Opinion Focus

- Plastic demand pattern shifted in 2020 due to the pandemic.

- These behavioural shifts indicate a long-term increase in plastic demand.

- There are significant opportunities for rPET to increase its market share.

A new report from the OECD shows that plastic consumption changed dramatically during the pandemic. In 2020, overall plastics use fell in large industrial sectors such as automotive manufacturing but its use picked up in packaging and retail due to the growth of e-commerce and meal delivery. Now, with plastic use set to increase as economic activity rebounds, where does rPET fit in and where are the opportunities?

Overall Plastic Use Declines

The OECD has just confirmed that, as expected, both plastic use and production fell in 2020. The 2.2% or 10-million-tonne drop in consumption was largely caused by full-scale global lockdowns for six months of the year.

But although 2020 plastic use was 4.5% below original projections, the drop was smaller than that in GDP. This means that, rather than dropping, plastic use shifted. This new demand, coupled with the impact of the economic rebound, means plastic demand could soar. Manufacturers should, however, be mindful of a potential derailment due to inflationary pressures.

Industrial Sectors Reawaken After Reopening

Industrial sectors – some of the largest users of plastics – suffered a significant drop in demand in 2020. Widescale closures coupled with lockdowns ate into demand for plastics in the automotive, construction and textiles sectors.

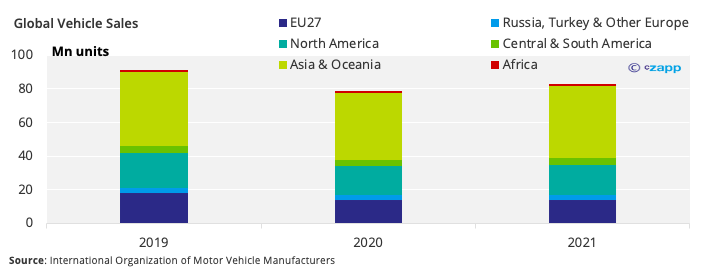

Global car sales fell by 15% in 2020, which had a huge impact on plastic demand. Plastic content represents about 12% to 15% of a vehicle’s mass – or 150-200 kg.

But although vehicle sales did not completely recover in 2021, there was a rebound. According to the International Organization of Motor Vehicle Manufacturers, 82.6 million vehicles were sold in 2021, up 5% from 2020.

This would suggest that the drop in demand is due to the artificial effects of the lockdown, with industrial activity recovering after reopening. There should therefore be a corresponding recovery in plastic demand in the sector.

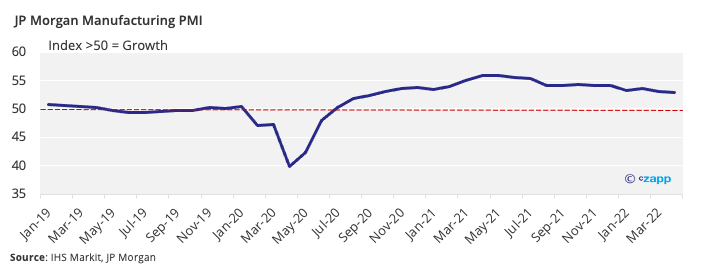

However, going forward, new demand could be complicated by supply chain issues. Port congestion, staffing issues and problems procuring components in the industrial sectors are all contributing to sluggish global manufacturing rates. This is not to mention the global cost of living crisis, which will likely hit demand for such major purchases.

Global manufacturing PMI has been stagnating in the first few months of 2022, which could spell demand destruction for some plastics.

Shift in Packaging Demand Keeps Up Momentum

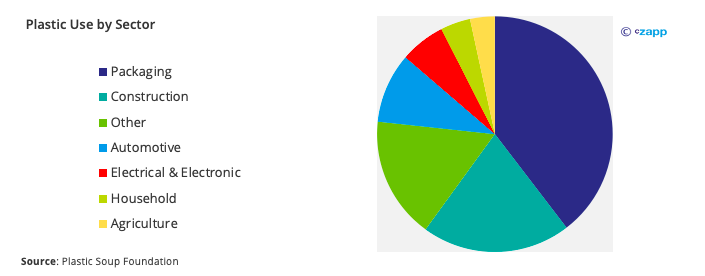

Packaging is one of the most plastic-intensive sectors, accounting for almost 40% of all plastic use.

