Insight Focus

The European Commission has given into pressure to delay the EUDR implementation. Amid a lack of regulatory clarity and a failure to prepare critical processes, the delay will be put to a vote. But will the move come too late?

EUDR Delay Hangs in Balance The European Commission has proposed an amendment to the wording of the EUDR regulation to delay its entry into application from December 30, 2024 to December 30, 2025 for in-scope operators. The compliance deadline would also be moved from June 30, 2025, to June 30, 2026, for SMEs.

Since the measure was announced, there have been calls for delay from the European Cocoa Association and the European Coffee Federation along with German Coffee Federation. Origin countries like Brazil, Indonesia and Malaysia, affected by the regulation have also joined in the calls as well as European Member States like Austria, Portugal and Germany, which have been particularly vocal.

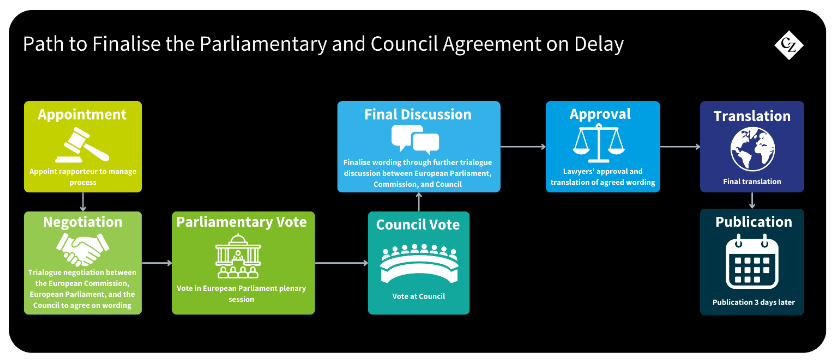

But the delay is not yet a done deal. Several bureaucratic steps are required to finalise the Parliamentary and Council agreement to delay the process.

For the delay to be approved, Parliament has three available sessions left in which it can put the measure to a vote. These sessions are November 13/14, November 25 or December 16.

If the vote does not happen before that last available date of December 16, then the proposed delay will not happen. Even then, the parliamentary vote must be completed on either November 13/14 or November 25, or else it is likely time will run out to carry out the rest of the processes.

In addition, if there is any attempt to amend the wording for elements other than a delay (requiring at least 71 votes in Parliament), then the time needed to complete the process would be extended. This would cause the amendments to overrun the allowable time, meaning we revert to the original timing.

Delay Could Eliminate “Soft” Launch

The probability is that there will be a delay.

This will allow the National Competent Authorities (NCAs) to prepare adequately, resulting in a more controlled and competent audit process. Consequently, operators will face a more stringent kick-off than they would have under the original timeline, eliminating the possibility of a “soft” launch.

The benchmarking will likely to be a political process to keep producing countries from running to the WTO or Member states disrupting the process even further.

The NGOs will not be happy and will use the time to highlight non-compliance in the supply chain. They will use the time to plan and prepare substantiated claims for when the regulation is in play. The delay could make the situation more punitive more rapidly for operators than if there had been a soft start with the original timing.

However, it is also likely that the laggard participants who have not got their supply chains ready by now will still not be ready in 12 months. And with the prospect of a soft launch fading, they face harsher penalties from the outset.

The Next 13 Months

The Commission has specific responsibilities under the regulation. It must create a framework for compliance to allow the relevant industries to understand their responsibilities before the EUDR comes into force.

