Insight Focus

- New year, same range for raw and refined sugar.

- Sugar is finely balanced and one poor crop away from higher prices.

- Patience and discipline will be an edge for hedgers.

Hello and Happy New Year. It’s Stephen from Czapp with a sugar market video for January 2023.

I’d love for the sugar markets to be exciting in 2023. We finished last year with a Santa rally to the top of the range in raw sugar. But I think we also need to be realistic.

Both sugar markets have traded sideways for a long time. The refined sugar market for 10 months…

Source: Refinitiv Eikon

…and the raw sugar market for 17 months.

Source: Refinitiv Eikon

Source: Refinitiv EikonThere’s been lots of noise in the meantime, but no real direction. As I’ve said before, this tests the patience of analysts who need to sell stories. But for anyone managing sugar market risk this is perfect. Your patience and disciplined risk management plan can be a real edge in the kind of market.

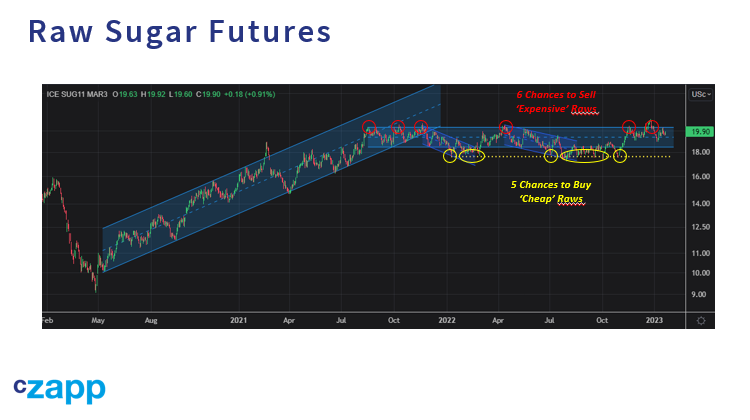

Look at the raw sugar futures. Anyone wanting to buy sugar has had 5 opportunities in the past 12 months to do so below 18c.

Source: Refinitiv Eikon

Meanwhile, producers needing to sell have also had 6 opportunities to do so at more than 20c. Much as I’d like to start 2023 with a big story, it’s also possible the market continues to go nowhere for a long time. There’s no reason we couldn’t stay in the range for the entire year, for example. That would be perfectly possible, great for anyone needing to hedge and a nightmare for me. I’ve got videos to make.

So what should we look out for right now?

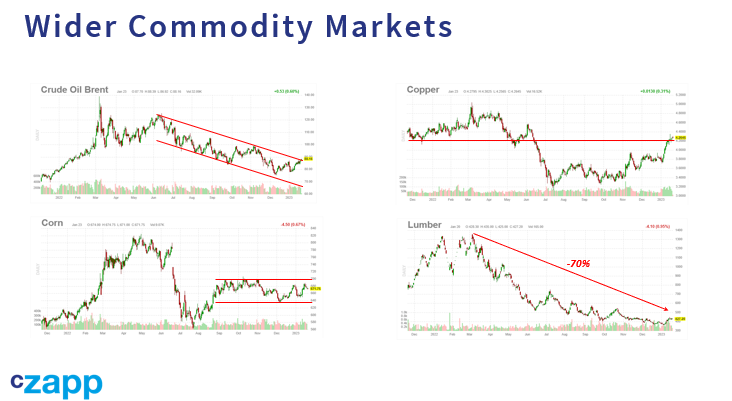

Firstly, be aware of the tone of the wider markets. Most other commodity markets are a mixed bag. Many are quite weak – including the energy markets which are also important for sugar seeing as cane can be used to make ethanol as well.

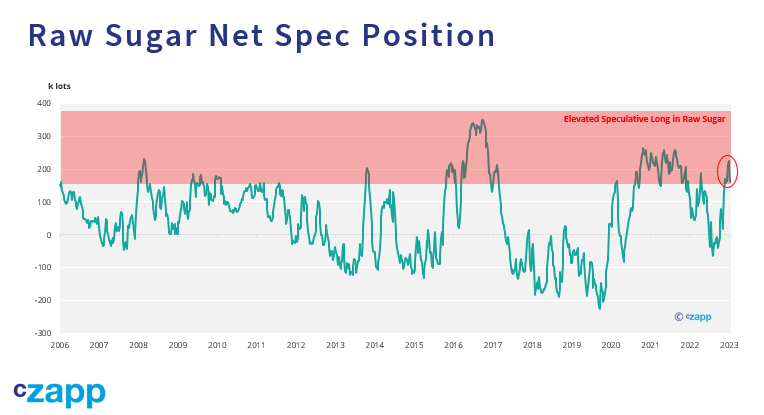

This isn’t great news for sugar sentiment, especially seeing as speculators remain quite heavily long raw sugar.

