Opinion Focus

- Global sugar production isn’t growing.

- Brazil is the world’s largest cane growing region.

- Are current sugar prices enough to trigger cane expansion?

Where’s The Growth in Sugar Production?

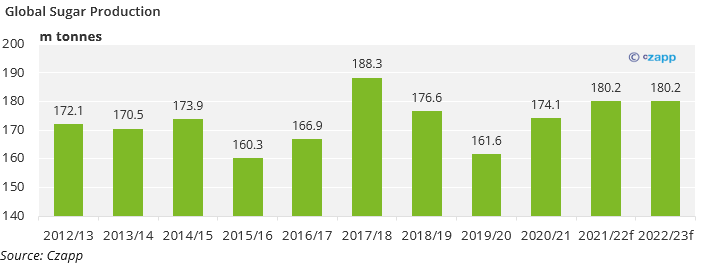

Global sugar production has flatlined for more than a decade at 175m tonnes (+ or – 15m tonnes each year).

No-one has invested in sugar cane or beet planting/processing in the last 10 years because sugar prices have been falling. But ever since they doubled off the 2020 low we’ve been looking for signs that investors are returning to the sector.

We’ve seen this happen in India. Here, the government has given huge incentives to expand cane processing in order to increase ethanol production capacity. This new ethanol supply will then be blended into gasoline to make an E20 blend for road fuel.

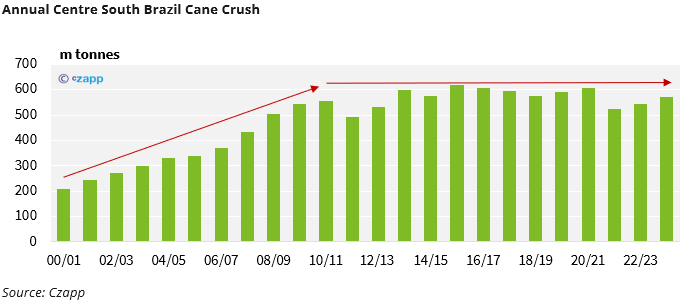

A side effect of this is that Centre-South (CS) Brazil is no longer the world’s largest sugar producer, partly because cane area isn’t growing and partly because of successive years of drought affecting agricultural yields.

In a good year, India takes the crown. When will we see Brazil resume expansion?

What Are Mills Doing in Brazil?

We last wrote about the financial health of Centre-South Brazil’s cane sector in June. We noted that higher prices meant the outlook for the sector was brighter, especially for ethanol.

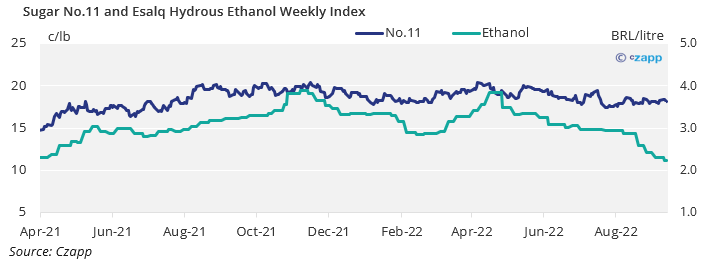

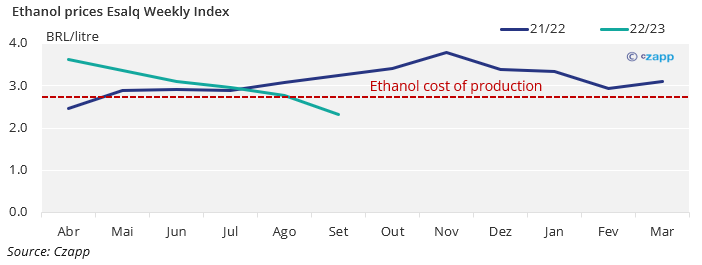

Since then, prices for both sugar and ethanol have retreated, notably ethanol which has fallen by 30%.

In addition, farmer and mill costs have increased: fuel, fertilizer, cane prices and interest rates have reduced margins.

In order for the industry to expand production once more, they need to reduce their debt burden (deleverage). Mills can then invest to improve their operations and diversify their businesses. They could then seek to buy other distressed assets in the sector. Expanding into new milling projects is the 5th step in the process.