Benchmarking countries

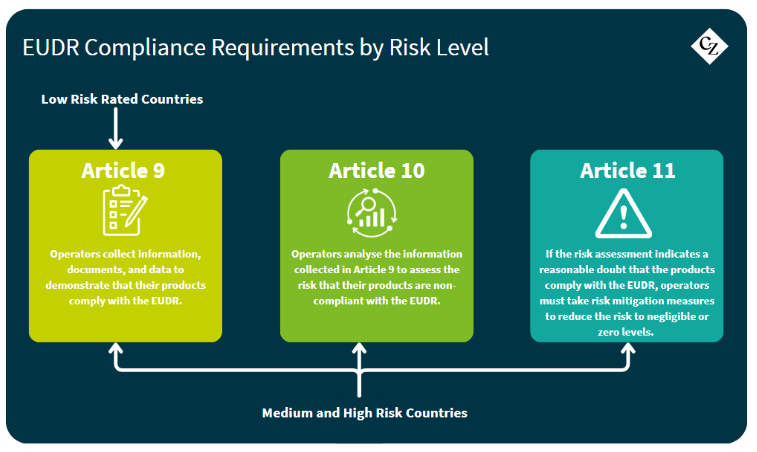

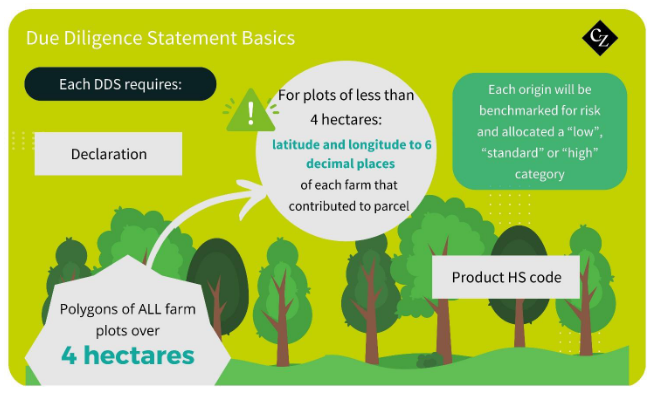

Each producing country must be risk rated by the Commission, including EU member states, on the basis of low, standard and high risk. Operators placing relevant commodities on the EU market coming from low risk rated countries are only required to conform to the requirements of Article 9.

This means they only have to collect data and supply proof of the farm plots where the commodity came from. Companies from standard and high-risk countries are required to follow these steps, as well as following the additional steps of Articles 10 and 11.

Finally, the NCAs are required to inspect 9% of parcels from high-risk countries, 3% from standard-risk and 1% from low-risk countries.

Around six months ago, the Commission announced that it would not be able to finalise the risk rating on time, meaning that, for an interim period, every country would be risk rated as standard. The implications are that countries that would normally have been low risk would now have to implement Articles 9, 10 and 11 rather than just Article 9.

This has specifically frustrated EU member states who believe that they would fall into the low-risk category. The delay in benchmarking has burdened their timber, soy and cattle industries far more than would have been necessary if the benchmarking had been completed on time.

There are also political implications that the Commission must manage where objections from producing countries expecting to be rated as high risk already calling on the World Trade Organisation to prevent the regulation entering into application because of discrimination of their countries.

Publishing guidelines and FAQs

Feedback from operators indicates that the articles and clauses within the regulation are confusing. As a result, the Commission promised the publication of regularly updated FAQs and official guidelines.

The first version of the FAQs was initially published in December 2023 with a promise that an updated version would be published by February 2024. The guidelines were also promised imminently. Finally, the updated FAQs were published in October 2024 along with the guidelines. However, this was too late to appease the objectors.

NCA readiness

There is a specific clause written into the regulation that obligates each Member state to appoint an NCA that should be ready between entry into force and entry into application. In some cases, these NCAs were not even appointed. In addition, there is a view that the NCAs will be under-resourced with the requirement to implement the regulation across seven commodities.

Regarding cocoa, I believe the most relevant member states—namely the Netherlands, Germany, Belgium and France—are prepared, while some of the smaller cocoa-consuming countries may not be as ready.

Voluntary Partnership Agreements (VPA)

The earlier development stages of the regulation highlighted the need to provide support to highly affected origin countries to enable them to comply with the requirements of the regulation.

The expectation was that there would be programs of support timed to precede the entry into application but this never happened.

Readiness of the EU information system

The information system being developed by the EC received critical feedback during its initial pilot testing phase, raising significant concerns among corporate operators. The primary issue was the system’s user-friendliness, particularly in supply chains requiring the upload of multiple smallholder farm plot locations.

While improvements have been made to the platform, the initial negative perceptions remain entrenched in users’ minds. Subsequent lobbying has focused on the argument that if the Commission isn’t ready, then the operators and producing countries shouldn’t be expected to be prepared either.