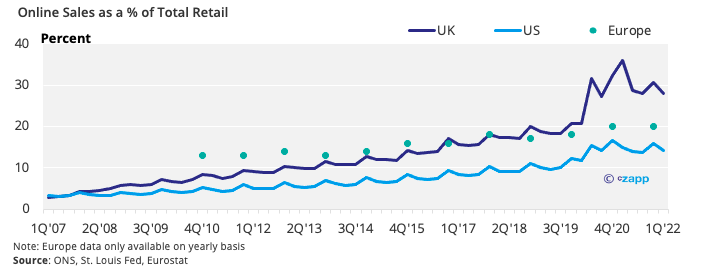

Increased consumption from e-commerce during lockdowns meant an additional 12,000-18,000 tonnes of plastic was used in 2020 compared with 2019. And while e-commerce in the first quarter of 2022 dropped off compared to the first quarter of 2021, levels are still elevated.

In fact, in the US and Europe, 2021 e-commerce sales as a percentage of all retail sales remained largely unchanged from 2020 at around 14.5% and 20%, respectively. In the UK, 2021 e-commerce sales were up about three percentage points from 2020.

This suggests that, rather than a lockdown-driven trend, the desire for e-commerce will continue long after the pandemic. This is good news for plastic packaging demand.

Full Speed Ahead for Food Packaging

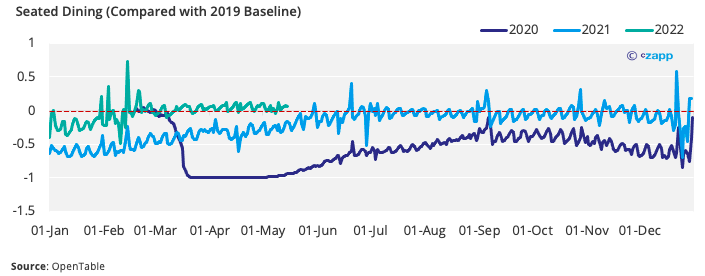

There was also an increase in food packaging in 2020 due to a higher number of takeaway meals rather than dining in. Now, according to restaurant data, there has been a surge in dine-in and this looks to pick up in 2022 based on seated dining information for the beginning of the year.

However, this uptick in eating out could be upended by the rising cost of living as households cut down on discretionary spending.

But does an increase in eating out mean that plastic packaging will take a hit due to a lower amount of takeaway food being consumed? Not necessarily.

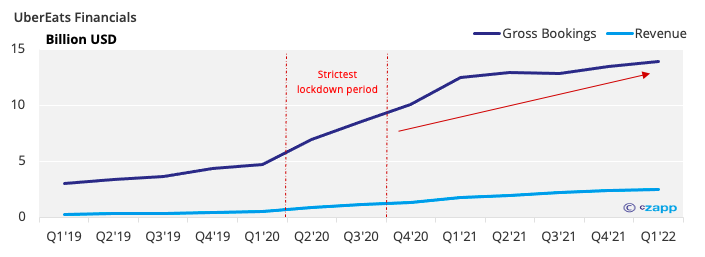

Global food delivery firm UberEats has continued to see revenue and gross booking growth even after the most severe lockdowns were lifted. Lockdowns did lead to a surge in bookings on the platform, but this growth has been sustained and even exceeded post lockdown.

In addition, changing behaviours post-lockdown has caused convenience spending to increase. UK supermarket Tesco noted in its latest financial statements that growth has been particularly strong in its ‘On-the Go’ stores and ‘Food to Go’ ranges. Convenience food typically uses a higher amount of plastic packaging than fresh food.

