Insight Focus

Thailand’s cassava yield dropped to its lowest in a decade in 2024. The price of cassava chips fell sharply in 2024 due to decreased demand from China and the Thai government’s EV mandate. But cassava prices could recover, on the back of a drop in supply and increased starch demand.

Decreased Demand Drives Down Price

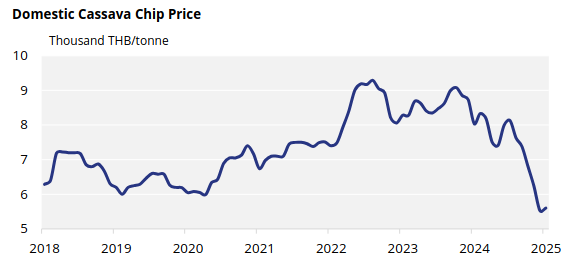

The price of cassava chip in Thailand has fallen sharply to THB 5,600/tonne in 2024, after reaching a peak in October 2024.

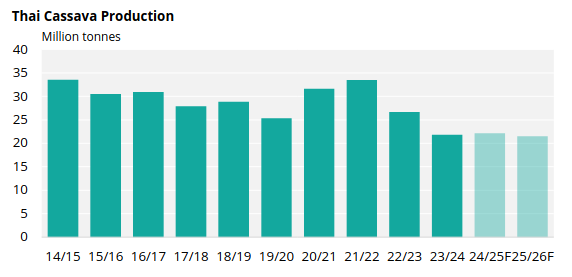

Domestic production has declined due to the spread of disease in 2024, as well as erosion of demand from China, which caused the price to tumble.

Thailand is well-known for exporting over 90% of its cassava chips to China for ethanol production. However, the Chinese government has recently introduced a project to increase ethanol production from coal and support domestic corn farming.

China is now increasingly switching to using corn for both ethanol and animal feed because of its lower cost, local availability and the ability to sell by-products.

This has resulted in a decrease in cassava chip imports from Thailand, as China now imports more cassava from countries offering lower prices, such as Cambodia and Laos.

Thailand’s Q1 ethanol price has also fallen to THB 19/litre, which is equivalent to THB 1,850/tonne of cassava roots. This was largely caused by the government’s support for EVs instead of the E20 mandates that promote ethanol consumption.

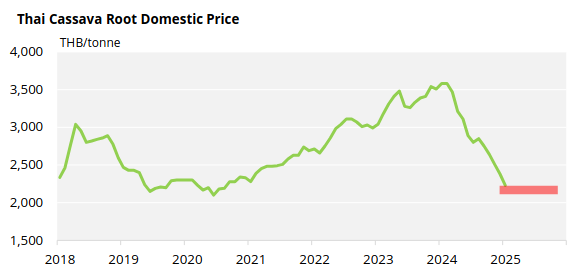

As of January 2025, the cassava root price is at THB 2,230/tonne, a five-year low.

Disease, Weather, Starch Demand Lend Support

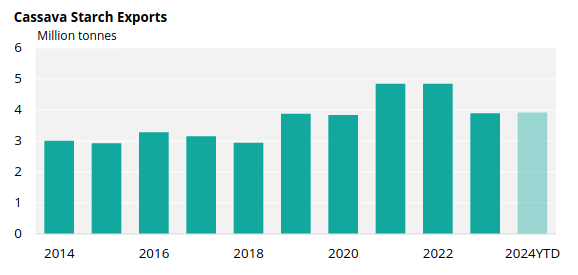

The demand for starch is increasing though — particularly for tapioca flour — which supports a stable outlook for cassava prices.

Already facing low selling prices, farmers are facing extremely challenging conditions for growing cassava. Drought caused by El Niño and the continued spread of Cassava Mosaic Disease have been damaging cassava crops.

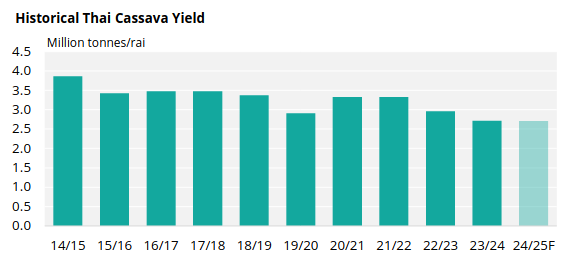

The Thai Tapioca Trade Association (TTTA) recently announced that cassava yields have reached their lowest point in over a decade in 2024, at 2.710 million tonnes/rai (16.94 million tonnes/ha), dropping from 2.716 million tonnes/rai in 2023.

