Insight Focus

Worries about CS Brazil’s cane crush have propelled raw sugar futures higher. But this year’s sugar production will still be excellent and logistics remains the key factor to watch.

Hi everyone, it’s Stephen from CZ with another update on the sugar market.

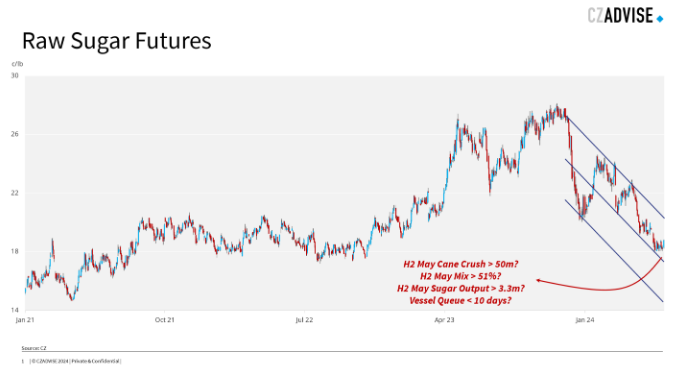

I finished my last video with a few questions for the market.

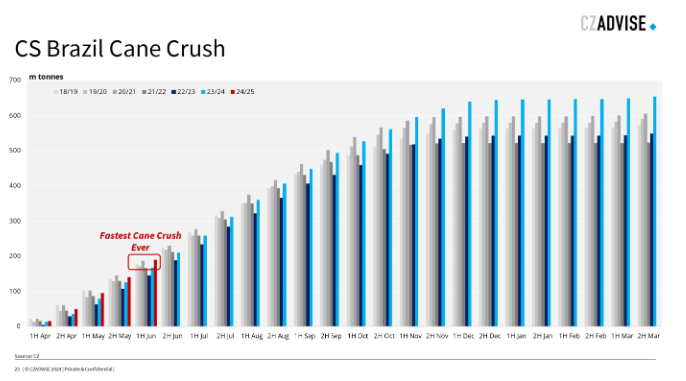

If the price downtrend was to persist, we’d need to see a stronger cane crush in Centre South Brazil – more than 50m tonnes in the second half of May. We’d also need a stronger sugar mix, high sugar output and a lower vessel wait time at the ports.

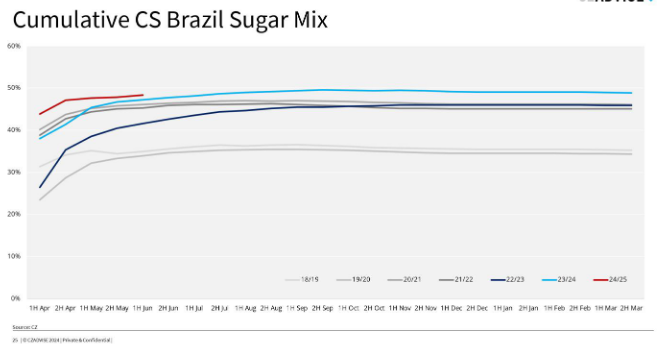

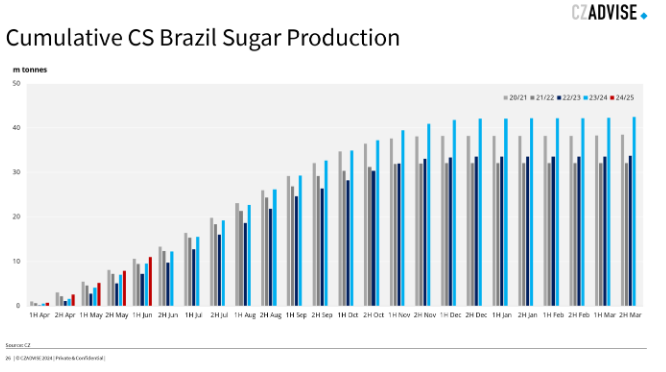

As it happens, the second half of May cane crush was 45m tonnes and the crush in the first half of June was only 49m tonnes. The fortnightly mix remains below 50%. Sugar output therefore remains below 3.3m tonnes. The vessel queue at Santos port is still roughly 20 days.

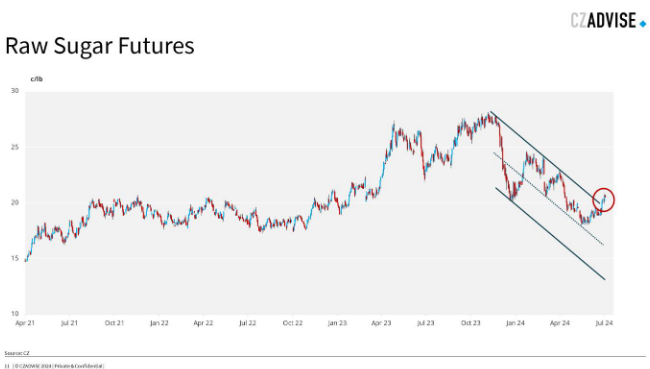

Is it any wonder, therefore, that since my last update sugar looks like it might have broken out of its 2024 downtrend?

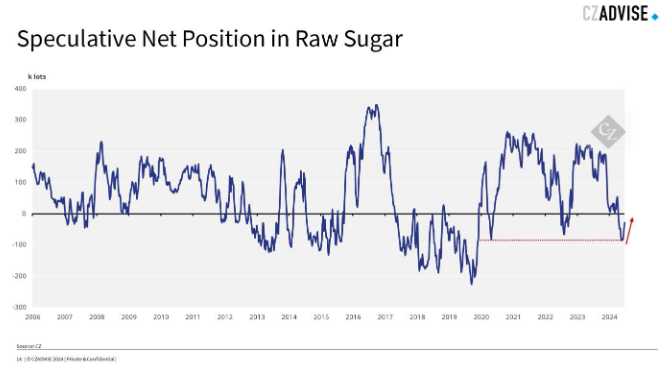

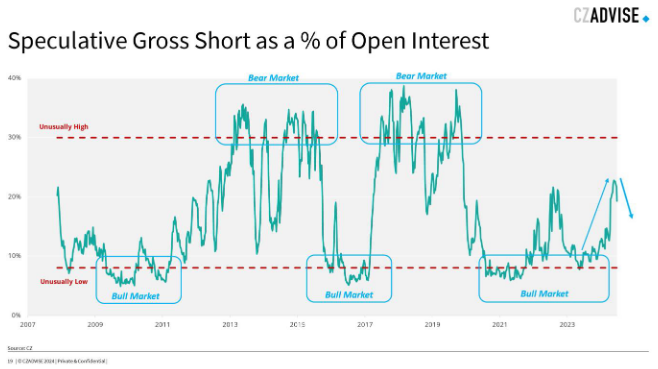

CFTC data shows that this is because speculators, who had previously been short – and in fact held their largest net short in raw sugar since before covid – have now bought back that short position and are effectively neutral in the market.

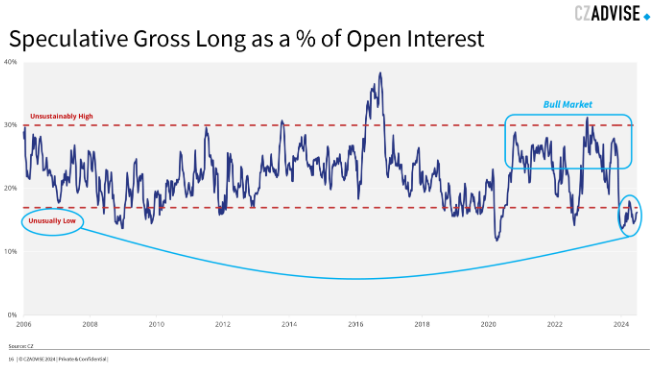

Note they’ve not yet built a new long – it’s too early to say that the 2020s bull market is continuing.

But they’ve definitely been spooked out of their short. And they’ve been spooked out well before they’d managed to build enough momentum to put sugar into a proper bear market like we saw in the 2010s.

The question now is whether this short goes back towards bull market territory again. It looks like speculators lack conviction about where the sugar market is going next. You can add me to that list too.

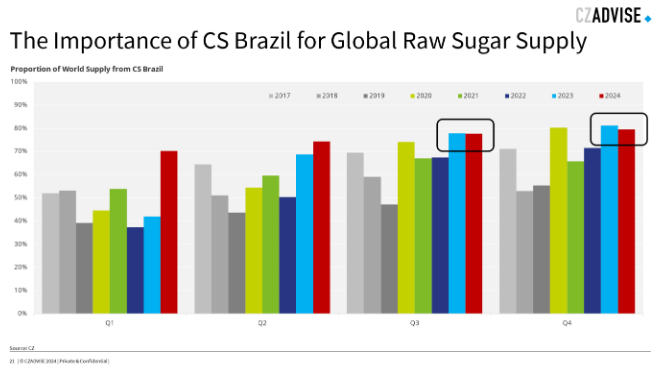

We think CS Brazil will account for 75% of the world’s raw sugar supply in 2024, so what happens here is clearly important for the market. Poor cane development is bad news and so immediately bullish for the market, right? I’m not so sure.

I still think this year the focus should be on Brazilian logistics and it’s too early to call a crop failure. Let’s look at the crop quickly first.

Despite all the gloom so far, cane crushing is still the highest it’s ever been at this time of year. It’s comfortably ahead of last year’s and also the 20/21 season when around 600m tonnes of cane has been crushed. Obviously this doesn’t tell you how much cane is in the fields and it’s a reflection of the dry weather meaning there’ve been lots of crushing days, but it’s still good to see.

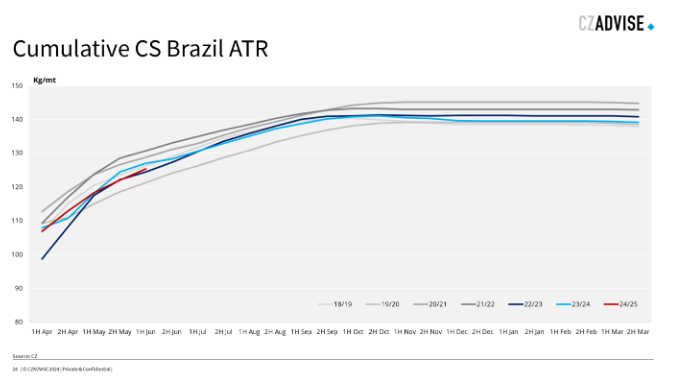

The sucrose yield, or ATR, is mid-range for this time of year too, so there’s not much to see here, even if it is a bit lower year on year.

The sugar mix is also doing ok – it’s not hit the highs we’d hoped for yet, but it’s still comfortably the highest we’ve seen in recent history.

Which means sugar output is the highest on record. On this basis, you’d be forgiven for wondering what the big fuss is.

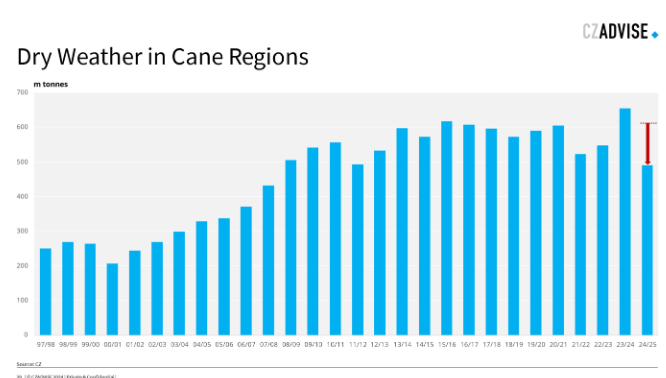

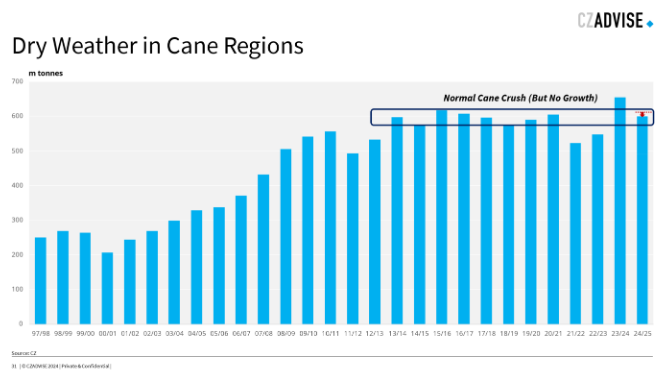

And yet, the weather in the Centre-South Brazil cane regions remains really dry, which isn’t too much of a surprise seeing as it’s the dry season now, but it comes after a very dry rainy season. This crop is failing to reach previously high expectations.

When this happens, the best thing to do is to hit the road and see what’s happening for yourself. That’s exactly what we’ve done. In the past week we’ve visited mills that together account for around 5% of the region’s cane crush and they don’t think this crop will be a disaster. Our team went to Aracatuba and the message we got was that cane would be 15-20% lower than they’d first hoped.

If we applied that to our previous 610m tonne of cane forecast for all of Centre-South Brazil, that would imply a crush of 490m tonnes, or thereabouts. But mills have also planted a lot of cane in the past 18 months and so given the new acreage they don’t think they’ll be down by much at all this year. Remarkably, some mills also stood over cane from last season too.

We therefore think it’s possible mills in the region crush around 600m tonnes of cane this season. Clearly that’s disappointing compared to last year’s monster 654m tonnes, but it would still be normal for most of the past decade.

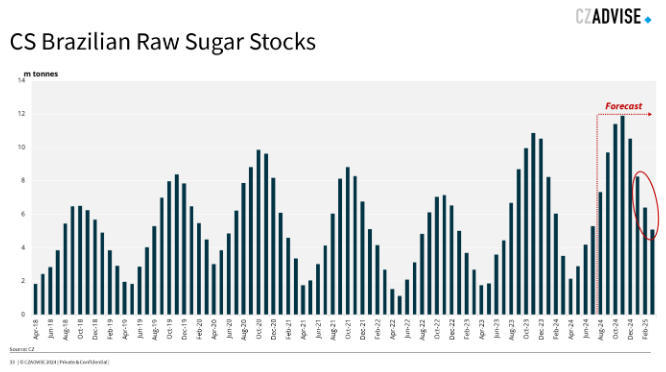

And while Brazil makes 7m tonnes of sugar a month, it can only export 3m tonnes a month. This was true when speculators shorted the market in December, and it’s still true now. Nothing much has changed. Brazil will still build stock into the off-crop in Q4 and it will then need to be exported.

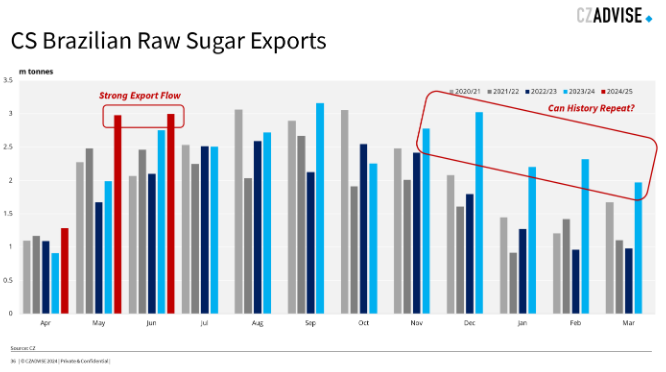

On the export side things are going well. Around 3m tonnes of raw sugar was shipped from Brazil in May, and a similar amount left in June. The world is getting the sugar it needs at the pace that everyone expected.

So it’s hard to see what happens next. If the Brazilian crush continues as it does, is that enough of a reason for speculators to go long? Possibly not. Not enough has changed since they went short.

It’s unlikely that last year’s amazing shipments from November to March are repeated in the coming year, because it’s unlikely the weather is dry enough to let it happen again. But that’s not new information.

But now the speculators have bought back, I think they’ll be even more aware of the Brazil concentration risk this year than they were in the previous months. This might make it harder for them to want to short in the short term. For all the distractions of the crop performance, this year is still all about Brazilian logistics.

Good luck out there. It’s a very difficult market to call right now.