Insight Focus

- EU consumers cut meat consumption amid rising prices this year

- Beef, dairy production was in decline before recent price hikes

- Fall in meat consumption cutting livestock numbers, feed demand

The EU’s livestock population is falling due to declining meat consumption and tighter environmental rules, resulting in less demand for animal feed.

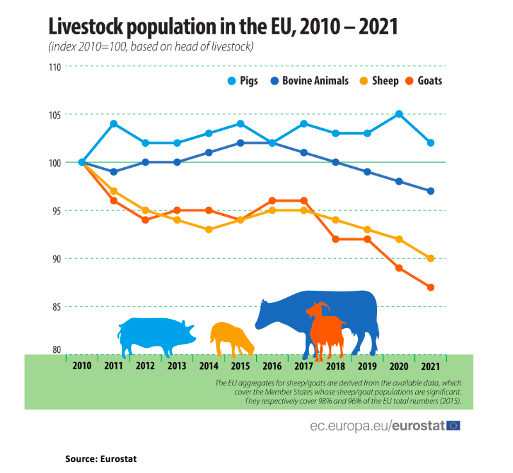

Data from EU statistics agency Eurostat shows there were 142m pigs, 76m bovine animals, 60m sheep and 11m goats as of December 2021. Spain accounts for 24% of the EU’s pig herd, followed by Germany on 17% and France on 9%. France reared 23% of the EU bovine animals, followed by Germany and Spain.

Economic Woes Hitting Demand

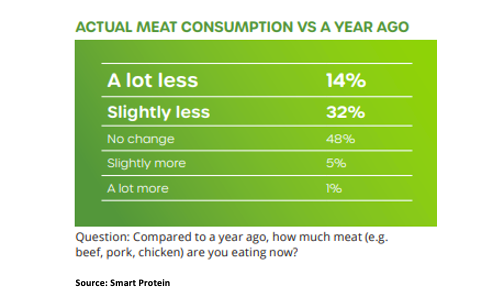

Meat consumption in Europe had been falling for around a decade before the recent price shock caused by Russia’s invasion of Ukraine because consumers are cutting meat in-take for health and environmental reasons.

However, the downward trend in meat consumption has picked up over the past few months as consumers cut spending because of the economic uncertainty caused by spiralling inflation.

“The uncertainty is slowing consumption,” a major European meat supplier said.

“German consumers are very quick to cut back on luxuries; they go back to basics very quickly,” he added.

“It’s easier to pass on the costs to industrial customers, it’s very hard to get consumers to pay more, the choices are between paying for electricity or buying meat,” he added.

Prices Soaring

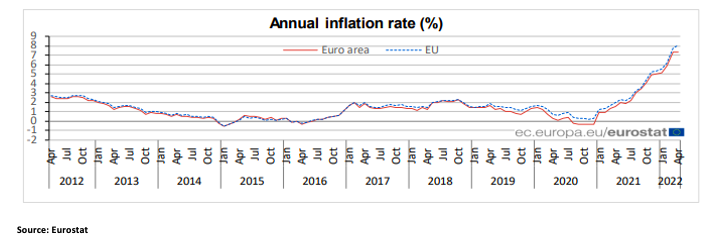

Annual inflation in the EU was 7.4% in April, the highest since records began in 1997 EU statistics agency Eurostat said. Inflation was mainly driven by surging energy prices, which in turn helped push food production costs higher.

The European Food Price Monitoring Tool showed the average meat index across the 27 EU countries has been rising since Q4 2021. In April, the meat index was up 4.2% from the previous month and 6% higher than at the beginning of the year. According to EU food price data from Eurostat, the average meat price in April jumped by 9% from a year earlier.

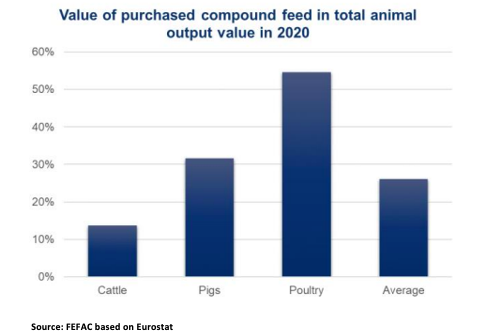

Animal feed costs have increased sharply since Russia’s invasion of Ukraine, as the latter is a key supplier of grains and oilseeds to Europe. According to the UN’s Food and Agriculture Organization (FAO) data, Ukraine is the third largest corn and rapeseed supplier in the world in 2021, exporting 24.7m and 2.66m tonnes, respectively. The war has severely disrupted Ukraine’s exports, causing global grain and oilseed prices to spike. According to the European Feed Manufacturers Federation (FEFAC), “animal feed is the most important livestock production cost factor and represented in 2020 up to 55% of the farm gate value of poultry, 32% of the farm gate value of pigs and 14% of the farm gate value of cattle.”

