Insight Focus

While the USDA is projecting a pretty grim outlook for vegetable oil crush rates and storage, prices have not followed the normal trend. Bets on the renewable diesel industry snapping up soybean oil capacity may just be overblown.

USDA Warns of Supply Shortage

A hallmark of USDA reports is measured language. I am not certain why the USDA maintains this vocabulary equilibrium, but I suspect the economists who analyse and forecast grain, oilseed, and livestock supply and demand balance sheets understand their ability to influence global markets.

While private analysts can influence traders’ views of global supply and demand to a certain extent, it really is the USDA economists who provide the global trade with key statistical and written forecasts — in large part due to their US-taxpayer-funded infinite resources that allow their work to be freely accessed by global traders.

Imagine my surprise, then, when I read my favourite monthly USDA report, Oilseeds: World Markets and Trade, and found this verb in the May 2024 report: deplete. “Deplete” is a very active verb and contains an ominous tone that other verbs like reduce or decrease do not. Deplete suggests that a stored resource, in this regard an agricultural commodity, is going away and baby it is NOT coming back.

Why would USDA economists employ such unambiguous language to describe global demand for vegetable oils overtaking global supply? And why would the economists employ such strong language amid a major bear market in the price of global vegetable oils? I suspect that USDA economists see a major trend unfolding and they wanted to put their readership on notice: pay attention!

Here is the USDA economists’ usage of deplete in the May report:

If a commodity gets depleted rather than reduced, then one of two outcomes must happen. Either the commodity gets widely substituted — maybe permanently — to restore the supply and demand balance. Or the commodity’s balance between supply and demand gets restored via a sharply higher repricing that brings on more supply and slows growing demand.

But the USDA economists selected an ominous verb to characterise a reduction in global supplies in the midst of a major bear market in global vegetable oils where supply is being aggressively offered. This is especially true in US domestic markets.

US Confronts Bear Market

Perhaps this was done to incentivise either actual consumption or storage of supplies. The latter will only encourage the bears to remain bearish as they point to the stored supplies and ignore producers’ demands for higher prices.

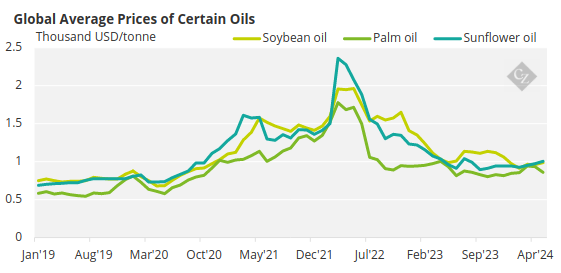

Source: World Bank

And how bad is this bear market in global vegetable oil markets: bad, real bad. For US soybean oil traders, finding a home for production requires a sharp reduction in physical pricing relative to the CME futures market by at least 7c/lb on a 45c/lb futures market, which represents a 15% price discount.

Really, really need to sell some pounds due to (widespread) storage or logistical constraints? A 25% discount MIGHT get it done.

Vegetable oil producers are begging buyers for assistance and calling in favours from old friends in the US domestic markets. US crush rates, as evidenced by the National Oilseed Processors Association (NOPA) April report, are slowing dramatically as the consumer system cannot handle the next unneeded pound of soybean oil produced. This is true even as the US returns from a two-year hiatus from the global export markets to find buyers. In my 36 years of vegetable oil trade, I have never seen supply excess this bad in the US.

How else is the bear manifesting himself in US trade? The Chicago Mercantile Exchange’s (CME) delivery window has a lot more supply in it than in recent times with 2,589 receipts, 82% of which Cargill delivered. The futures curve also remains in a generous carry, and physical bids for soybean oil through Q3 2024 remain depressed (and depressing).

And yet, during this bear market, USDA economists employ the verb “deplete”, complete with all its worrisome overtones. Huh?

