- The world should produce 38.8m tonnes of tomato paste this year, down 400k tonnes from 2020.

- China and the US have both suffered tricky weather conditions.

- Prices are climbing as supply tightens and packaging becomes more expensive.

Chinese Tomato Paste Production Hit by Floods

- China, the world’s leading tomato supplier, should produce 4.8m tonnes of tomato in 2021/22.

- This is up 200k tonnes from 2019/20, but parts of the country have recently endured severe flooding.

- This could mean plantings are down with cropland needing time to recover.

- If they are, Chinese tomato prices could be 6-7% higher year-on-year as supply tightens.

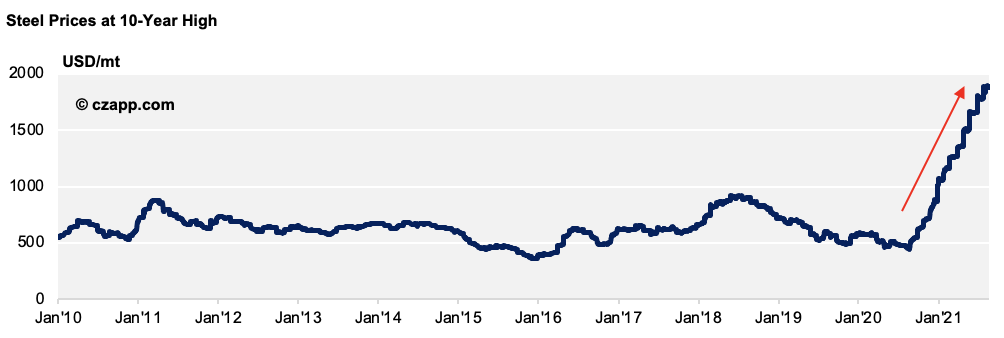

- Packaging costs could increase by around 30% as steel continues to rise.

- China’s exports have held strong this year, despite the recent flooding and its continued COVID troubles.

- Most tomato paste shipments have gone to Asia, Africa and the Middle East, but general shipments to Europe were up 131% year-on-year in H1’21, with tomato-based products making a frequent appearance in the line-up.

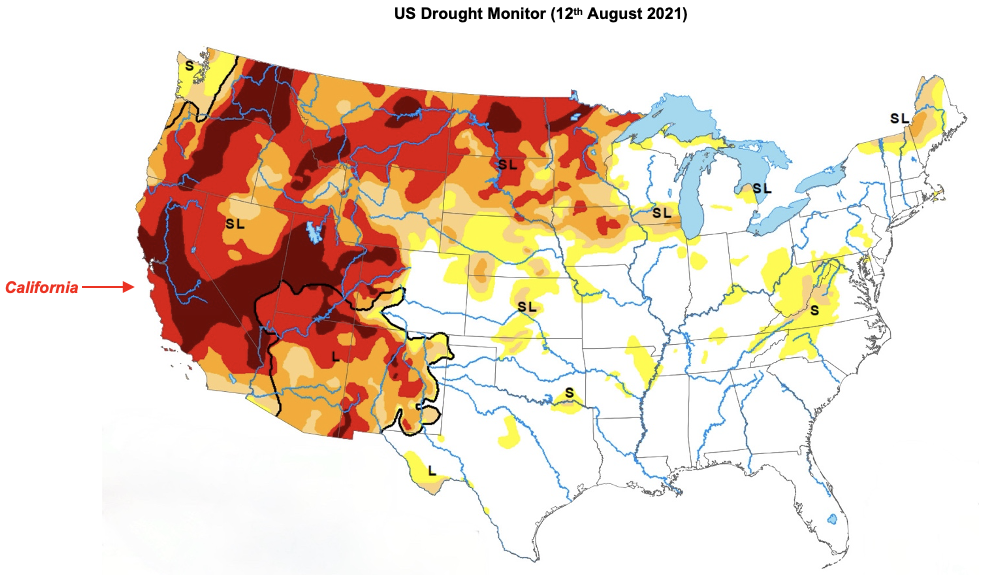

US Tomato Paste Production Hit by Drought

- From June to July next year, there may not be any tomato paste available in the US.

- The drought in California has harmed the crop and led to a poorer harvest.

- Some farmers have also turned to plant other, more drought resilient, crops.

- With this, it’s been tougher than usual for US processors to source tomatoes.

- This is bad news as California produces more than 90% of America’s canned tomatoes and satisfies a third of global demand.

News from Other Parts of the World

- Most European processors have reportedly sold out of tomato paste, with high quality product hitting the market.

- Yields look good for Turkish processors, with prices now climbing to reflect this.

- Egyptian production is also on the rise, with brix and yields looking very good.

- The same cannot be said for Ukraine, with production falling to 800-820k tonnes on the back of a very wet and stormy June.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: The Mexican Sugar Industry