Insight Focus

- New Zealand seen as having reached ‘peak milk’

- US milk production seen rising later in year

- German, Dutch butterfat production rebounds

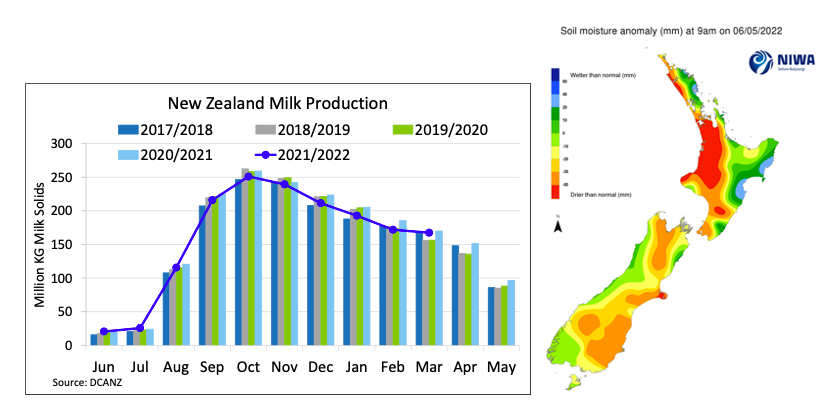

New Zealand: March’s drop in production was much less than those posted from December through February as milk only fell 3% from February to March, well below the five-year average of an 8% drop seasonally.

Pasture improved slightly in March, but both islands are experiencing drier conditions as the calendar approaches the final month of the season.

While milk prices are high, input costs for supplemental feed such as palm kernel and urea are continuing to cut into margins.

There are also reports of difficulties with culling cows due to labor shortages at meat plants; the influx of cull cows on the market as dairy farmers wind down for the season is coinciding with the meat company bottleneck. This has meant that cows are staying on milk longer than anticipated.

A farmer reported to the Otago Daily Times that Dairy farmers welcomed the high payout, but this headache had arrived with many extra costs, and they had their own staffing issues to deal with.

Into next season, the industry has already been warned that New Zealand is at peak milk by Fonterra’s CFO and has been at peak cow for about seven years, which means that growth potential is limited in the near-term as the country focuses on sustainability efforts. Less milk will mean moving milk into more value-added dairy products, which will also create a need to compete for that milk to satiate global demand for commodities.

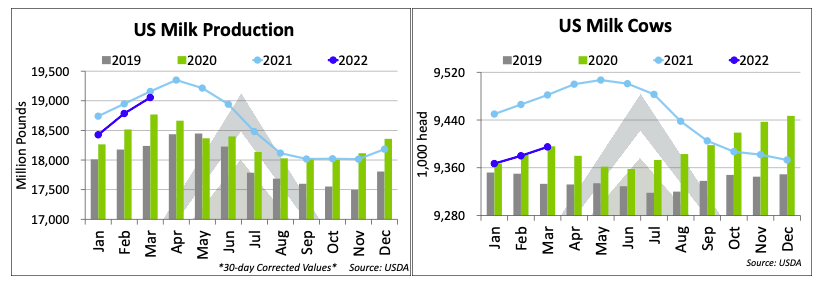

United States: Milk production was weaker versus prior year for the fifth consecutive month into March, a largely expected result as HighGround expected a 0.3% decline. While still negative, it was the closest to parity that milk production has totalled over the past five months, with signs emerging that volume could eclipse the previous year’s soon.

Output was equal to or higher than prior year in four of the top five states in March, even as two-thirds of the remaining reported states still showed declines. Looking ahead, HighGround expects a weaker Spring Flush in April and May, but milk production strength versus 2021 could emerge by June and persist throughout the back half of the calendar year.

Last month, data showed that a February herd size increase broke an eight-month streak of significant losses across the US. March followed February’s trend reversal with another monthly build, a sign that profitability has elevated to levels where farmers are more comfortable adding cows to the herd to capture attractive margins, earlier than HighGround expectations. The herd size grew by 15,000 head in March, but February was revised 10,000 head higher meaning the report-to-report increase was 25,000 cows. March marked the strongest monthly herd climb since April 2021’s 18,000 increase. However, due to strong gains one year ago, the year-on-year herd size gap actually widened in March, with cow numbers now DOWN 87,000 head versus a year earlier, stronger than the 86,000 head gap in February. In fact, the herd in March was the lowest versus prior year of any month since March 2019. Due to gains in Q2 2021, any increase in cow numbers into Q2 this year will likely not be enough to narrow the gap, keeping milk output weaker in the near term.

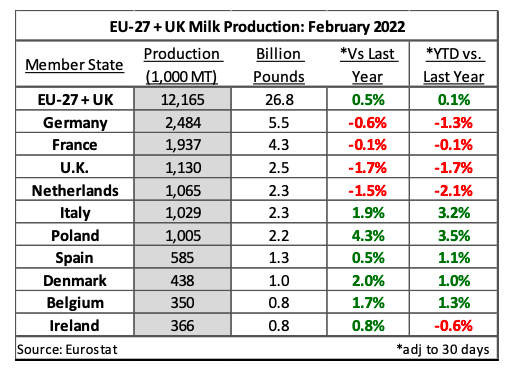

EU27+UK: France’s milk production data remains conflicted, with Eurostat reporting slightly stronger figures than the French Ministry of Agriculture, France AgriMer, has been reporting. Weekly figures in February averaged a loss of 0.9% from the previous year, very different from the 0.1% drop reported by Eurostat. AgriMer reported an average loss of 0.9% from prior year during March as well, with the first two weeks of April recording losses back below 2% YoY. There are also conflicting reports about Italy’s production figures from Eurostat with AGEA (Italian Agricultural Payments Agency) reporting muted gains versus Eurostat’s 1.9% increase.

Despite weaker milk collections from Germany and the Netherlands, butterfat production recovered slightly from the two countries during February. Germany’s butterfat production fell for five consecutive months through January but lifted 2% from the previous year into February. February 2021 is when Germany started to report extensive losses, so the gains are on top of a 10.9% loss last year. Dutch butter production was UP 1.7% from prior year following five months of losses as well.

Poland keeps cranking out the milk with strong increases observed for five consecutive months into February. As a result, SMP, butter and WMP all experienced solid gains over prior year. Poland is not immune to higher costs concerns though; Agnieszka Maliszewska, Director of the Office of the Polish Chamber of Milk, admits that there are a lot of signals from small dairy cooperatives that the current situation may overwhelm them and lead to an avalanche of bankruptcies from plants due to high costs.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial