Opinion Focus

- The global economy is undergoing a transition from a period of growth to a recession.

- Companies need to focus on key indicators to make smart business decisions.

- However, it is unlikely that anyone will escape imminent cost pressure.

After a period of money flooding the economy, now consumers and manufacturers alike are starting to feel increasing cost pressure. A strong dollar, rising natural gas prices, continuing inflation and higher labour costs are all issues that are going to challenge the supply chain in the short to medium term.

Strong Dollar Pushes Up Price of Imports

The US dollar has reached its strongest level since 2002 as the Fed doubles down on efforts to throttle inflation.

There are several implications of a strong dollar. On the positive side, companies with a large proportion of US business benefit because they earn more for each dollar in sales.

On the negative side, exporters based in the US will suffer as prices increase for their international customers. US companies with a large proportion of operations in other countries will also see negative exchange rate impacts. Emerging market economies are likely to be particularly hard hit.

For the UK in particular, the pound sterling has shed value against the US dollar after the new Chancellor revealed a budget that proposes tax cuts.

This means it becomes more expensive for UK importers. Any company importing from or exporting to the UK is sure to face volatility over the coming months.

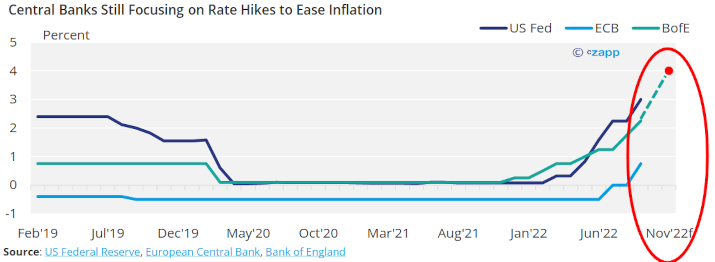

Rate Hikes Fail to Tame Inflation

At its latest meeting the Fed hiked interest rates by 75 basis points to the range of 3% to 3.25%. In the UK and Europe, rates were up by the same amount from August to September to reach 0.75% and 2.25%, respectively.

The Bank of England is expected to enact an emergency rate hike of up to 175 basis points by November in response to the weakening pound sterling.

Of course, this makes the cost of doing business more expensive as lending costs rise.

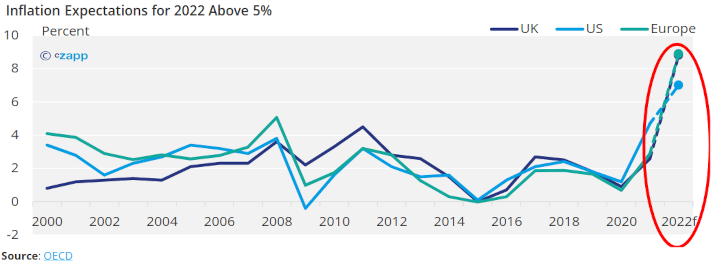

Despite ever-stricter monetary policy, inflation continues to surge. For 2022, inflation in Europe and the UK is expected to reach almost 9%, while in the US, 2022 inflation is estimated at 7%.

Several more rate hikes are expected before year end, making the cost of doing business even more expensive and access to credit even more restrictive.

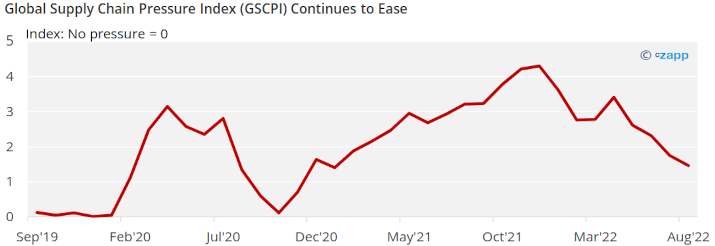

Supply Chain Pressure Eases Despite Labour Issues

After two years of congested supply chains, pressure is beginning to ease as supply begins to catch up with demand.

