Insight Focus

- Research by the Bank for International Settlements shows that global conflicts are complicating supply chains.

- Recent events in Israel and Palestine are one example of this.

- Czapp takes a look at how the conflict could impact global food trade.

According to new research by the Bank for International Settlements, there is an ongoing re-alignment of global value chains caused by a host of factors – one of which is conflict. The IMF warns that, over the long term, trade fragmentation – nearshoring, friendshoring and the creation of regional trade blocs – could shave up to EUR 7 trillion (USD 7.4 trillion) from global GDP. This would be the same impact as if the combined GDPs of France and Germany were wiped out.

The Israel-Palestine Situation

The conflict between Israel and Palestine has been ongoing for decades, but last week the violence escalated. Ongoing conflict could cause trade disruption and a reshuffling of supply chains in the long term.

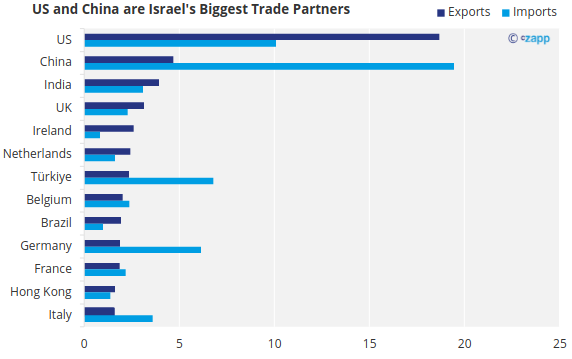

As of 2022, the US and China were Israel’s biggest trade partners. According to UN Comtrade data, Israel sent goods worth about USD 19 billion to the US, mainly in the form of fertilisers, petroleum oils, concrete and chemicals.

And like many countries, Israel imports significant amounts from China, mainly machinery, cars and other manufactured goods. In return, China buys fertilisers and chemicals from Israel, but also large quantities of fruits and fruit juices.

Source: UN Comtrade

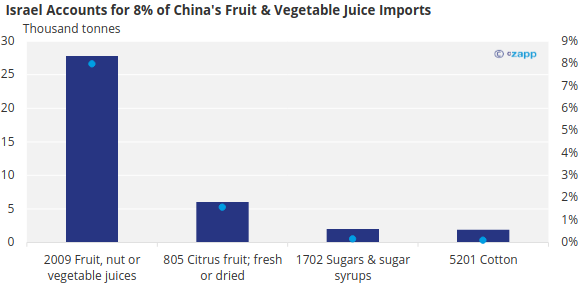

In fact, the fruit, nut and vegetable juices imported by China from Israel accounts for almost 8% of its total imports under the HS code 2009.

Source: UN Comtrade

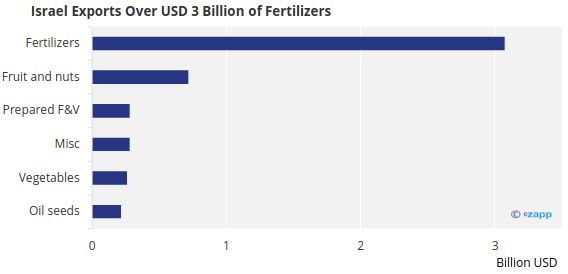

Israel Major Fertiliser Exporter

But by far Israel’s largest export is fertilisers. Trade data shows that in 2022, Israel exported over USD 3 billion worth of fertilizers globally. According to UN Comtrade figures, this is 3% of global fertilizer exports in value terms.

Source: UN Comtrade

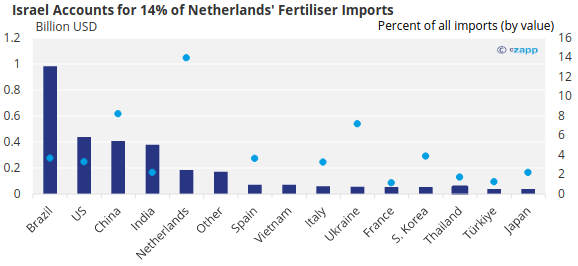

Israel exports large quantities of fertilisers to several countries, including major food producing countries Brazil, the US, China and India. Israeli fertiliser exports account for over 8% of China’s fertilizer imports according to Comtrade data and almost 14% of fertiliser imports to the Netherlands.

Source: UN Comtrade

This is especially important in light of trade disruptions caused by the Russian invasion of Ukraine. The invasion almost doubled global fertiliser prices to highs of almost USD 1,000 per tonne.

Source: World Bank

Israeli Ports Impacted

The Israel-Palestine conflict also has implications for shipping companies. Two of the ports in the region are located less than 50km from the centre of the conflict on the Gaza Strip.

The Port of Ashdod is a deepwater port that handles a variety of goods such as agricultural exports, citrus fruit, timber, metals and pelletized cargo. Along with the Port of Haifa to the north, is it the country’s major port, handling over 3.1 million TEU of container cargo each year.

The smaller Port of Ashkelon is just 15km from the Gaza border. It is an oil terminal, mainly handling petroleum products and derivatives. According to Reuters, the port was closed after the conflict broke out last week. Shipping firms are also likely to impose war surcharges and will likely be facing higher premiums upon P&I renewal next February.

A Humanitarian Crisis for Egypt?

The conflict also has knock-on effects on other countries in the region. Palestine’s regional allies include Saudi Arabia and Iran. By far its strongest ally is Iran but its closest ally is Egypt, which could feel the impacts of the conflict. Egypt directly borders Israel and the Gaza strip. So far, authorities have rejected the idea of refugee corridors. But Gaza is home to 2.3 million people who have no alternative exit route.

Concluding Thoughts

- The Israel-Palestine conflict is the latest in a series of events that have splintered global trade.

- Supply chains are becoming more and more complex resulting in higher operating costs.

- The IMF predicts that a dip in globalisation will wipe 7% off the global economy – but says this could rise as high as 12%.