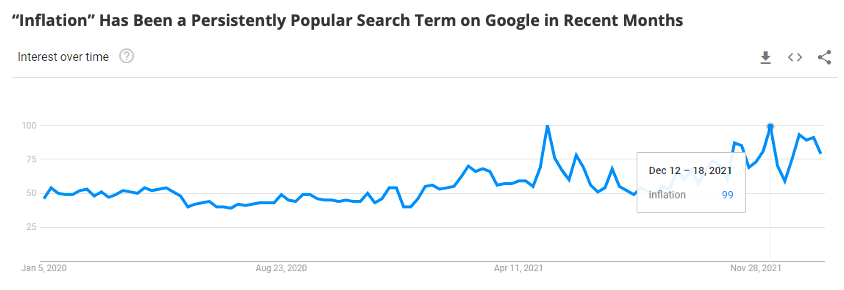

- Inflation is front-page news.

- The ‘long commodity’ trade is crowded.

- Consensus views in markets are dangerous.

Inflation is Here!

Inflation is today’s big news.

But higher inflation shouldn’t come as a surprise. In the past two years we’ve all endured a global pandemic, which has led to:

- Repeated restrictions which have hit demand for goods;

- Re-openings leading to renewed demand;

- Unsustainable demands on just-in-time supply networks.

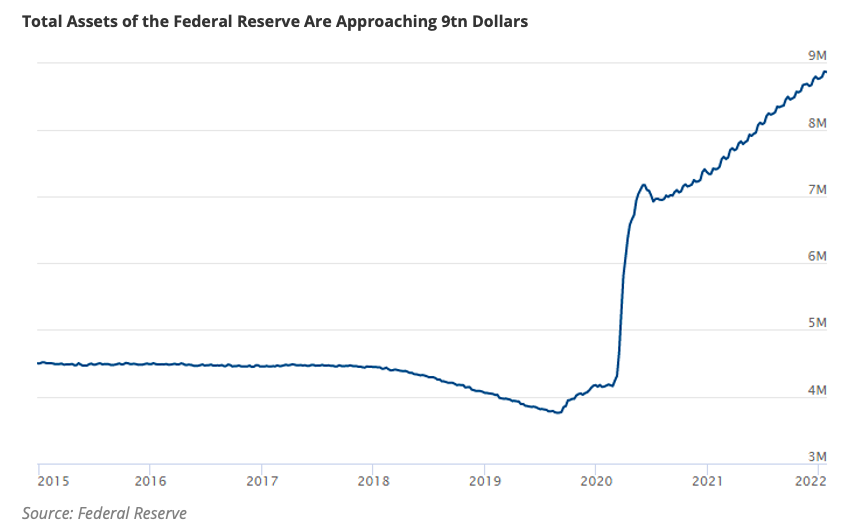

On top of this, the world’s Central Banks have responded to the pandemic by printing money through quantitative easing.

More money, lumpy demand and strained supply is a recipe for higher prices.

We worry that the ‘long inflation’ trade is getting too crowded and would like to present a counterargument. First, we’ll see the cause of today’s inflation stems from 2020, then we’ll see if it’s likely to persist.

Commodity Prices Have Been Rising

In February and March 2020, commodity prices collapsed as it became apparent COVID was a global problem. But the price recovery was also rapid. Sugar bottomed in April 2020 and was 35% higher than the lows around a month later.

Source: Refinitiv Eikon

Brent crude oil more than doubled in a month.

Source: Refinitiv Eikon

These two were among the leaders, but by the end of June, most other commodities had followed.

Source: Refinitiv Eikon

The energy and agriculture markets have rallied for almost two years now and this kind of sustained strength was always going to ultimately lead to higher prices for end-consumers.

Source: Refinitiv Eikon

Supply Chain Failure in 2021

Matters were made worse by the enormous disruption in the world’s supply chains.

The cost of moving goods by road, rail, sea, and air became increasingly expensive through 2021 as there wasn’t enough transport capacity to meet demand. We detailed some of the challenges we were facing in the container market in September.

Inflation was inevitable, and we tried to warn it was coming last October when we wrote it would be negative for sugar prices.

Source: Refinitiv Eikon

Since this time, sugar prices have fallen by 10%. Yet worries over inflation have intensified to a point where major central banks have capitulated.

Money is Becoming More Expensive in 2022

Having maintained for the last six months that inflation would only be ‘transitory’ and so didn’t need any new measures, the Federal Reserve has announced its intention to taper quantitative easing and has signaled it will raise interest rates in 2022. The Bank of England has raised rates twice in three months.

These moves are long overdue. There’s no comparison between where we are today (economies re-opening, milder Omicron variant dominant, increasing vaccination coverage) versus this time last year (many countries in full COVID lockdowns, serious Beta variant dominant, limited 1st shot vaccination).