Source: Federal Reserve Bank of New York

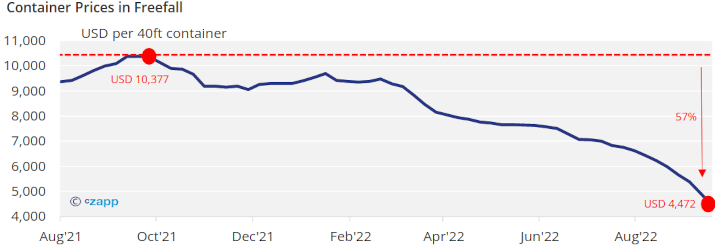

One symptom of this untangling is a container market that has lost about 57% since its October 2021 highs of over USD 10,000 per 40-foot container.

Source: Drewry Container Index

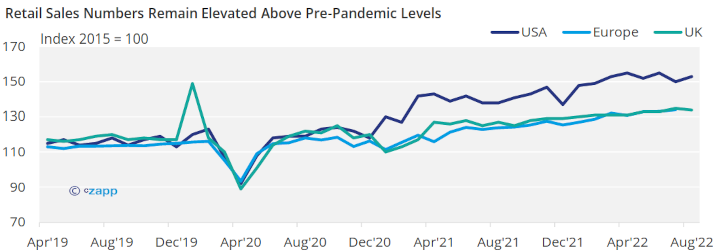

However, final consumer demand does not seem to be dropping significantly. In fact, demand looks stubbornly high in the US, Europe and the UK.

Source: ONS , US Census Bureau, Eurostat

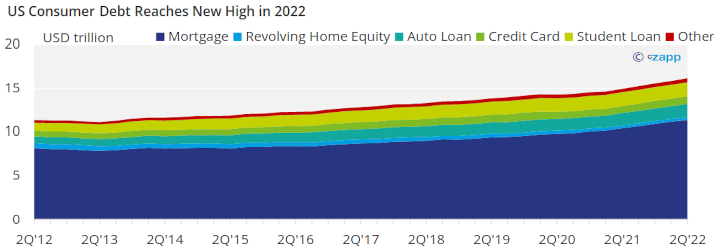

However, this can be explained by a more substantial use of credit. Between the second quarter of 2021 and the second quarter of 2022, USD 100 billion was added in new credit card debt alone.

Source: Federal Reserve Bank of New York

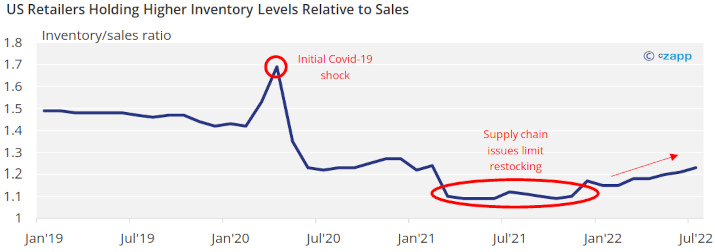

In the US, retailers seem to be holding higher inventory levels, creating a higher inventory/sales ratio. This could make retailers more vulnerable to a sudden economic shock.

Source: US Census Bureau

That being said, the inventory/sales ratios are still not nearly as high as pre-pandemic levels. Retailers need to strike a careful balance between stocking up to meet demand and cushioning themselves from a potential downturn.

Manufacturing Activity

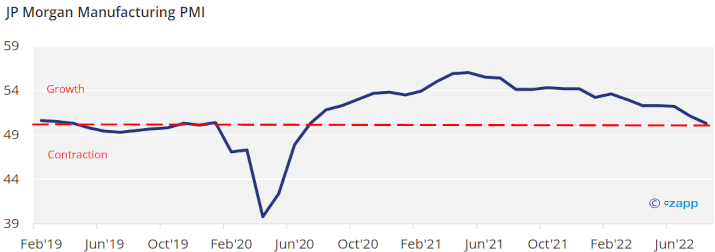

Supply seems to be suffering more than demand as global manufacturing output wanes. August’s PMI number came in at 50.3, on the cusp of dropping into negative territory.