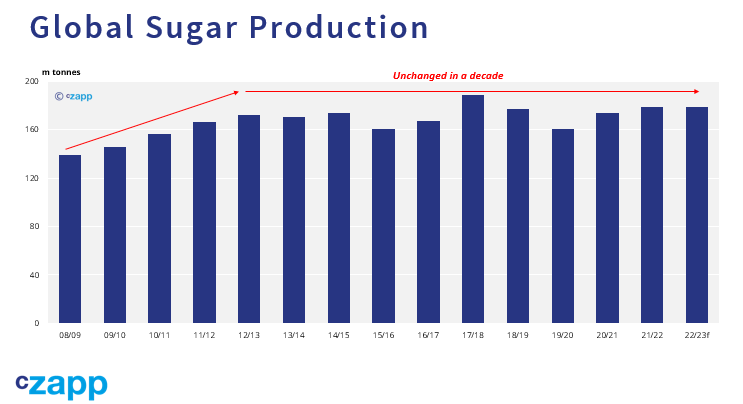

But sugar itself has a couple of positive things going for it. The world isn’t making very much of it. I covered this in a lot more detail in last month’s video – check it out for more information.

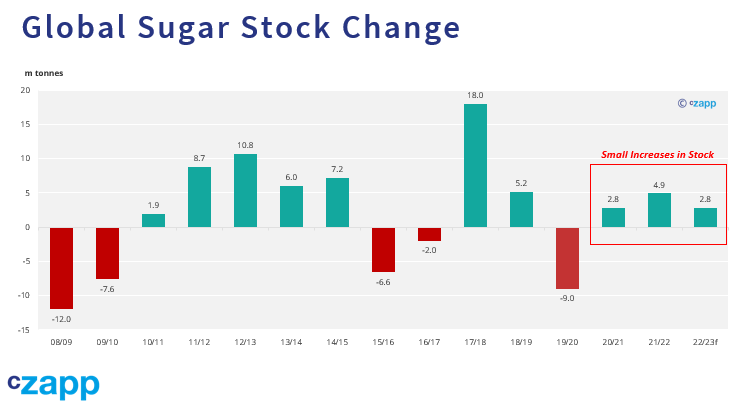

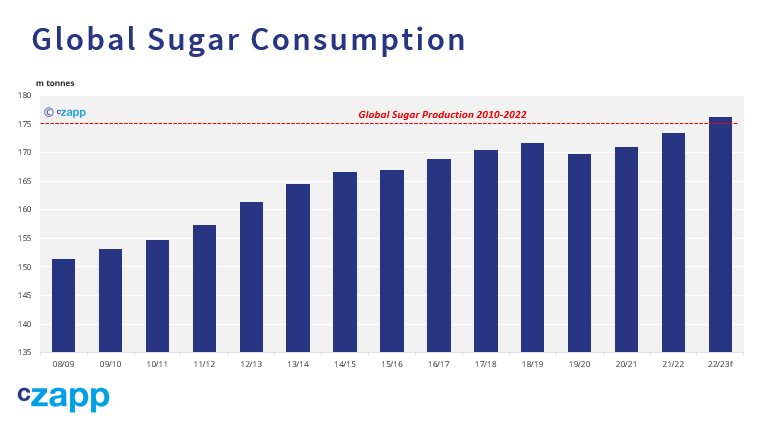

Production has stagnated for a decade at 175m tonnes, plus or minus 15m tonnes. This means that each year we are now only making a small surplus of sugar.

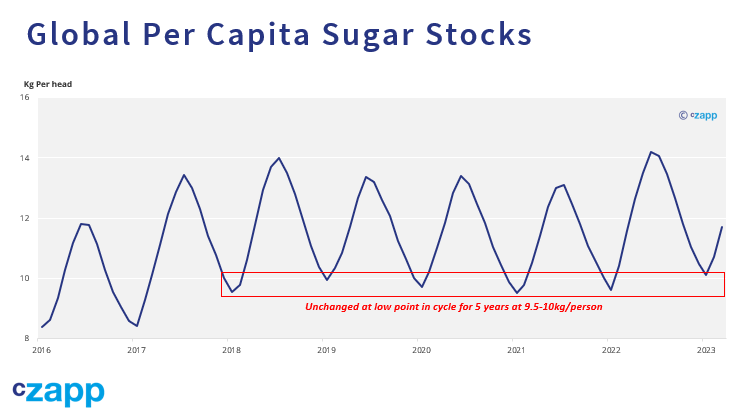

Fine, that’s still a surplus, but don’t forget that the world’s population keeps growing too. So if we look at global sugar stocks on a per capita basis, these aren’t growing at all.

