Insight Focus

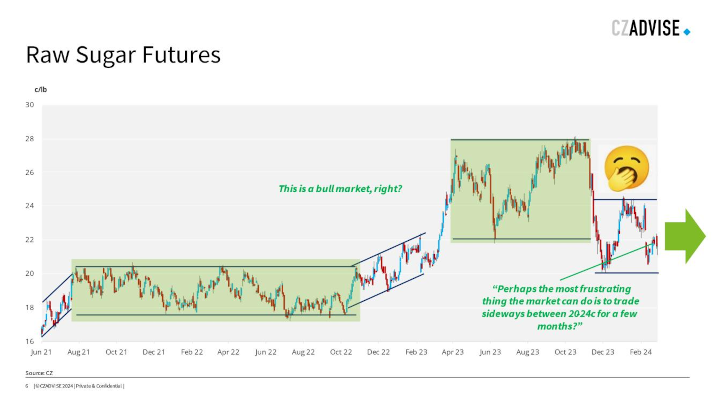

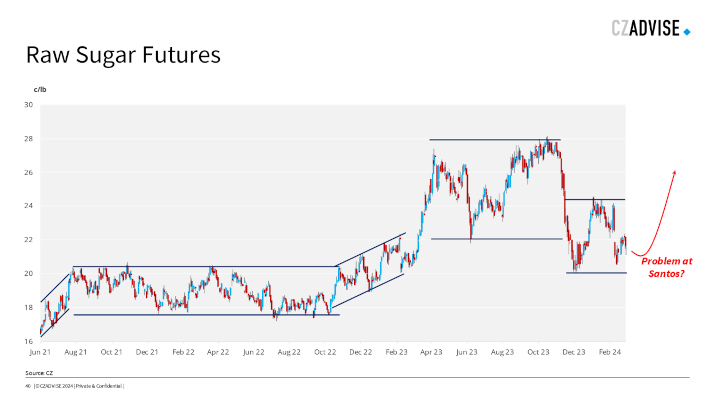

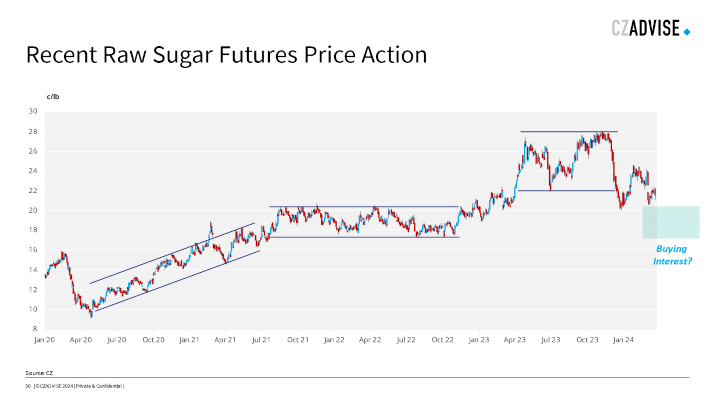

- Sugar futures are once again trading in a range.

- Global stocks are low and buyers would like to replenish

- Sugar supply is dominated by Brazil

Hi everyone, it’s Stephen from CZ and you join me during an especially dull moment in the sugar market.

I’d said on my return from the Dubai sugar conference that the market doesn’t owe excitement to anyone. Well, it’s living down to that.

My best guess is that it will trade between 20 and 24c for the next few weeks, possibly months, which is unsatisfactory for everyone.

- For me, because I have to make interesting videos on the sugar market.

- For buyers, who’d love a chance to buy below 20c for the first time in a long time.

- For sellers, who’d love to see prices back at 28c once more.

- For the trade, who need moderate volatility to profit most from their books.

