Insight Focus

Brazilian sesame production and exports have surged. This growth is driven by high profitability and market expansion to countries like India and China. The crop is mainly grown in the Central-West region as an alternative to second-crop corn.

Sesame Production Takes Off in Brazil

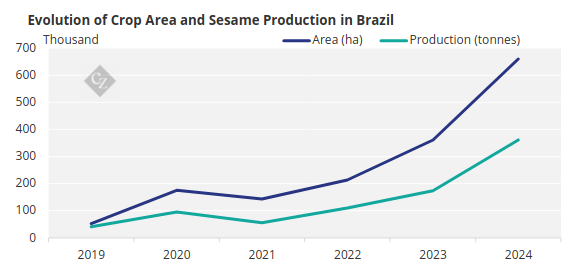

A government policy to open the market for sesame exports, along with the crop’s strong profitability, is encouraging Brazilian producers to boost production. Between 2023 and 2024, the planted area increased by 82%, and production grew by 107%, according to Conab.

In 2024, production reached 361.3 thousand tonnes, around 775% more than five years ago, and this year, initial estimates indicate that it should reach 332.8 thousand tonnes, according to Conab.

Source: Conab.

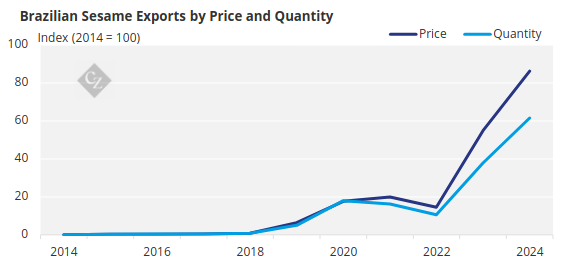

Exports also surged, increasing from 151,200 tonnes in 2023 to 246,200 tonnes in 2024—a 62% rise—along with a slight price appreciation, according to Comex.

Source: Comex.

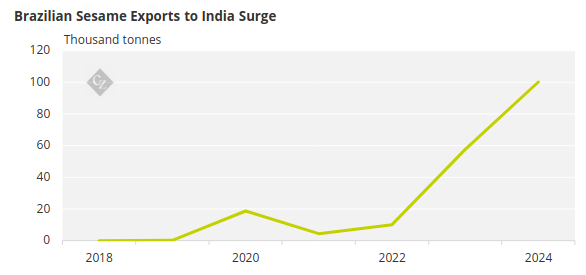

There are good reasons behind the rise in shipments and production. In 2020, India, the world’s fourth-largest sesame importer, signed a trade agreement with Brazil, based on phytosanitary protocols that aims to prevent pests and diseases, to allow the import of Brazilian sesame.

The agreement, as is common in these cases, includes the Brazilian government commitment to implement rigid quality control mechanisms for sesame and the issuance of technical reports and phytosanitary certificates for the exported cargo. The objective is to prove that the product meets Indian quality standards, as is customary in agreements of this nature.

The initiative provided a significant increase in exports. Today, India accounts for approximately 40% of Brazil’s sesame exports.

Source: Comex.

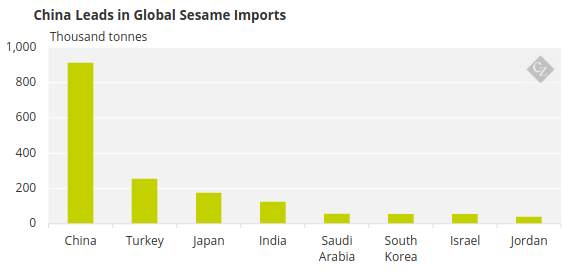

Brazilian producers also received good news at the end of last year, when the government reached a customs agreement to allow Brazilian sesame to be exported to China, in the same way as it was done with India, based on an agreement on phytosanitary standards and strict quality control.

China is the world leader in imports of the grain, followed by Turkey and Japan.

Source: FAO

With the signing of the phytosanitary export agreement to China, Itaú BBA expects exports to reach a new level of growth. “Shipments to China should gain momentum in the coming years once negotiations are complete,” said Cesar Castro Alves, manager of the company’s Agro Consultancy, which recently conducted a study on the sesame market.