Deleveraging

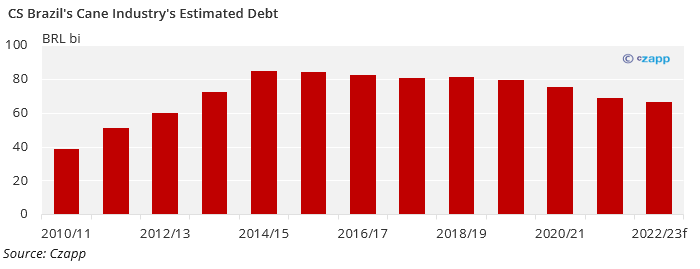

Much of the cane sector in Brazil is still trying to reduce their debt. Total sector debt has been above BRL 70b for almost a decade following the rapid expansion in the late 2000s.

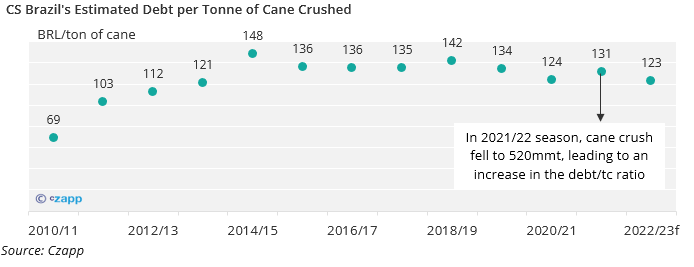

Mills have accelerated their deleveraging in the past 4 years, so that we think total debt will be BRL 66b at the end of the 22/23 season. While this is a positive trend, lenders look at the sector on a debt per tonne of cane basis and believe that anything above BRL 110/mt cane is unhealthy. We think this season will end with mills owing BRL 123/mt cane; better than in the past but still not good.

Even though the industry’s debt burden is reducing, so is the amount of cane being crushed!

It’s important for the industry to try to hit this BRL 110/mt cane level. At this point banks will be able to offer cheaper financing, which will make it easier for mills to invest in existing assets or to acquire other assets, taking the industry closer to the point where it can expand once more.

Investment & Diversification

With improved cash flow, mills have been able to put earnings back into their fields and other assets such as cogeneration, and so we think cane processing will increase in the 23/24 season. This should be positive for mills when looking at their debt per tonne of cane, so long as sugar and ethanol prices remain above the cost of production.

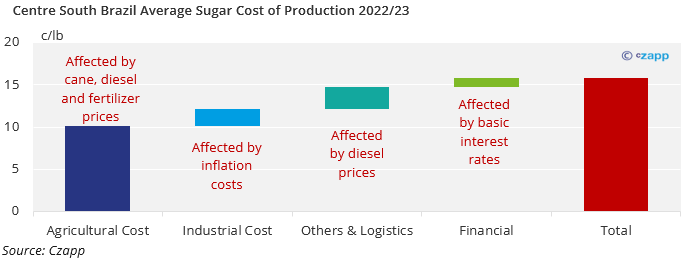

On average, mills currently need to hedge sugar at more than 16c/lb to keep margins positive. This has been achievable for the mills so far, though hedging has slowed in recent weeks as the sugar market has declined.

Getting a good margin for ethanol will be much harder.

Cost of production is around BRL 2.6/litre so mills are already making a loss on ethanol. The outlook for 23/24 isn’t much better. Global energy prices are falling in the face of a global recession. Even before this, the energy price spike triggered by Russia’s invasion of Ukraine led the Brazilian government to reduce fuel taxes and pressure Petrobras ’ pricing policy, as a result reducing ethanol prices.

It’s hard to see ethanol returns becoming remunerative for mills in the future.

Acquisition

Despite these challenges we have already seen some acquisitions and consolidation in the sector.

This is the first good sign we have that cane sector expansion might be close.

Expansion

But we aren’t there yet.

Apart from the uncertainty triggered by poor ethanol returns and falling sugar prices, cane mills need stable government policies for the sector to invest. This was true in the 2000s boom, when ethanol was championed by then-President Lula. Now, even though Lula is running for president again, the outlook is not the same.

Petrobras has suffered from heavy political interference this year, and fuel taxes and the Renovabio program have been changed. This all means there are too many uncertainties in the sector to attract brave investors.

The industry will probably therefore spend the next 12 months continuing to deleverage and investing in existing assets.