Demand Growth Outstrips Supply

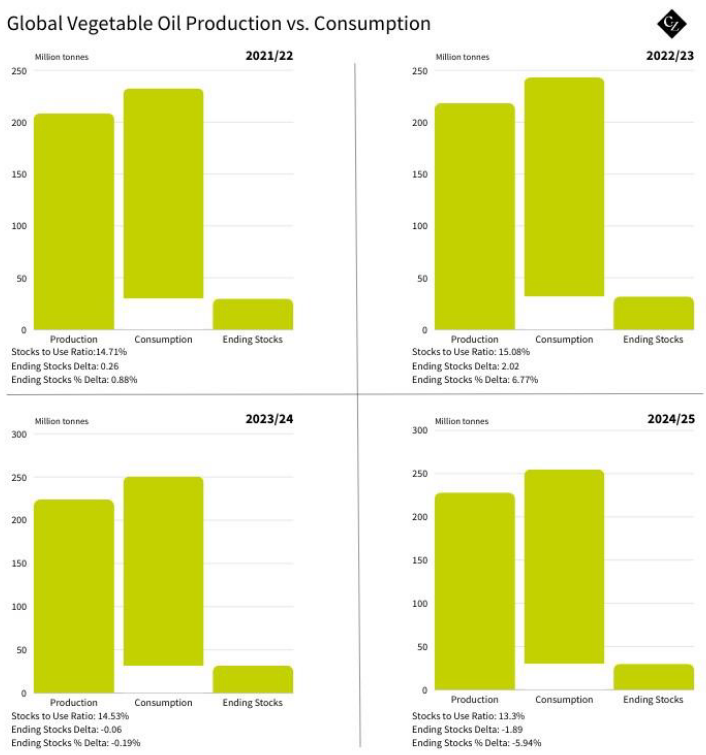

“Okay,” I thought to myself, “let’s go find the reason the economists selected the verb deplete.” First to the USDA’s supply and demand table for all global vegetable oils.

Two metrics jump off the page immediately:

- The stocks to usage ratio — normally the professional trader’s most important metric used to qualify a bull or bear market — dropped to its lowest level in six years at 13.3%.

- Global production is up 19.45 million tonnes over four years.

- Global consumption, led by rapid expansion in demand for biofuels feedstock from the global biodiesel and renewable diesel industries, is up 22 million tonnes.

- Both trends are not sustainable and if continued would deplete global supplies — just not in the immediate future.

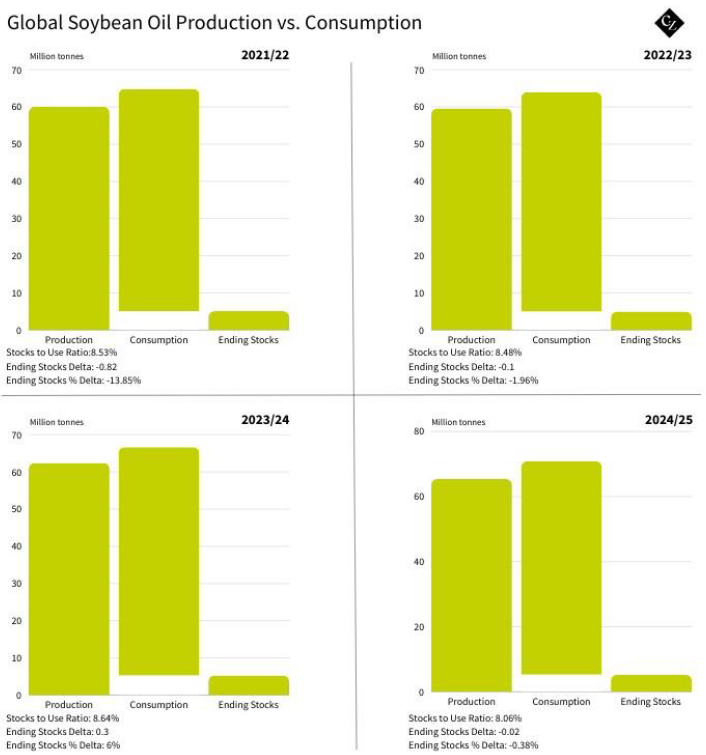

Secondly to the USDA’s global supply and demand projections for soybean oil:

The latest stocks to usage ratio dropped to its lowest level in six years.

- Global production up 6.52 million tonnes over six years, while global consumption up 8.26 million tonnes.

- US domestic consumption accounts for 2.7 million tonnes of those 8.26 million tonnes — or 33% of all global domestic demand for soybean oil. This is led primarily by growing demand from the renewable diesel sector.

- Both trends are not sustainable and if continued would deplete global supplies — just not in the immediate future.

USDA Projections Diverge from Price Reality

USDA economists see a tighter balance sheet for the coming year with the tightest stocks-to-usage ratio since 2020/21, but the change is not dramatic and certainly does not suggest depletion.

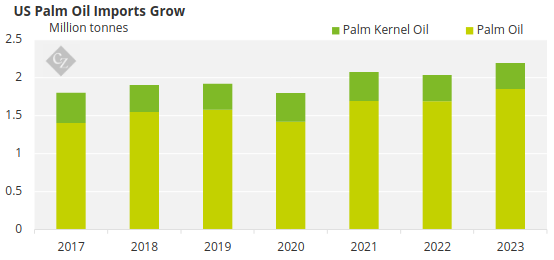

Most of the headlines in global vegetable oil trade focus on the US renewable diesel industry and its massive demand. However, the reality is that the US renewable diesel industry is in actually morphing into the US renewable palm oil diesel industry if recent headlines from various news agencies are correct. There have been massive increases in “used cooking oil” imports to meet feedstock needs.