Source: IHS Markit

According to analysts at S&P Global, which compiles the index, new orders have continued to fall and inventory levels have risen. The downturn is expected to gather momentum in the coming months, according to the report.

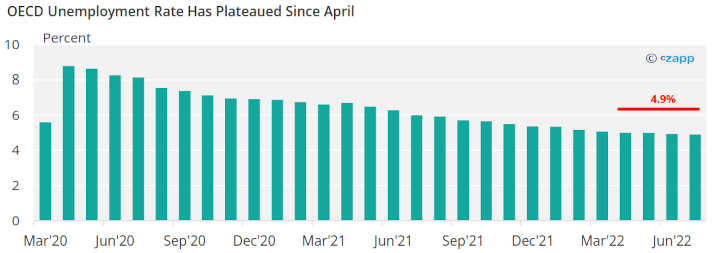

As manufacturing sentiment takes a hit, labour cost pressures are also setting in. If manufacturing activity drops, this would indicate a knock-on effect for employment rates. But the OECD’s unemployment rate has remained at about 4.9% for the four-month April to July period.

Source: OECD

This rate is likely to increase as the world heads into a recession.

Commodity Prices

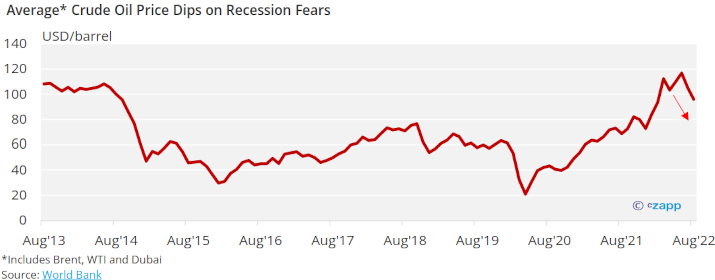

Average crude prices for August fell below the USD 100 threshold for the first time since February, prior to the Russian invasion of Ukraine.

Even though OPEC+ fell 3.6 million barrels per day below production targets, oil prices have been sinking since June. It seems that recession fears are outstripping negative sentiment over supply.

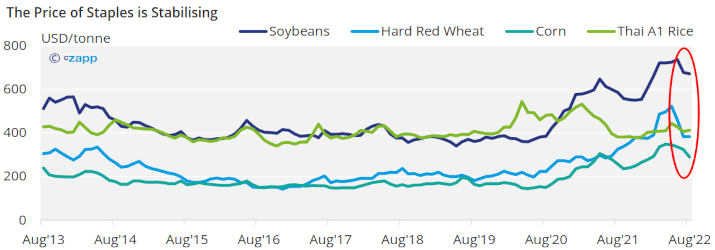

This in turn seems to be slightly pulling down the price of food from all-time highs during the summer.

Source: World Bank

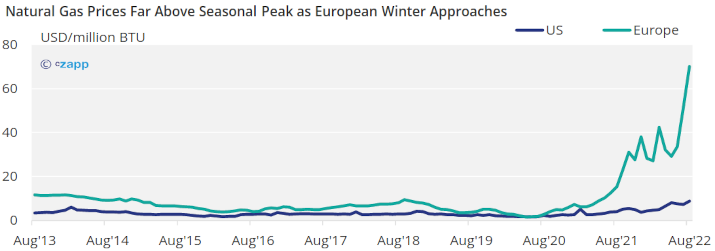

That being said, the price of natural gas continues to reach new heights, particularly in Europe where supply constraints are being felt ahead of the high-demand winter period.

Concluding Thoughts

- Costs are going up on all fronts for the supply chain.

- A stronger US dollar is going to exacerbate the situation for US-based companies and international companies alike.

- There are early signals of a sudden dip in demand as consumers are pushed into a recession and inflation shows no sign of abating.

- The fall-off in demand should be met with an equal drop in supply or companies will be challenged by downward price pressure.

- All signs point to recession, and the global economy is unlikely to recover quickly.

- The next year will be a challenging period for governments, companies and consumers.