Insight Focus

- The shipping industry currently uses about 300 million tonnes of fossil fuels.

- Something must change if the industry is to meet its strict environmental targets.

- Could LNG be the marine fuel of the future?

Vessel Penetration Continues to Grow

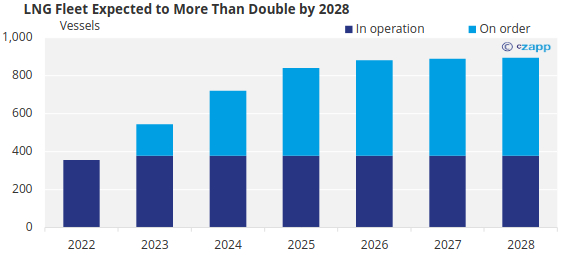

Liquified Natural Gas (LNG) is undeniably the alternative fuel that has received the most attention from shipowners. The LNG fleet has grown strongly in the past 10 years and orders to 2028 would double the current LNG fleet.

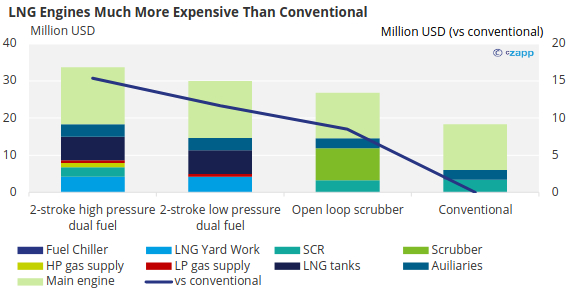

However, a large investment is still needed to either retrofit vessels or buy new ships.

Source: SEALNG

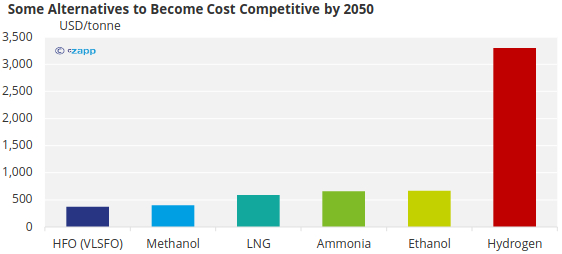

That being said, LNG as a fuel is much more cost competitive than other alternatives. By 2050, it is expected to be almost on par with VLSFO.

Source: IMO

LNG Infrastructure Continues to Develop

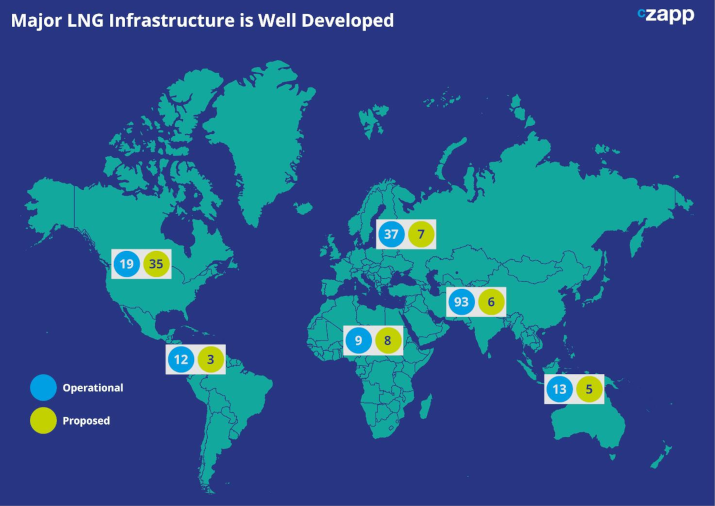

One of the biggest advantages of LNG is that it is a proven technology that offers higher energy content and lower operational and maintenance costs. It can be used in a range of vessel types, so the existing infrastructure is extensive. These economies of scale are also favorable for lower prices in the future.