And this may be the disconnect between the economists’ view of “depletion” and current US soybean oil prices. US soybean oil futures are currently 5% below a year ago and physical prices are 20% below a year ago with vegetable oil surpluses all over the US.

The economists are betting that the US renewable diesel industry will use US soybean oil as the primary feedstock, but the reality is the most rapidly expanding feedstock supply is international used cooking oil imports (primarily palm oil from Indonesia) that economists may not be factoring into their “depleting” models.

Source: USITC

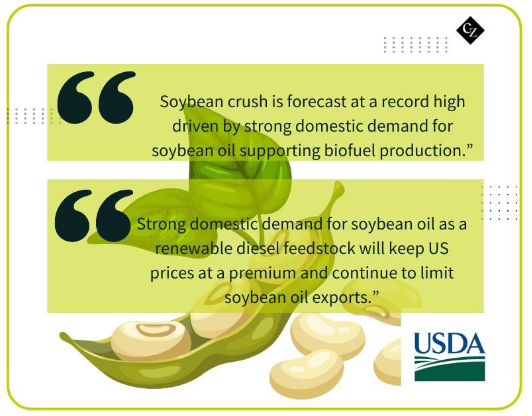

Two sentences detailing US soybean demand from the May report capture what may be the USDA economists’ “overestimation” of the renewable diesel industry’s reliance on US domestically produced soybean oil:

US Soybean Crush Slows

Unfortunately for the US soybean processing industry, neither sentence accurately captures the current market. US crush is slowing dramatically due to the unmanageable soybean oil surplus and US soybean oil is now competitive for export globally. Weekly sales and shipments continue to expand.

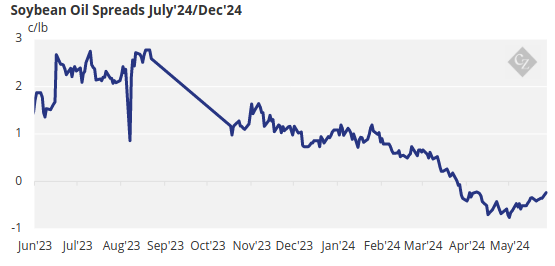

To me, it is clear that the renewable diesel industry intends to remain a user of other feedstocks instead of domestic soybean oil. This was demonstrated by the futures market’s response to the shocking decline in US crush rates as well as stored supplies for the month of April as reported by NOPA.

The actual crush figures came in at 166 million bushels – far below average analysts’ estimates of 183 million bushels. Similarly, the NOPA report showed 1.755 billion pounds of oil in storage – less than the average analysts’ estimates of 1.882 billion pounds of oil.

And the response from the US renewable diesel industry? A big fat yawn. However, there was a sharply inverting curve in soybean meal futures and physical prices as the US poultry, swine, dairy and aqua industries start to realize that the only thing depleting right now is their vision of generous surpluses of domestic soybean meal from an expanding US soybean processing industry.

Since the April NOPA report, which provided the renewable diesel industry a very clear insight into the US soybean processing’s industry need (and willingness) to dramatically decrease run rates to manage soybean oil surpluses, futures prices at the CME have increased a paltry 4.5%. Much more importantly, the carrying charge shaped curve has not budged. Yawn again.

US soybean processing industry run rates will likely surprise again to the downside for the month of May. The industry is using the poor margin environment to take a much-needed expanded maintenance and repair period that it has not been able to do over the last three years given extremely profitable margins during the traditional summer downtime period. Plant managers were urged to rush through the summer maintenance period and get plants due profitability over the last three years.

Concluding Thoughts

The US renewable diesel industry has, in my opinion, caught the US soybean processing industry completely by surprise with its used cooking oil imports. The US soybean processing industry will likely continue in the same manner of sharply slowing operations to manage soybean oil surpluses. This means the US soybean meal consumer ends up carrying all the risk.

Why? In order to get the US soy processing industry capacity utilization higher, protein meal consumers need to start bidding up prices of soybean meal. This would offset the negative contribution to margins from soybean oil futures and much below average physical prices.

Until this happens, those consumers face a summer of depleted supplies that might lead to a spike (or super spike?) in soybean meal prices that does not moderate until new crop soybean supplies arrive.

Surely the US industry will crank up to process the cheaper new crop supplies of soybeans during October, November and December. After all, cheap soybean basis should offset cheap soybean oil basis and return the industry to profitability.

But the probability that the industry will crank up from now until then is at best a 50-50 proposition. That should give US soybean meal consumers, both domestic and globally, pause.

Nearby soybean meal versus new crop soybean meal (the July versus the December spread): a “carry” has become an “inverse.”