Output Cut as Demand Falls

In response to the lower demand in Q1, EU meat producers have cut production. In times of weak demand, it is common practice for livestock farmers and meat producers to slow down the slaughter rate of animals or freeze unsold meat.

“The consumption is not there, we will slow down the production,” the major meat supplier said.

Total beef and bovine meat output across the EU 27 countries fell to 513,450 tonnes in February, a drop of 0.9% from January and 0.4% on the year, provisional data from Eurostat showed.

The number of pigs slaughtered in the EU fell by 1.4% on the year in February.

In addition, meat producers in Europe are also implementing cost-cutting measures to manage the rising operating costs, such as reducing the meat content in packaged food.

“There will be less weight in the package but it’s the same price, it’s a legal practice,” the meat supplier said.

Meat Output Shrinking Before Ukraine Crisis

However, even before the recent price shock, EU meat consumption was expected to fall.

The EU forecast in December 2021 that per capita consumption in the bloc would fall to 67 kg by 2031 from 69.8 kg in 2018.

Following record high export demand from China in 2020-2021, the EU pork production is expected to fall in 2022. The USDA forecast 2022 production at 3.3m tonnes carcass weight equivalent, down 1.8% year on year.

The USDA also expects EU beef and dairy output to fall.

“The recent price hike is not expected to curb the trend of declining beef production. It is anticipated that only a sustained and structural price increase for beef and dairy products or financial support can change the overall trend of a contracting herd,” it said.

As a result of the lower livestock forecast, feed grain demand is also expected to fall. The total grain (wheat, barley, corn, rye, sorghum, oats, and mixed grains) consumption for marketing year 2022/23 is expected to fall to 259.4m tonnes, down 0.5% from the previous year, USDA data showed. The EU’s feed grain consumption in 2022/23 is projected at 156.1m tonnes, down 1% from the 157.7m tonnes forecast for 2021/22.

Dietary Trends Changing

In addition, many Europeans have reduced their meat consumption and are opting for more plant-based protein because of health, environmental and animal welfare concerns.

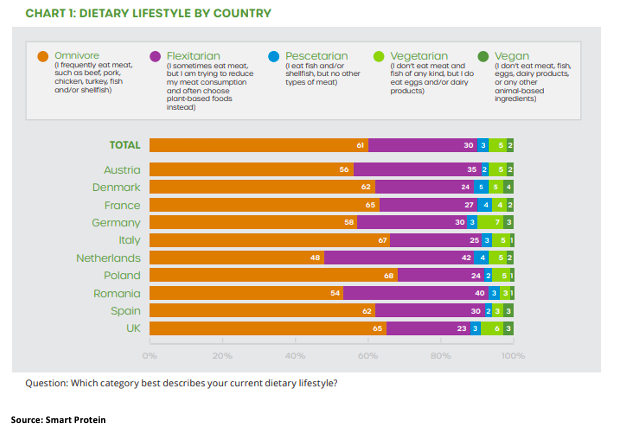

According to a survey conducted by the EU-funded the Smart Protein project, which interviewed more than 7,500 people in 10 European countries (Austria, Denmark, France, Germany, Italy, Netherlands, Poland, Romania, Spain and the UK), 46% of those surveyed have already reduced their meat consumption substantially and 7% were following a completely plant-based diet.

Of the 7,500 surveyed, 30% identified themselves as flexitarian – a diet that consists mostly of plant-based food with the occasional meat dishes. Half of the flexitarians stated that plant-based food is currently too expensive.

As demand for plant-based protein has grown, some meat producers have invested in alternative meat production, including one of the major Spanish producers Vall Companys, which launched its plant-based protein operation Zyrcular Foods in 2018. Zyrcular Foods subsequently started plant-based protein production in 2020.