The world’s supply security for sugar isn’t improving. Sugar consumption also keeps grinding higher. It’s now above the 175m tonne level, which is where production has stagnated for a decade.

We are one crop failure away from a sugar deficit and a drawdown in stocks. Depending on where this happens, this might be meaningful for price.

The front of the futures curve nicely reflects this risk: it’s trading at 20c/lb, which is a premium to most major producers’ cost of production. The nearby spreads are also backwardated, encouraging supply forward and deferring demand.

Source: Refinitiv Eikon

But the back of the futures curve looks cheap. It is roughly aligned with cost of production for major countries, giving no reason for anyone to invest further in sugar production to meet needs in the years ahead.

Source: Refinitiv Eikon

It’s also currently at the bottom of the range. It looks mispriced given the supply risk in the market.

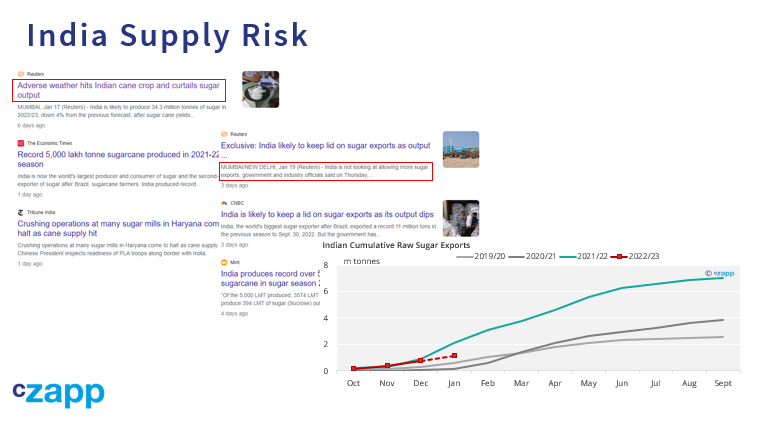

Thinking about this year, there are reports in India that this year’s cane crop might not be as good as we’d first hoped.

The government is unlikely to authorize more sugar exports until it knows how big the cane crop is. This means the 6m tonnes exports that it’s already allowed and that’s been fully taken up won’t be extended for a few months yet at least.

That’s less sugar availability in the short term.

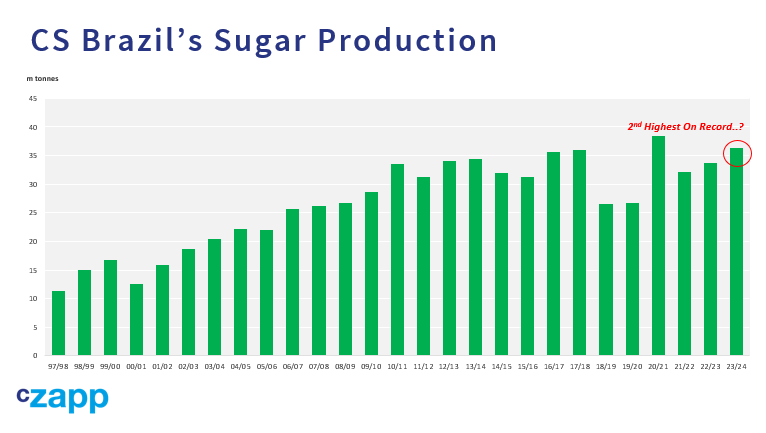

Counterbalancing this, this year’s cane crop in Center South Brazil looks like it’ll be large.

But as a southern hemisphere producer, any additional sugar from here won’t be available until the end of the year, so this won’t help the short term supply problems.

This makes the raw and refined sugar markets quite finely balanced in the short term

20c is probably fair for raw sugar prices today, but the back of the curve probably also needs to rise to account for the tightness of global supply.

This can all happen while spot sugar prices trade sideways in the range. Lots of noise, but very little signal.

I think it’ll be a challenging year for anybody in the markets.

I wish you lots of luck and I’ll try to support you as best I can.

Thanks for watching and see you next time.

Other Insights That May Be of Interest…

Frost Risk Alert in CS Brazil Cane Fields

Could US Beet Planting Delays Mean Repeat of 2019 Supply Gap

Explainers That May Be of Interest…

Czapp Explains: The Impact of El Niño and La Niña in Each Region of Brazil