This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Adverse weather in Louisiana affects sugar cane ratings

- Producers of beets saw mixed sales: upticks along with some underperformance

- Beet harvesting is underway, processors are poised to pivot if sugar supplies change

Drought in Louisiana sugar cane areas became the focus of the market in the week ended Aug. 25 as crop ratings deteriorated. Sugar beet harvest was in its beginning stages with slightly declining condition ratings. Spot and forward prices for bulk refined sugar were unchanged.

Louisiana sugar cane ratings dropped to 38% good-to-excellent as of Aug. 20 from 47% a week earlier and were the lowest for the date since at least 2015, the US Department of Agriculture’s state field office said. The USDA in its assessment of the Aug. 22 US Drought Monitor said 100% of cane was in areas of drought in Louisiana, with the severity of drought worsening noticeably from a week earlier. With no significant rain in the forecast into early September, analysts were lowering forecasts for 2023-24 Louisiana sugar production.

Sugar beet crops, meanwhile, were faring better even if good-to-excellent ratings declined in several states as of Aug. 20. Bumper crops were not expected as some areas lacked heating degree days, and others had spells of adverse weather, but beet crops in most areas were expected to be good to above average.

Early harvest continued in the Red River Valley and was set to start in other states through early October.

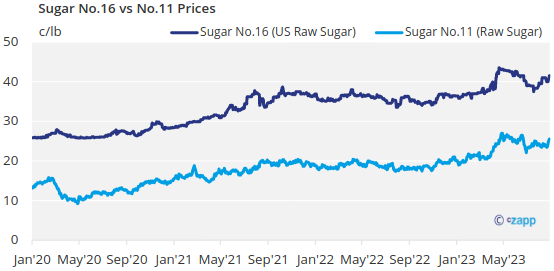

Sugar sales continued at a slow pace for 2023-24 after most business was done earlier than normal in March. A sizable number (possibly more than average) of buyers were not fully covered for 2023-24, and some smaller and mid-size users still were without coverage. Those buyers were hoping for a late-season price break as beet processors re-enter the market in October once they have a good handle on the potential of their new crop. While those users who delay buying may be rewarded this year, the potential decline in the Louisiana cane crop and strong global prices are increasing the risk of waiting too long.

Deliveries of contracted sugar were mixed. Some beet processors saw an uptick in August, while others saw continued underperformance on contracts. It was generally accepted that demand was soft, mostly attributed to weaker consumer demand for food products in general. Most sellers have sugar available.

Spot and forward cash sugar prices were steady. Some beet processors are waiting to see what their final crop prospects will be to see how much sugar they can offer before considering price changes. Cane refiners are watching the Louisiana situation, almost assured that less cane sugar supply will be available.

Annual corn sweetener contract negotiations were expected to gain traction in early September. Buyers are looking for lower prices on 42% high-fructose corn syrup after dismal demand and available supplies in 2023. Users are hoping for flat prices on dextrose, glucose and heavier corn syrups as a large corn crop and lower corn prices may offset strong demand and tight supplies.