All this suggests that plastic demand in the food packaging sector will continue to grow.

Clinical Plastic Demand Remains Healthy

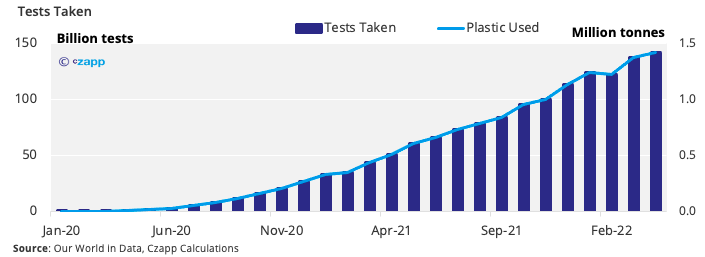

Plastic in the healthcare sector was one of the biggest winners in 2020 given that it is known as a sterile material. Tens of billions of facemasks and gloves were produced, as were Covid rapid testing kits, which require 90% polypropylene, 8% polyester and 2% polyethylene.

According to country data, a total of 1.45 trillion PCR and antigen Covid tests have been taken since the beginning of the pandemic. Every rapid test requires about 10g of plastic. This equates to around 14.5 million tonnes of plastic in testing over a 28-month period.

This momentum is unlikely to remain quite as strong, but testing should still be around for the short term. The same goes for plastic face shields and divider screens that experienced a surge in demand as shops, beauty salons and restaurants reopened following the lockdown.

But one demand area that is likely to last – albeit not as strongly — is that for face masks. Tens of billions of face masks and gloves have been produced in the past two years, with levels reaching 200 million masks per day in April 2020. Each surgical mask requires about 2.7g of plastic.

While in some countries demand for facemasks and other PPE has already dropped off quite strongly, across Asia the habit is likely to live on as it did in the wake of the 2002 SARS outbreak in China.

The OECD estimates future mask production of surgical masks at about 85 billion – requiring around 229.5 tonnes of plastic a year.

Legislative Changes Unlikely to Stick

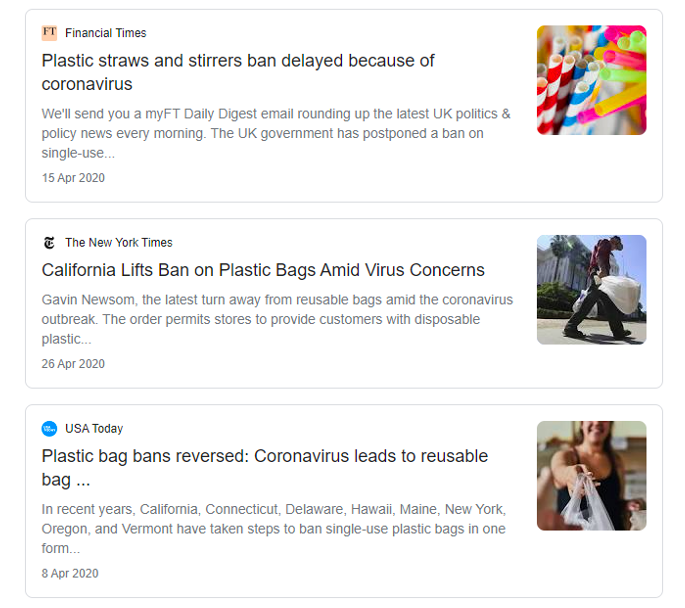

Many multinational chains adopted policies favouring single-use containers because of reports single-use plastic would be more effective in halting the spread of the virus. Starbucks stopped accepting refillable cups and Target no longer allowed customers to bring their own bags.

Several states in the US also announced deferral of bans on single-use plastic bags. The UK also postponed an imminent ban on single-use plastics in response to the pandemic.

Now that we know more about the spread of the virus and are more comfortable living with it, this of course has changed. Coffee shops now welcome reusable cups and food delivery services are limiting the amount of single-use plastic items they distribute.