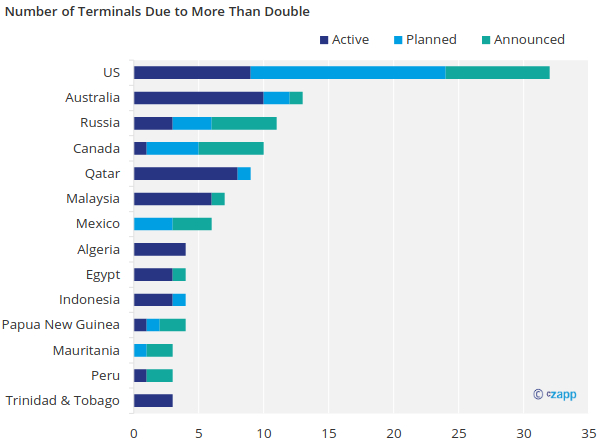

Investment in infrastructure is set to continue too, with the number of terminals set to more than double through planned and announced projects.

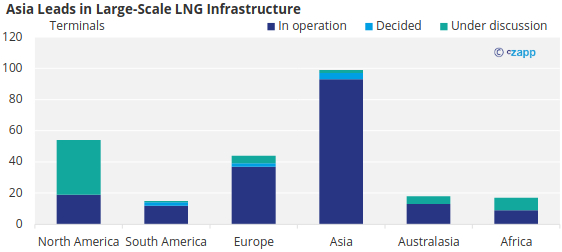

But certain regions are pulling away from others in LNG infrastructure. Asia is a leader in its number of LNG terminals, while North America is mulling new investments.

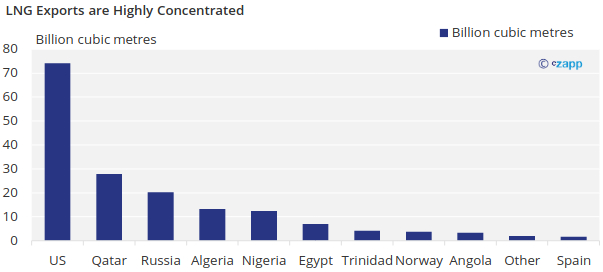

And LNG production is highly concentrated. The major exporters are the main natural gas producers – the US, Qatar and Russia. This means the fuel is at risk from geopolitical constraints.

Source: IEEFA

Ukraine-Russia War Factors In

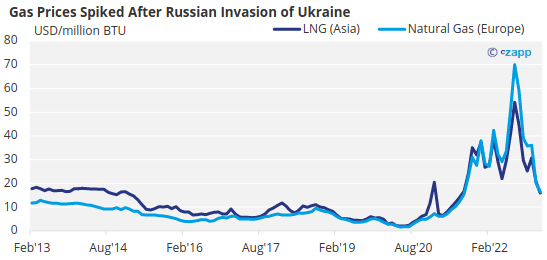

These geopolitical issues have become more evident over the past year due to Russia’s invasion of Ukraine. Russia accounts for about 14% of global natural gas supply.

A result of the war was a natural gas shortage, creating volatile prices for both natural gas and LNG.

Source: World Bank

As a result, several countries, particularly in Europe, are looking to phase out Russian gas. According to the Institute for Energy Economics and Financial Analysis, the amount of new capacity coming online could therefore far outstrip European demand, which is projected to stay flat.

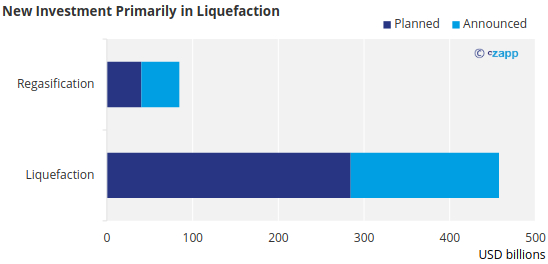

There have been two impacts of this scenario. Firstly, more countries have begun to invest in regasification terminals to import gas from other locations. Previously, the majority of investment was in liquefaction facilities.

And secondly, others are moving away from gas and toward renewable energies. In fact, while IEEFA predicts a 19% rise in LNG demand in 2023, it says appetite will fall by 5% in 2024. This may mean a fall in investment in LNG infrastructure in the near future.

