Insight Focus

- High grape prices from 2022 have stuck around well into 2023.

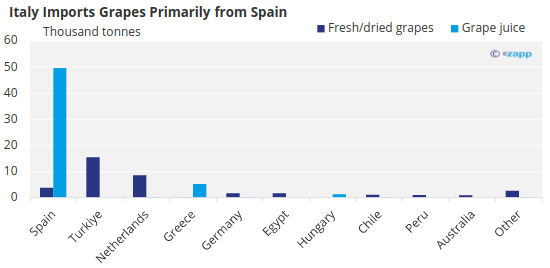

- Italian producers are buying Spanish product to meet their own demand.

- So far, Argentina has not seen any benefits from the removal of its 4.5% export tariff.

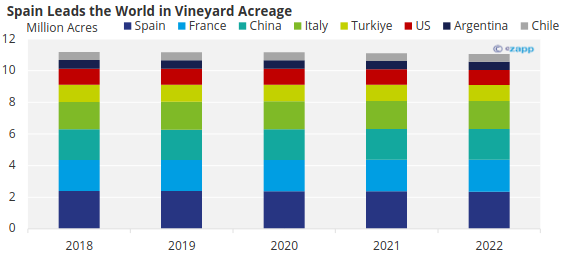

The largest grape-producing countries often unsurprisingly correspond with those who produce high-quality wines. Italy, Spain and France are major grape producers in the northern hemisphere and Chile and Argentina stand out in the southern hemisphere.

Source: Italian Wine Central

At the end of 2022, grape prices were high due to low availability. While prices normally drop during the September/October months as Mediterranean crops are harvested, weather issues and less attractive import prices due to Argentinian tariffs mean prices remain unusually inflated.

Argentina Exports Lag

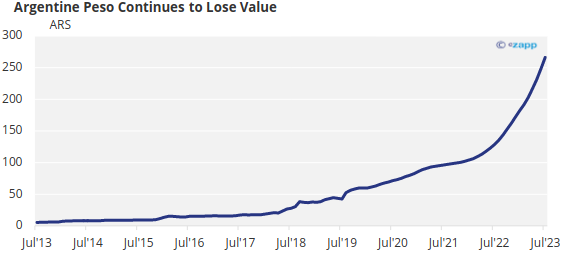

The Argentine peso devalued significantly in 2023, losing over half of its value against the US dollar. This is due to a number of factors, including the country’s large fiscal deficit and a lack of investor confidence. In August 2023, the peso lost over 18% of its value against the US dollar in a single day after the country’s ruling Peronist party lost a key primary election.

Source: St Louis Fed

The Argentine government has taken several steps to try to stabilize the peso, including devaluing the currency. This promoted exports since producers can earn more when selling internationally compared with the local currency.

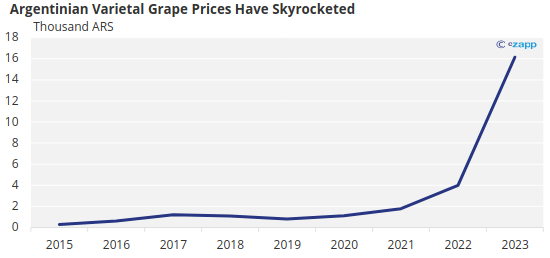

Argentina is a major source for grape juice concentrate, so naturally processors are paying close attention. The country also eliminated a 4.5% export tariff that was imposed in 2018, making exports more attractive. However, inflation has offset the effect, meaning Argentine grapes and grape juice remains unattractive for export to Europe.

Source: Mendoza Stock Exchange

The outlook for the Argentine peso is uncertain but there was greater investor confidence after the current government won the first round of the elections, beating far-right candidate Javier Milei. But the country’s economic problems are deep-rooted and will take time to resolve and, in the meantime, the peso could experience further devaluation.

Apple Juice Undercuts Grape

Grape juice concentrate can be easily interchanged for apple juice concentrate in some formulas, primarily with the deionized product. At the moment, Chinese apple juice concentrate prices are lower than those of grape, suggesting this season’s grape demand has been slow. As a result, the grape juice concentrate tonnage exported from Argentina this year is around 50% lower than that of last year.

The Northern Hemisphere’s grape harvest period coincides with the Chinese apple crop harvest. However, after December, Chinese apples will not be harvested again until next August. This could provide more appetite for grape juice, depending on processor inventories.

Northern Hemisphere Battles Poor Weather

Poor grape juice sales might reverse in the next few months as the Northern Hemisphere grape crop gets underway. However, hopes of a large crop have been hampered by poor weather in Italy and Spain.

In Spain, heatwaves and drought have forced farmers to harvest grapes early this year, which might slightly reduce juice concentrate volumes in comparison with last year. Despite this, the Italian market will still depend on Spanish production. In previous years Spain has exported around 80,000 tonnes of grapes, more than 50% of which is sold within the EU.

Source: UN Comtrade

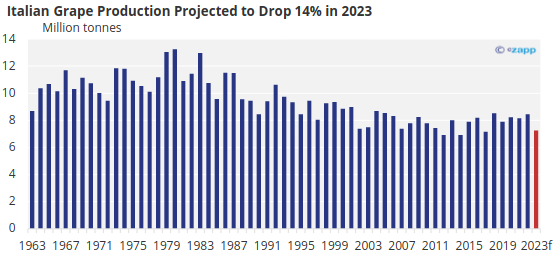

Italian producers have not only suffered low production levels but also are experiencing quality issues such as low sugar content in grapes. Italian national production is estimated to plunge 14% to almost 43 million hectoliters in 2023.

Source: Eurostat, Coldiretti

Concluding Thoughts

- The higher grape selling price Argentinian producers can obtain from currency fluctuations has been largely offset by inflation.

- Demand remains weak while buyers can still substitute Chinese deionized apple juice concentrate.

- But weather issues in the Northern Hemisphere continue to take their toll on grape production.

- These supply constraints could push up grape prices.

- With prices high, producers can see how much processors are willing to pay for concentrate.

- Those who are not willing to pay these prices can focus on the production of other fruit concentrates, or on compounds.

- This means rising prices in other fruit concentrate markets, such as orange, might translate to the grape market.