It is unlikely that authorities will reconsider or roll back bans on single-use plastics. The EU is pushing ahead with its Single-Use Plastics Directive and in April, the UK applied a tax of GBP 200 (USD 250) a tonne on plastic packaging that contains less than 30% recycled content.

These measures boosted plastic use in 2020, so it should now normalise for these purposes. However, there is likely to be some damage done to the habit of bringing re-usable items due to these short-term policy changes.

Increased Plastic Recycling Needs Attention

With all this increased demand for plastic and a lack of supply, it may seem that the rPET movement lost momentum during COVID. Over the years, the recycling rate has been gradually increasing but the pandemic seemed to put the brakes on this growth.

While figures for 2020 and 2021 vary wildly between countries and trends remain unclear, in the UK household waste recycling dropped to 44% from 45.9% in 2019. In the US, the National Association for PET Container Resources’ (NAPCOR) latest report estimated a 26.6% recycling rate for PET bottles in 2020, down from 27.9% in 2019 and 28.9% in 2018. Globally, efforts were suspended during the pandemic due to lockdown measures and fear of spreading the virus. Waste collection efforts were reduced due to less movement.

Plastic littering rates increased during the pandemic, particularly of personal protective equipment such as gloves and face masks. It is estimated that 1.56 billion face masks entered the oceans in 2020.

During the pandemic, secondary production did continue to grow, although so did virgin plastic production. Secondary production still only makes up 6% of total plastic production.

Concluding Thoughts

The demand for plastic is growing on a net basis – this is only expected to continue after the pandemic reopening. The fact that overall plastic use did not fall in line with the economic dip suggests that the increased demand in some sectors is offsetting drops in others.

But of course, there are sectors that have been artificially inflated by the pandemic. The demand for face masks, gloves and other PPE is likely to drop off in most countries, challenging growth prospects.

While this year, some inflationary pressure could stifle growth in plastic demand in some sectors, the data shows that the pandemic did not cause any drastic reduction in our long-term consumption habits. This means that, beyond 2022, demand could be set to soar.

While increased plastic demand can also good news for rPET, lack of efficient supply means pricing is becoming prohibitive. Prices continued to rise going into May, with high bale prices and mounting logistics costs supporting high prices. Food-grade rPET pellet prices have reached as high as EUR 2,700/tonne (USD 2890/tonne) delivered, which is off-putting for companies that can buy virgin PET at a considerably lower price of around EUR 1,600-1,660/tonne.

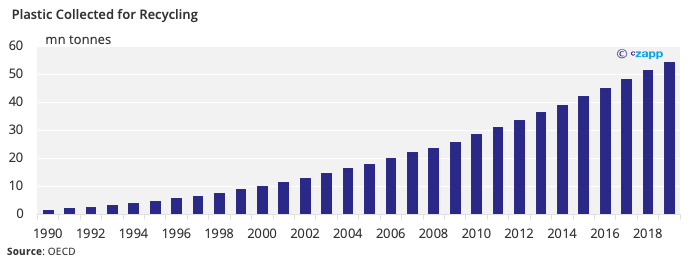

With multinational companies, such as Coca-Cola, Pepsi and Nestlé, making ambitious commitments to rPET, there are clear opportunities to incentivize plastic return schemes. Currently, only 55 million tonnes of plastic are collected for recycling, while 298 million tonnes are incinerated and sent to landfill.

While not all plastics can be recycled, there are significant opportunities for those that can. There is now a greater need than ever, not only for strong policies that support recyclers but also for encouragement in the form of incentives.

The only bump in the road for plastic manufacturers is inflation on the horizon, which will inevitably hit consumer spending. With that in mind, green COVID recovery packages could be the ideal place to start.

Other Insights that may be of interest

What the Energy Crisis Means for Inflation & Commodities

Interactive Data Reports that may be of interest …

Consecana Panel

CS Brazil Weather Update