- A soft drinks tax has been introduced in Malaysia.

- Beverage-makers are starting to reformulate to avoid needing to increase their product costs.

- Per capita consumption could reduce in the future as a result.

Per Capita Sugar Consumption Likely To Fall

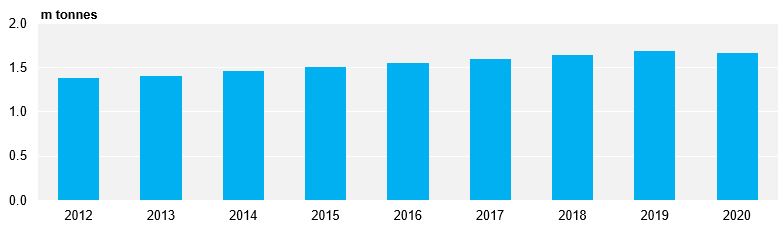

Malaysia’s Annual Sugar Consumption

- Following the introduction of a soft drink tax in Malaysia on July 1st, we think sugar consumption will maintain close to 1.7m tonnes per year.

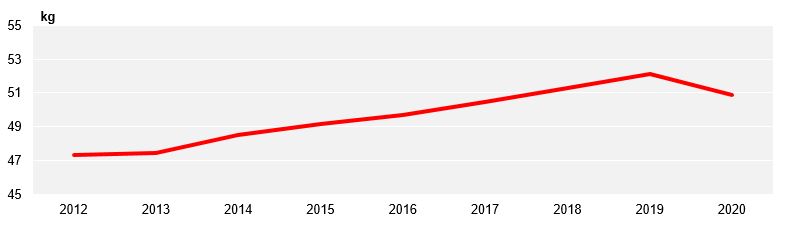

- This means per capita consumption will reduce from 52kg this year to 51kg in 2020.

Malaysia’s Per Capita Sugar Consumption

- The tax is being applied to drinks containing sugar above 5g per 100ml.

- We understand some major drinks manufacturers are starting to reformulate some of their products as a result of the tax.

- However, reformulation can be a lengthy process and so we are not aggressively marking consumption lower for the short term.

- Sugar-containing beverages are a major source of sugar consumption in Malaysia.

The Malaysian Soft Drinks Tax

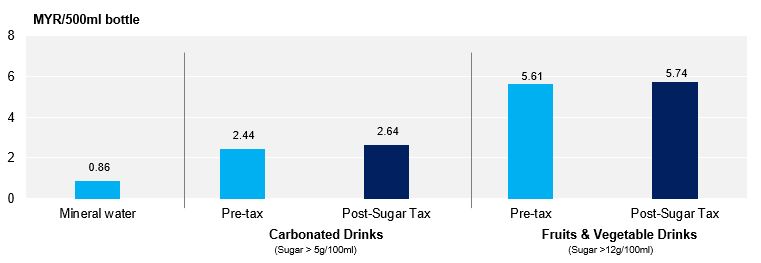

- A tax of MYR0.40 per litre is being levied on carbonated drinks with a sugar content above 5g/100ml, and fruit drinks with a sugar content above 12g/100ml.

Beverage cost in Malaysia; Post sugar-tax

- It will be levied on food and beverage manufacturers, and so costs are likely to be passed on to consumers.

- This is a similar model to that applied in the UK, where many manufacturers reformulated drinks with other sweeteners to avoid needing to increase drinks prices.

- However, it’s still not clear if the price differential between taxed and untaxed soft drinks will be enough to change Malaysian consumer behaviour.