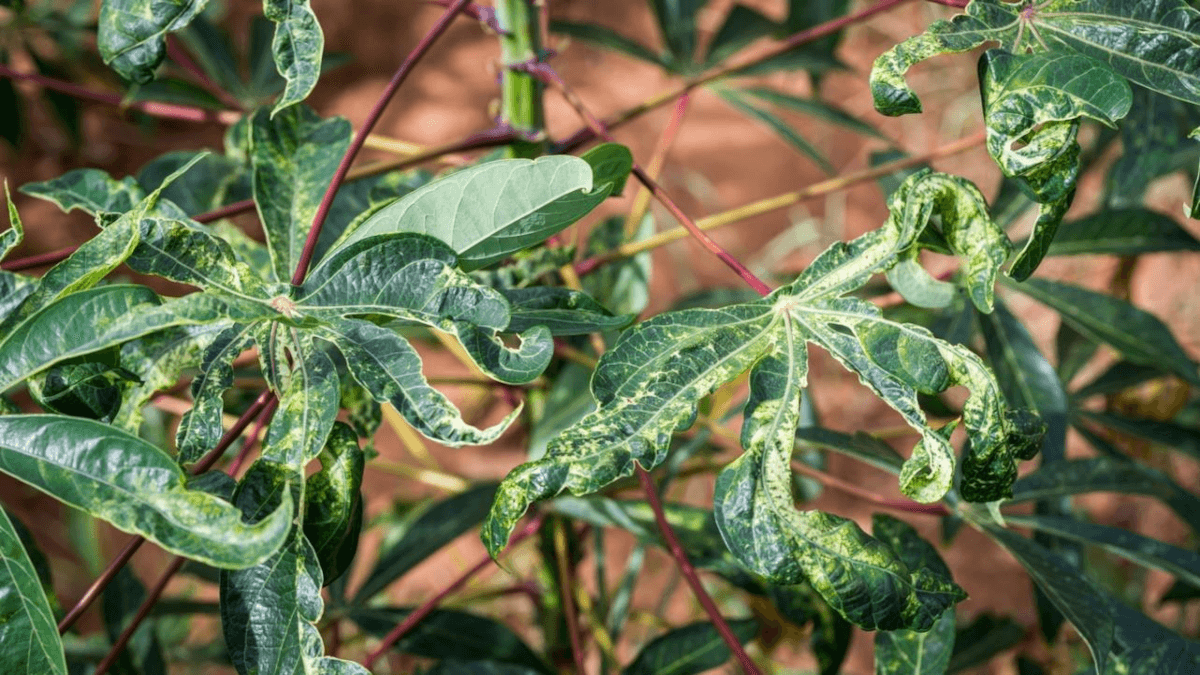

The downfall of Thai cassava began when Cassava Mosaic Disease was introduced to Thailand in August 2018. The disease couldn’t be properly controlled, causing massive damage to the crop.

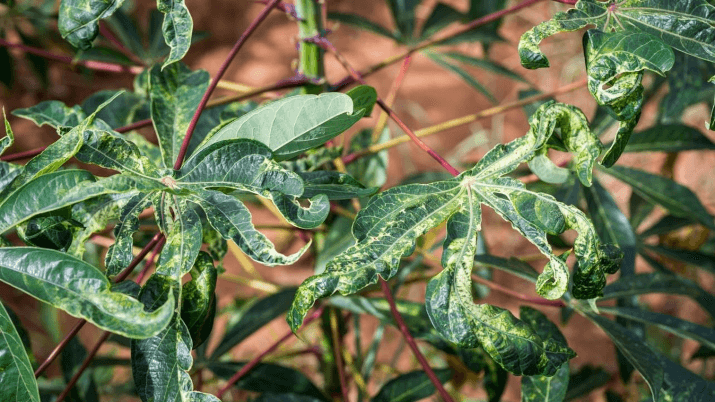

Cassava Mosaic Disease causes new growth to show light green mottling, curling and distortion, preventing cassava from forming storage roots.

Cassava leaves infected with Cassava mosaic disease

Lack of rainfall and early harvesting have also impacted both the quality and yield of the cassava plant. All these challenges will lead to a decrease in cassava production for 2025/26, which is already expected to decrease to an estimated 21.5 million tonnes.

Despite challenges, we expect cassava prices to remain stable through 2025, supported by ethanol parity and starch demand. Low current prices have made farmers reluctant to sell, which could drive prices up, but the Q2 ethanol tender will be crucial in determining the direction of cassava prices.