Insight Focus

The wheat market has adapted to the Russia-Ukraine war. An end to the conflict could bring more stability to shipping, reducing insurance costs and easing trade flow. However, global wheat demand will still be largely shaped by broader economic factors and trade dynamics, rather than the war’s resolution.

In light of the enormous political pressure being exerted on both the Presidents of Russia and Ukraine, a peace agreement—whether just or not—may be reached in the coming months. This would bring a degree of calm to the wheat market not seen since before February 2022.

World Wheat Supply

Ultimately, as we have discussed many times before, price comes down to supply and demand. In the event of the war’s end, there will inevitably be a sense that supply from the Black Sea will flow more freely than it has.

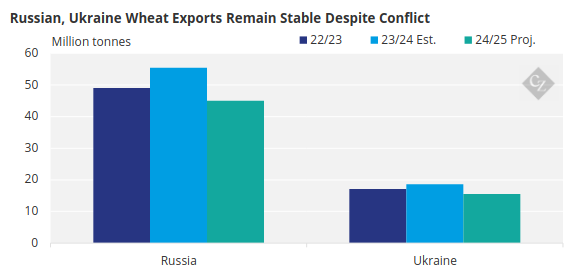

Over the last three years, Russian exports have continued with relative ease, while the Ukrainians have achieved herculean results in maintaining significant exports despite Russia’s aggression and almost desperate attempts to either occupy or destroy their ports.

Source: USDA

Given the volumes exported by both countries since February 2022, it is fair to say that shipping will become easier, but it is unlikely to increase radically as a direct result of any peace deal.

War and Price

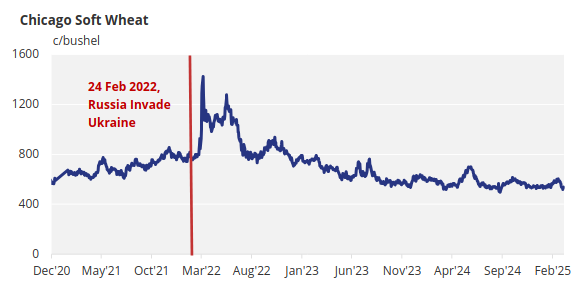

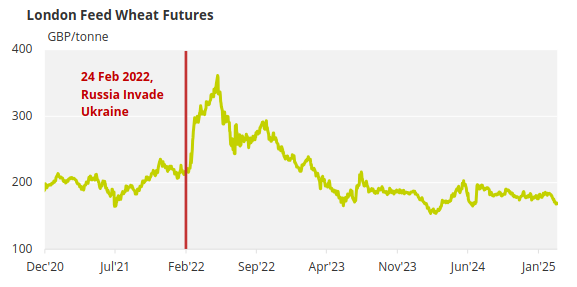

War in Europe was not a concept that many of us had considered prior to Russia’s full-scale invasion of Ukraine in February 2022. The annexation of Crimea in February 2014 had resulted in only a minor movement in wheat prices, with few wider concerns about stability throughout Europe and the world.

February 2022 was an entirely different scenario, as buyers of wheat across the globe feared the fragility of Black Sea supply chains when the Russian military swept into Ukraine. Prices rose at an extraordinary and unprecedented rate as fears grew.

The economic implications of Russia’s invasion were felt across the globe as fears of more widespread unrest grew. Demand is fundamentally dependent on two factors:

- The number of buyers, in this case, the world’s wheat-consuming population.

- The finances of buyers—simply put, the funds they have to purchase wheat and related products.

Early 2022 demonstrated that prices will be rocked by a conflict involving such prominent players in the global wheat trade. Russia was the largest exporting country in the world in 2022, while Ukraine was the fourth largest.

The majority of wheat for these feeders of North Africa is shipped through Black Sea ports.

Nonetheless, Russia needed to continue its own exports just as much as Ukraine. Thus, the Black Sea Grain Agreement, brokered by Turkey and the United Nations in July 2022, lasted until July 2023, managing to reduce fears and helping to ease prices. This week, diplomatic efforts continue in attempts to further the prospects for peace.

Conclusions

Global economic challenges have varied throughout Russia’s war in Ukraine, and it is hard to predict how this will change in the event of any cessation of hostilities.

While peace could lead to a marked turnaround in Russia’s economic outlook, the overall global trend may be less optimistic. The world’s largest economy, the US, has recently experienced a market slump, with deep concerns among businesses as trade wars look top be on the cards for virtually all major economies. Meanwhile, China’s economy has faced a multitude of challenges, even before any potential trade war with the US.

Unquestionably, an end to the war will ease shipping concerns in the Black Sea, which should lower insurance costs and free up the shipping trade. However, it is probably safe to say that demand for wheat, based on affordability factors, is likely to be more heavily impacted by political and trade fears than by any resolution to Russia’s war.