Insight Focus

Wheat prices in 2024 are increasingly volatile. Geopolitical tensions and climate concerns drive instability, with global stocks at an eight-year low. As October arrives, the market sentiment is turning bullish.

Economists often assert that supply and demand dictate prices, and while this holds true in the long term, the short term can present a different scenario. In the case of wheat, for example, short-term fluctuations are frequently influenced by ‘harvest pressure,’ as the need to move crops arises from limited storage and cash flow requirements during harvest.

The market’s interpretation of headline news — be it related to weather, conflict or political events —plays a significant role in driving prices up or down. Although supply and demand will ultimately guide prices over time, 2024 has demonstrated that low stock levels do not necessarily mean high prices in the short term. Ultimately, timing becomes critical in the wheat market, as shown by developments this year.

Markets Show Increasing Volatility

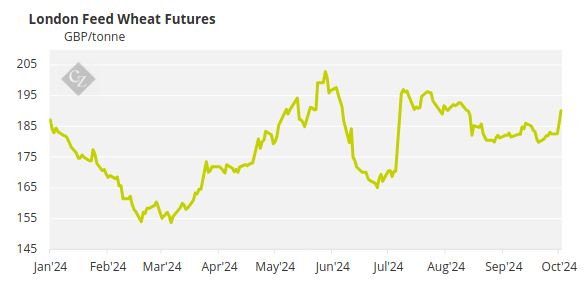

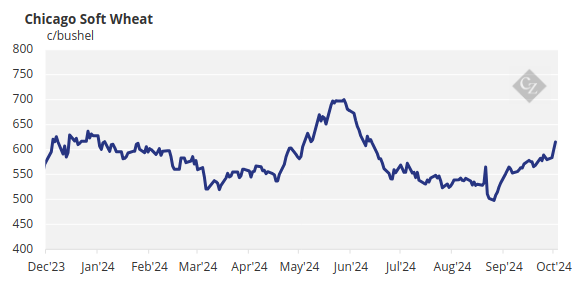

Looking at wheat prices during 2024 we have seen both bull and bear conditions.

Global Wheat Stocks Drop

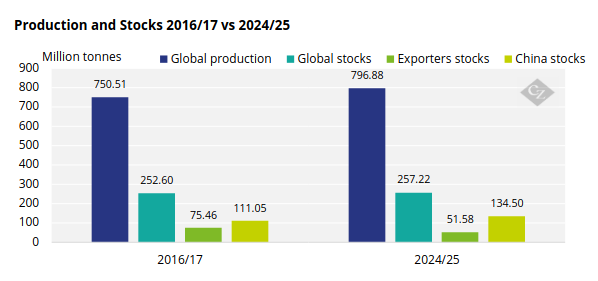

According to the USDA in its September WASDE report, global wheat ending stocks for 2024/25 are forecast to be 257.22 million tonnes: the lowest in eight years.

The main exporters are anticipated to account for a mere 29.05 million tonnes of these stocks. If we add in the US, which is playing a vital export role this year, its 22.53 million tonnes gives a total of 51.58 million tonnes.

Source: WASDE

These numbers are significant as since 2016:

- The world produces more wheat.

- Global stocks are similar but have recently been dropping year on year.

- The big exporters have less in reserve.

- China’s stocks represent a significantly larger proportion of the total and as the world’s largest importer, it will not be exporting its reserves.

The consequence of this change in numbers is that the world is potentially less able to deal with any major crop or logistics issue arising from weather or conflict. This was highlighted in 2022 when Russia invaded Ukraine which disrupted Black Sea wheat exports, leading to a huge rally in prices.

Disruptions to the big exporters, given that their reserves were 50% greater in 2016/17 than in 2024/25, have the potential to profoundly impact the global food supply chain.

A Calendar of 2024 Price Swings

The world is grappling with major challenges, such as climate change, ongoing conflicts in Ukraine and the Middle East, and escalating geopolitical tensions. Having experienced a year of falling wheat prices in 2023 as the market overcame the 2022 challenges following Russia’s invasion of Ukraine, 2024 has seen increased volatility.