Insight Focus

- Prices for the India urea tendeChina Re-Enters Processed Phosphate Marketr are expected around the USD 330-340/tonne CFR range.

- Processed phosphate prices are under pressure with increased Chinese supplies.

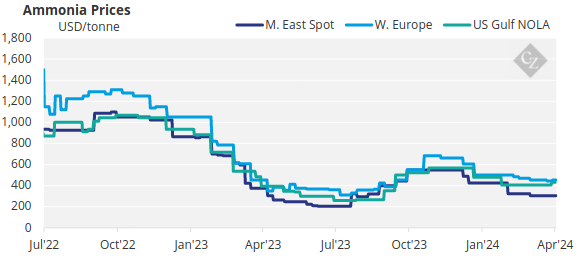

- The Tampa April ammonia contract price between Mosaic and Yara failed to materialize.

Too Much Urea Chases Too Few Buyers

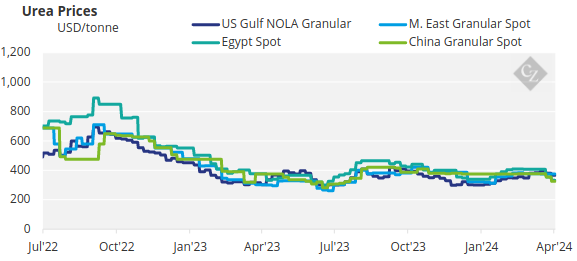

Again, India is the focal point of the urea industry with 3.1 million tonnes offered in the RCF urea tender yesterday. Price discovery is yet to be made public but enough was offered to indicate low prices should be expected.

There are rumours that Middle East values will be around the USD 325/tonne FOB mark while Russian prilled urea settles at around USD 270/tonne FOB. This is all subject to how much RCF buys, as almost all of the product offered will be coming from the Middle East and Russia.

There is no question that the urea market is bearish – and massively so. A perfect storm for even lower prices in the next couple of months is brewing with India most likely not re-entering the market after this tender until July. In addition, increased domestic production of urea in India is expected to decrease imports by between 1.5-2 million tonnes this year.

Chinese urea is coming back into the market in full force at the end of May and beginning of June. Chinese exports for the second half of the year are estimated to be around the 4 million tonne level. The current comparable export price for prilled urea in China is around the USD 305/tonne FOB mark, based on the prevailing domestic market price.

Key markets like that of Brazil will be sufficiently served by sanctioned products from Iran, Venezuela and Russia. A cargo of Iranian urea was reported sold at USD 290/tonne FOB, although the official price is set at USD 300/tonne. Iran will have 7 million tonnes on offer for exports in 2024 and is aggressively looking to expand regular supplies to Brazil and Turkey to include other markets.

Producers like Nigeria will have to conform to prices offered. There is a rumour in the market that Nigeria has offered at USD 335/tonne CFR to Brazil.

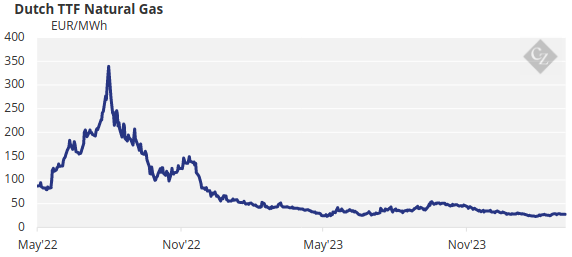

European buyers are holding off due to persistently bad weather although there is evidence of some movement of Egyptian volumes into the European market. In addition, gas prices in Europe remain relatively low and it could be possible to producing urea at competitive rates.

Thailand and Australia have been inactive in the spot market of late. This all means there simply will be too much urea chasing few buyers, putting massive pressure on urea prices in the next couple of months – not helped by looming Chinese supply.

China Re-Enters Processed Phosphate Market

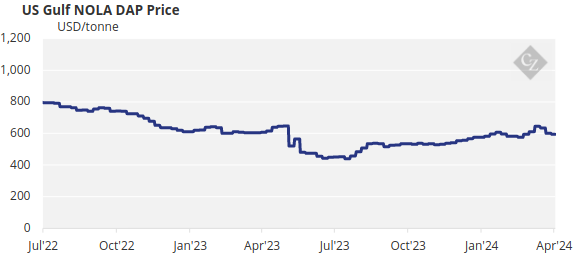

On the processed phosphate side, the impact of Chinese producers entering the market is being felt. RCF of India was offered DAP at between USD 563/tonne and USD 569/tonne CFR this week – down from the previous of USD 575/tonne CFR and USD 595/tonne CFR just a few weeks ago.

Traders are betting that they can negotiate lower prices with China so short selling is prevalent. Markets including the US, Brazil and Europe have yet to experience any DAP/MAP price declines, but downward pressure is expected to build globally as Chinese exports ramp up in Q2 and Q3.

China’s government recently released a 7 million tonne DAP/MAP export quota allocation for a period of 16 months starting January 1. It is expected that Chinese DAP/MAP exports will be roughly on par with 2023 volumes.

MAP prices in Brazil are holding up at USD 570/tonne CFR and are currently unaffected by increased Chinese supply. However, it is expected this will change in the time to come.

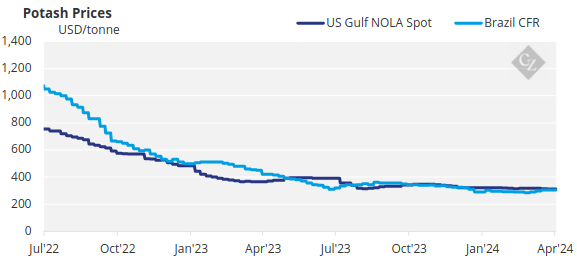

Potash

The potash market is quiet with limited demand but ample supply. Brazil granular MOP is holding at between USD 300/tonne and USD 315/tonne CFR after some small increases every week over the past few weeks.

The India contract has yet to be decided and India buyers are looking for sub-USD 300/tonne CFR levels. Chinese buyers are not in a hurry to conclude any contracts with ample deliveries from sanctioned origins like Belarus and Russia. The Pupuk Indonesia tender for standard MOP has yet to be announced but the result is expected to be around the USD 300-302/tonne CFR level.

Overall, there is limited upside in the potash market due to ample supplies and limited demand over the next period.

Ammonia

The Tampa CFR contract price between Mosaic and Yara failed to materialize this week to the consternation of some operators. Price discovery is difficult to come by due to contract supplies rather than spot buying. The ammonia market seems long with industrial buyers holding out.

With no capacity curtailments in key export regions, the outlook for April appears bearish and prices are again assessed as soft to stable in all regions.