Insight Focus

- India banned exports of most rice varieties last week.

- How would the soybean market react if major suppliers banned exports?

- Might the current demand-led bull market become a supply-constrained one?

This announcement received little if any market reaction. Strange.

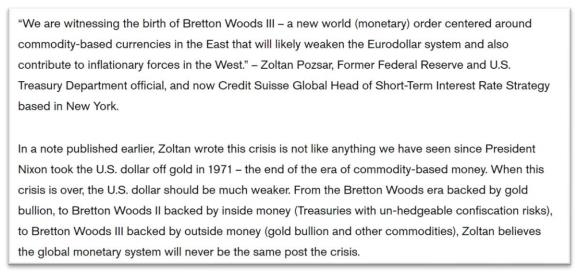

Which led me to reread this which was all the rage in March of 2022 when Zoltan Pozsar published it: https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/we-are-witnessing-thebirth-of-a-new-world-monetary-order-202203.html

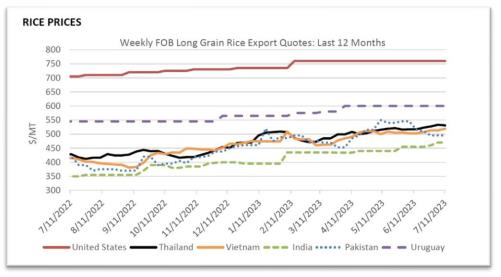

This Indian export ban seems strange when I quickly viewed this month’s Grains: World Markets and Trade issued by the USDA to check global rice prices. Cheapest source in the world banning exports? Huh?

And during the week more Pozsar-ish “my commodity, your problem” as the Chinese ban two strategic commodities I know nothing about (and by the way I really do not know anything about rice at all):

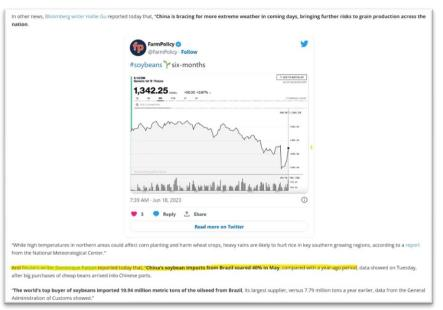

So of course my soybean brain goes right to the globe’s largest soybean import customer and wonders what the chances are that the US would ever up the ante (as the Indians have done on a key food item) and ban US exports which maybe the Chinese are preparing for?

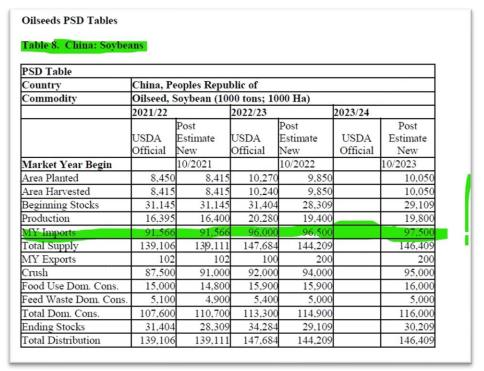

The US annually provides about 33% on average of the above Chinese imports. 33% times 97.5 million metric tons is a LOT of food and a LOT of diplomacy leverage and that might make the US’s number one soybean customer a bit anxious. So maybe the Chinese need to make closer ties happen with another potential supplier to secure a replacement for embargoed US soybeans:

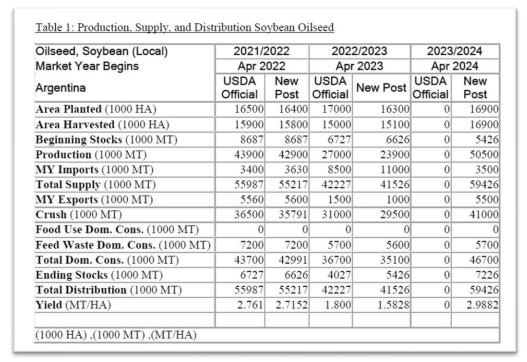

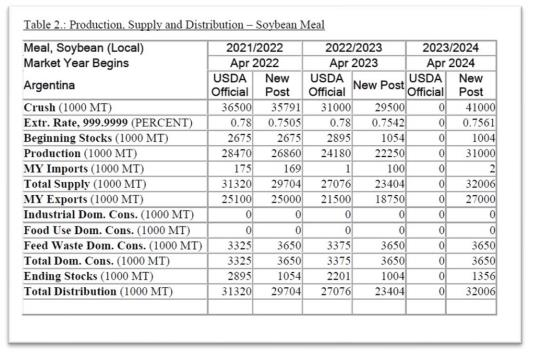

But Argentina is an importer of soybeans this year to replace its profound losses in domestic production (see the local USDA attaché’s estimate of crush at 29.5 MMT v production of 23.90 for this year):

And the country historically crushes most of its soybean production for exports of soy products as the below detail on meal exports relative to total production displays:

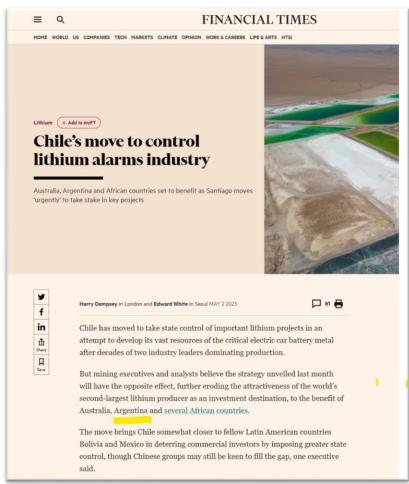

So the Chinese challenge would be to reorient the Argentine soybean “system” to exporter of soybeans instead of processor. The Chinese have other Argentine interests as well with recent deals for another “embargoed” commodity https://www.batimes.com.ar/news/economy/argentina-confirms-new-chinese-investment-in-lithium-production.phtml I know nothing about (but has been in the news recently with Chinese investors pouring money into Argentine developments maybe in response to this action):

I had clipped the above article in May for some thoughts on Pozsar’s “my commodity, your problem” thesis and never used it; since then the embargo process of key commodities continues to accelerate.

I am certainly not a global strategist nor do I have any inside look to all the developments featured in the news stories above but I am just a bit confused by the market’s calm reaction to an embargo of a key global food stuff (Indian rice) that might set off a global commodity embargo war that could include US soybeans (and corn and wheat and sorghum) that would be massively bullish for domestic processor margins (soybean crush and corn dry milling [misnamed the ethanol industry] come quickly to mind) and warehousemen earning huge carries and massively bearish for farmers and logistics providers (truck, rail, barge, dry bulk ocean freight).

Let’s see how the Indian story plays out in the coming weeks and whether it forces some trade flows to countries with a history of honoring contracts or maybe in Zoltan Pozsar’s new world order there is not such a country.

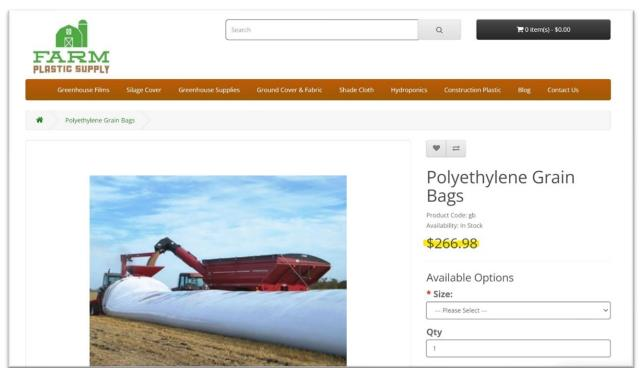

Maybe not $266.98 for long?

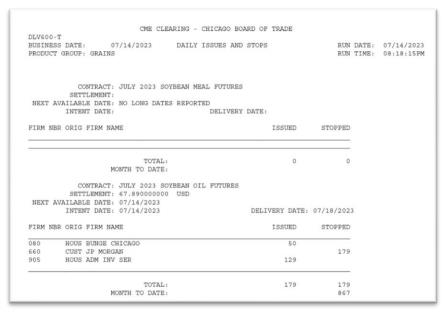

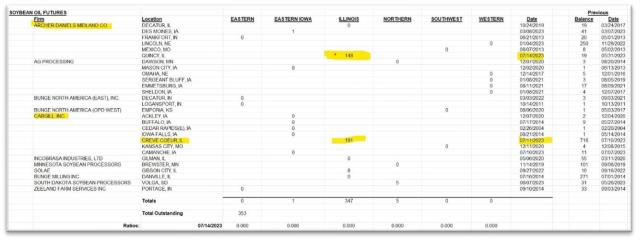

A quick return to the demand bull market today that will define agricultural prices in the coming quarters: soybean oil flat prices remain buoyant and the soybean oil futures curve continues to invert rapidly. The July expiration featured a former stopper of Cargill’s deliveries, ADM, giving them back to Cargill plus adding a few of their own new ones so the outstanding receipts in delivery position grew BUT Cargill stopped receipts on the last day which necessarily means they will have to cancel them:

And the ADM new 129 now show up in the delivery window:

So the 353 will get reduced by the portion of the 179 that are Cargill’s own receipts (CME rules require the cancellation of your own receipts if you stop them in the delivery process) but overall I expect that the soybean oil delivery window, like the meal window already is, will be empty in the not-too-distant future.

The major grain/oilseed macro story is a bull market for the oilseed sector due the RD industries’ sharply increasing demand for feedstock that strains current production capacity plus stored inventory and per prior letters/posts to LinkedIn you know that I will be listening closely to the earnings calls of feedstock providers and the refiners who use their vegetable oil production for guidance on the post finalized EPA BBD RVO “new” perspective. Do embargoes sneak into the bull market and help convert the demand bull market into a supply bull market? Dunno, but I am watching (as well many of my trade desk managing readers are as well).

Enjoy summer (the tomatoes are about 2 weeks away here in Omaha), pray for global peace, and trade well (take a look at deferred volatility strategies which are too cheap IMHO if embargos unfold).