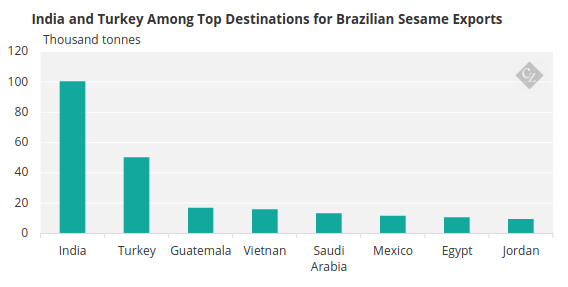

Today, Brazil exports mainly to India and Turkey, while the rest of its sales are distributed among countries such as Guatemala, Vietnam and Saudi Arabia.

Source: Comex.

The free trade agreement between Mercosur and the UAE, a major distribution hub in the Middle East, could also help exports, as countries in the region are among the largest importers of sesame seeds produced in Brazil.

Profitability Favours Sesame

Another key factor is the profitability of sesame, which is grown during Brazil’s second grain harvest. It is no surprise that Mato Grosso, the country’s grain powerhouse, leads production, accounting for more than 60% of cultivation, followed by Pará (22%) and Tocantins (13%), according to Conab.

Sesame is emerging as an alternative to the second-crop corn due to its low production costs and strong sale prices. Currently, the investment to grow sesame is around BRL 1,000/ha—just one-third of the amount required for corn—according to Itaú BBA.

This cost advantage is mainly due to sesame’s lower fertilization needs and its strong adaptability to drought conditions, which are common in the Midwest.

Price is another key factor. Last year, Brazilian corn sold for approximately USD 200/tonne, while sesame reached about USD 1,411/tonne, according to Comex—a trend that has persisted in recent years.

However, farmers may have some difficulty in accessing sesame markets. “Corn is traded on the Stock Exchange and priced on the futures market, unlike sesame,” explained Wharlhey Nunes, an analyst in Itaú BBA’s Agro Consulting team. “The producer takes all of this into consideration,”

Crop Yield Challenges Persist

Another challenge to be overcome is the low crop yield of Brazilian sesame. Although some producers have already achieved a yield of 1,000kg/ha, like that of corn, the national average is around 540kg/ha, according to Embrapa (Brazilian Agricultural Research Corporation).

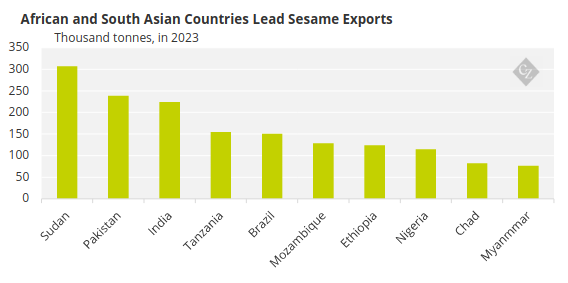

“The ideal would be to reach around 600 or 700kg/ha, a value achieved by some of the main exporting countries, especially in Africa, which have a longer tradition in producing the grain,” said Nair Helena Castro Arriel, a researcher at Embrapa.

Source: FAO.

Embrapa has been working on developing new species, focusing on varieties that are more resistant to drought and dehiscence—the premature opening of pods that contain the seeds. “These innovations, together with the increasing mechanization of farming, should boost productivity,” said Arriel.

Sesame Expected to Continue Strong Growth

Sesame producers are focusing not only on the current profitability of the crop but also on long-term prospects. This year, the global sesame market is expected to be worth around USD 7.8 billion, according to Mordor Intelligence, and nearly USD 9 billion by 2030.

Production of sesame in its traditional markets in Africa is also becoming increasingly difficult amid geopolitical, ethnic and territorial disputes, which would allow Brazil to step in to plug gaps.

The properties of sesame, rich in proteins, minerals and vitamins, have been driving consumption. The seeds and oil are primarily used in cooking, especially in Asian countries. In recent years, sesame has also become a key ingredient in the cosmetics industry, particularly in the formulation of skincare products.

“The benefits of sesame in food and other industries have contributed to increased demand, opening up a horizon of opportunities for producers,” says Arriel.