Insight Focus

- Itochu SUGAR and Nissin Sugar are merging their sugar refinery groups in Japan.

- The new entity will have around 30% of Japanese sugar market share.

- This is the second major merger in the Japanese refining sector in the last 2 years.

Japan is a major raw sugar importer and currently imports around 1.0 million tonnes of raw sugar per year. This accounts for about 55% of requirements, with the balance supplied by Japanese farmers who consistently produce 800,000 tonnes of sugar per year – about 80% from the sugar beet industry in Hokkaido in the north and about 20% from sugarcane in the southern tropical regions of Okinawa and Kagoshima. Total sugar consumption in Japan is about 1.8 million tonnes.

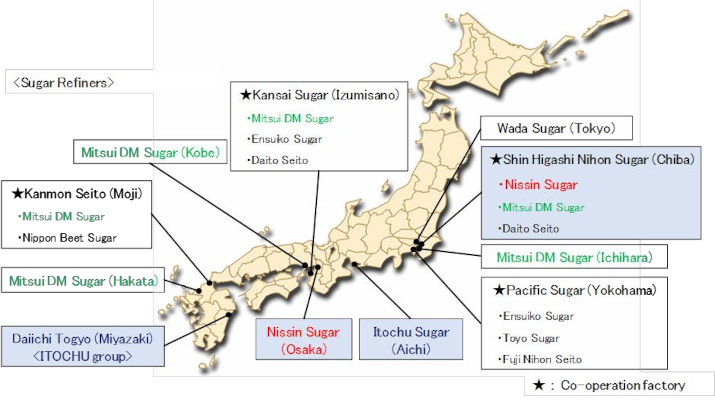

The sugar refining industry is relatively fragmented with 11 sugar refining factories and total capacity of 2.0 million tonnes. Ownership is complex with many refineries having multiple shareholders – often the large Japanese Trading Houses. To enhance industry economies of scale some factories are jointly-operated by multiple sugar companies (brand owners).

The industry has been relatively profitable and its listed companies have performed solidly on the stock exchange over the last 10 years. The Japanese government works to support rural incomes and smooth out the volatility of global sugar prices by buying the imported raw sugar from the refiners at the world market price, and simultaneously selling it back to them at a higher but stable price. The refiners have increased predictability over input costs and the Japanese domestic market price, close to USD 2,000/tonne, allows a positive refining margin. The surplus raised by the government at the time of import is re-distributed to assist the domestic sugar growing industry.

The long-term trend of sugar consumption however has been one of gradual decline due a decreasing and aging population as well as an increase in the availability of sugar substitutes. It is this gradual decline in consumption, combined with steady domestic production, which has led to a slow decline in raw sugar imports.

This domestic environment, combined with the recent sharp rise in raw material prices, has driven the need for the industry to consolidate to extract operational and management efficiencies.

In April 2021 Mitsui and Mitsubishi, merged their respective sugar businesses: Mitsui Sugar and Dai Nippon Meiji which are two of the largest Japanese refiners. The newly formed entity Mitsui DM Sugar has about 40% of the Japanese sugar refining market. Mitsui controls 26.5% of the new company and Mitsubishi controls 20.0%.

Now a further merger is proceeding between two more large refining groups: ITOCHU Sugar and Nissin Sugar. The new entity, due to commence on 1st January 2023, will be the second largest sugar company in Japan with about 30% market share. ITOCHU Corporation will own 35.9% of the new entity and Sumitomo Corporation will have 24.1%.

Both Mitsui DM Sugar and the recent ITOCHU-Nissin New Co will be listed on the Tokyo Stock Exchange in what is known as the “Prime” section, a new categorisation for the leading Japanese companies.

Czarnikow had the opportunity to speak with the President of ITOCHU Sugar Co Ltd, Mr. Koji Yamamoto when he was in London in October and heard that “We are very excited about the merger. Through the consolidation between ITOCHU Sugar and Nissin Sugar, New Co aims to enhance corporate value for all stakeholders by not only improving production efficiency and the nationwide sales network, but also by providing functional sweeteners in order to meet market needs.”

It is thought this consolidation will be beneficial for the Japanese sugar industry because it will create synergies between the two companies in the areas of logistics, production, management and research & development. Raw sugar imports in to Japan will be more efficiently handled. The new refiners will continue to provide a stable supply of quality sugar to the Japanese market under the current regulatory framework. Through this industry consolidation, the sugar business in Japan will be more robust and better placed to take advantage of future strong growth opportunities.