652 words / 3.5 minute reading time

- The USDA is publishing its first monthly World Agricultural Supply and Demand Estimates (WASDE) report of 2020 later today.

- With this, we will see the first official planting estimates for US wheat.

- These will provide a good indication of what the 2020 harvest will look like.

The WASDE Release

A number of issues which occurred over the last month could influence change in the USDA supply and demand numbers for wheat this month.

Such as…

- All of the above factors could well impact on the final global stock figures for wheat in the January WASDE. December saw 289.5m tonnes, with the average estimates for this month at 287.3m tonnes. Although it’s unlikely to go up from 289.5m tonnes, there is always the potential for larger reductions depending upon the influence of factors mentioned above.

- It will be interesting to see the numbers in relation to the world’s largest wheat exporters.

- These are also countries exporting meat to China and/or exporting to other countries producing livestock to feed china’s population where feed demand is likely increasing.

The Lowest US Winter Wheat Plantings in Over 100 Years?

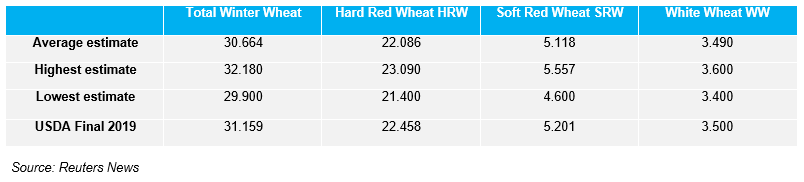

Trade Estimates for USDA US Winter Wheat Seedings (per 1m acres) for the 2020 Harvest

- The US winter wheat plantings are expected to be at their lowest in over 100 years for the 2020 harvest.

- The split between hard red winter wheat (HRW) and soft red winter wheat (SRW) will be of particular interest, due to the record differential in price between the two.

- SRW has a large enough premium to maybe encourage more acreage than expected, relative to HRW, which has experienced price lows unlike any seen for some years.

To read more about the different wheat classifications, please consult our previous opinion: ‘An Introduction to Wheat – Meet the Kernel’.