LNG Reduces NOx, SOx Emissions

Arguably the biggest question for alternative fuels to answer is whether they can reduce emissions. The reason why LNG has proven so popular is because it can reduce CO2 emissions by 20% compared with heavy fuel oil. Additionally, it releases 80% less NOx and 99% less SOx and produces very little particulate matter.

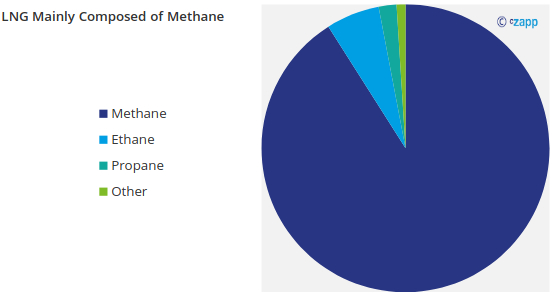

However, there are other emission types that are frustrating the widescale adoption of the fuel. LNG contains high levels of methane (about 90%), which can be even more damaging than CO2. Some estimates say that the global warming potential of methane is as much as 86 times higher than CO2.

There are also concerns over its composition. Given that LNG has a low flashpoint, it is more flammable than conventional marine fuels and is subject to much more stringent safety regulations. It also has a lower volumetric density (but a higher energy density) than heavy fuel oil, meaning storage requires twice the space of conventional fuels.

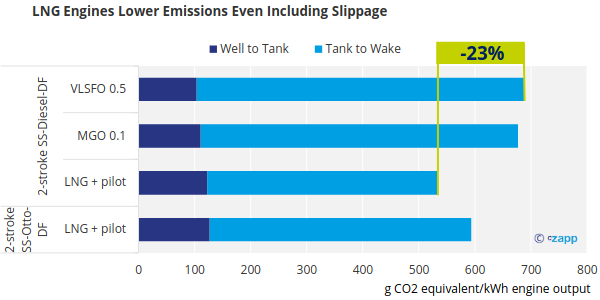

Slippage is often mentioned by LNG critics. Natural gas burning equipment will generally have a 98% efficiency rate but the remaining 2% is released as unburned gas – otherwise known as a slip. Some dispute the importance of methane slippage. One study shows LNG-fuelled engines lower emissions by between 20% to 30% for two-stroke slow-speed engines, and 11% to 21% for four-stroke medium speed engines, even when taking into account methane slip.

Source: SEALNG

LNG is created from natural gas, which is ultimately still a fossil fuel. This has generated concern that a transition to LNG for marine vessels would extend the use of carbon-based fuels.

Concluding Thoughts

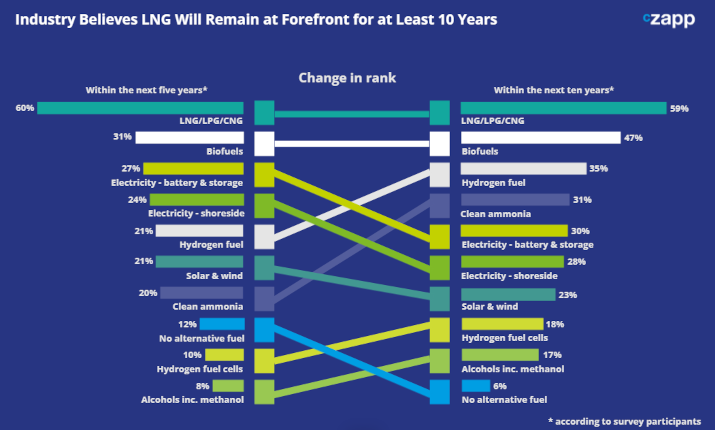

- LNG seems to be the industry choice as a transition fuel for the next 10 years.

- Extensive infrastructure and widespread adoption mean it is cost competitive.

- However, despite its low — emissions, it falls behind in – emissions.

- There are further emissions associated with its production process given that it relies on natural gas.

- While LNG adoption is sure to continue in the near term, future technological advances should mean a move away from fossil fuels.