Source: Refinitiv Eikon

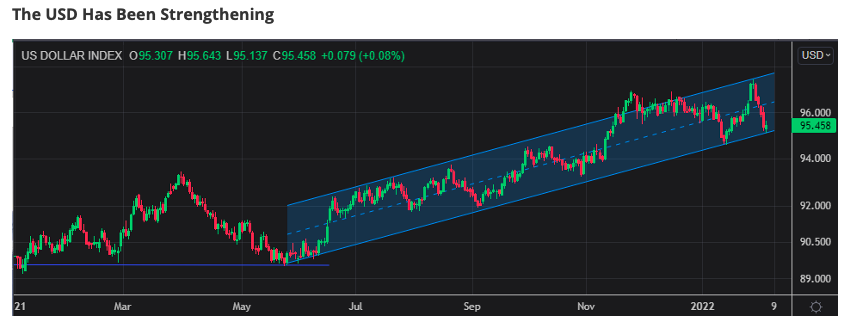

In addition, more than 100 Central Banks around the world have raised rates since 2020. The US Dollar has been rising since June 2021, which is a de-facto tightening (and often negative for commodity prices). US Treasury yields have rebounded sharply back to normal levels following the carnage of the last two years.

Source: Refinitiv Eikon

Money is therefore becoming scarcer and more expensive. This will weigh on demand for goods around the world.

Supply Chain Recovery in 2022…?

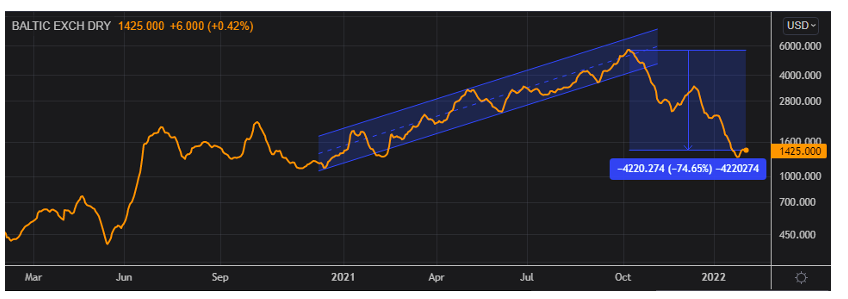

We hope that the huge disruption to global goods traffic in 2021 might be resolving. The Baltic Exchange Drybulk Index has now fallen by 75% since last October.

Source: Refinitiv Eikon

The big question now is whether container disruption follows suit now Christmas and the Chinese New Year are over. In 2021, the queue of container ships waiting to berth at Los Angeles & Long Beach resolved between February and June. If the same thing happens this year, it will help deflate what is a persistently expensive container market.

Commodity Market Outlook in 2022

Reduced demand for goods thanks to tighter macroeconomic conditions and the possibility of better supply chains. Might the outlook for commodities in the coming months not be as positive as the inflation doomers would have you believe?

So, what indicators are worth watching?

At face value, agriculture and energy are in rock-solid uptrends and you’d have to be brave to believe either will break. However, we note that sugar has already rolled over.

Source: Refinitiv Eikon

Coffee was one of 2021’s start performers but is trading sideways.

Source: Refinitiv Eikon

Copper is often considered to be a major economic barometer and is also sideways.

Source: Refinitiv Eikon

Corn and soy have also lost momentum.

Source: Refinitiv Eikon

It’s possible we might be about to see a repricing of the wider commodity complex as new longs exit their positions. This would inevitably impact the sugar market too, and sugar is already falling. Watch crude oil, copper, and grains for signs of further weakness.

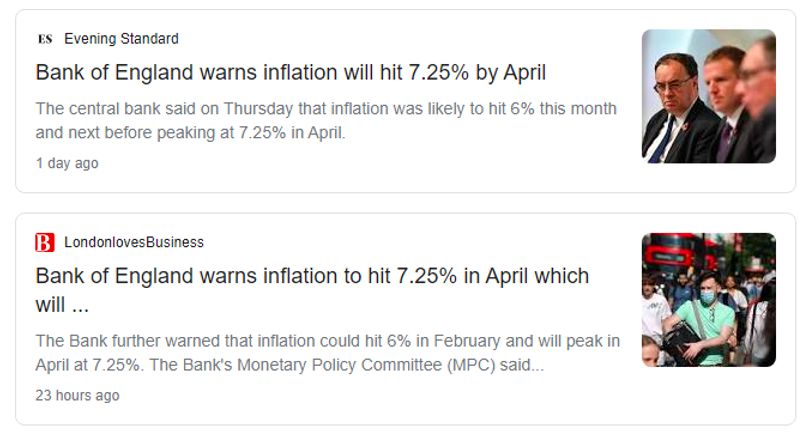

We accept that this is a contrarian view and expect to attract ridicule for standing apart from the crowd. This might well be one of the worst calls we’ve ever made. At the very least, we are probably expressing this view far too early; the Bank of England thinks inflation will only peak in April, for example. But the thing that scares us the most is when a large consensus forms in the markets.

Our expertise is in managing supply chains and helping to mitigate risk. We fear there’s so much noise around inflation today that everyone has lost sight of the risk that commodity prices fall. Please manage your own risks carefully and appropriately.

Other Insights That May Be of Interest…