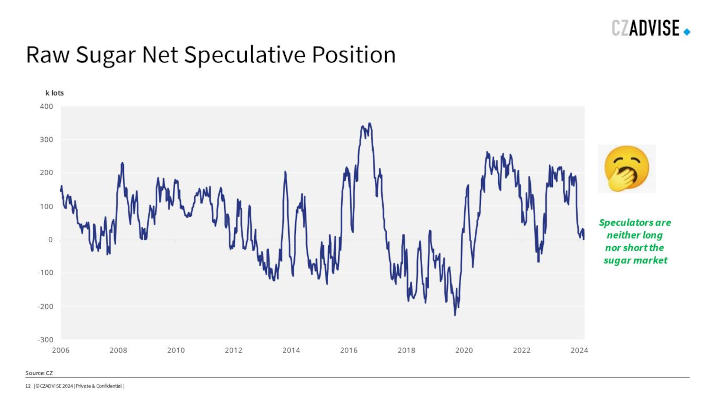

The problem for sugar is that its story is stale. Everyone knows the market is exposed to logistic performance in Centre-South Brazil and if anything goes wrong there prices will respond. Speculators don’t care for last year’s story, they need something new to re-engage. Until that time, they’re doing very well being long of cocoa and short of grains, thanks.

So for the time being sugar has reverted to being in the shadows once more. While everyone’s looking to other way, let’s look into the market in more detail.

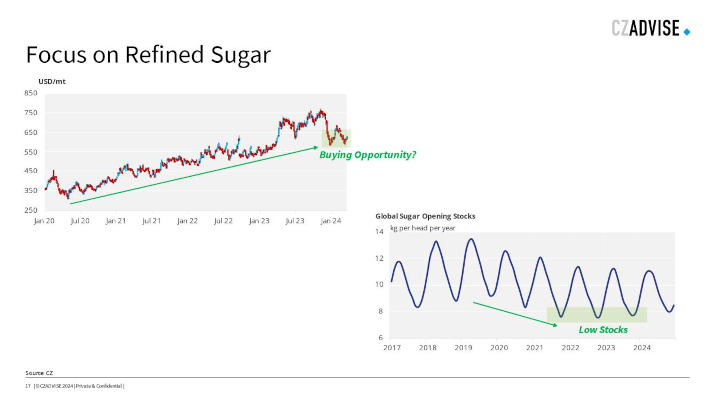

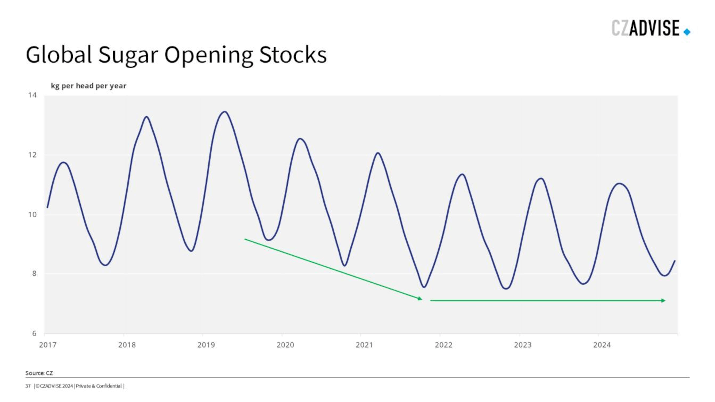

For much of the 2020s rally, the white sugar market has led the way. Many parts of the world have run sugar stocks lower as prices have risen. Stocks are the lowest they’ve been for more than a decade on a per person basis. Many places are playing a dangerous game and have hopefully used December’s fall in prices to add to cover in 2024. This means that refined sugar demand should be decent in 2024.

We should also see decent buying interest for Europe’s refined sugar this year once European prices have converged with the world market.

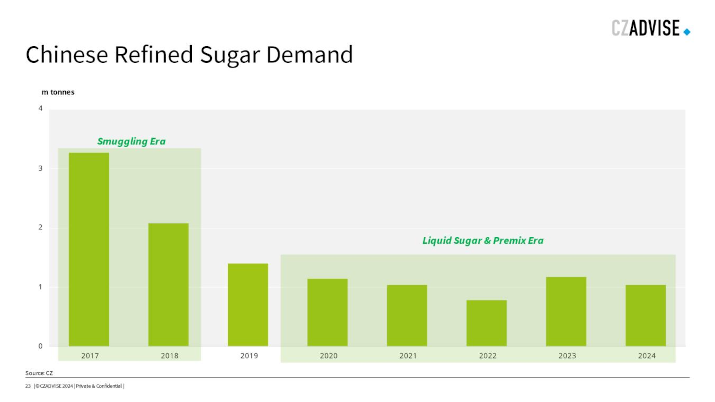

Then there’s China, which is still relying on informal white sugar channels to meet its import requirements. Once it was smuggled sugar from the region. Now it’s liquid sugar and premixes made from white sugar imported to special zones at the port.

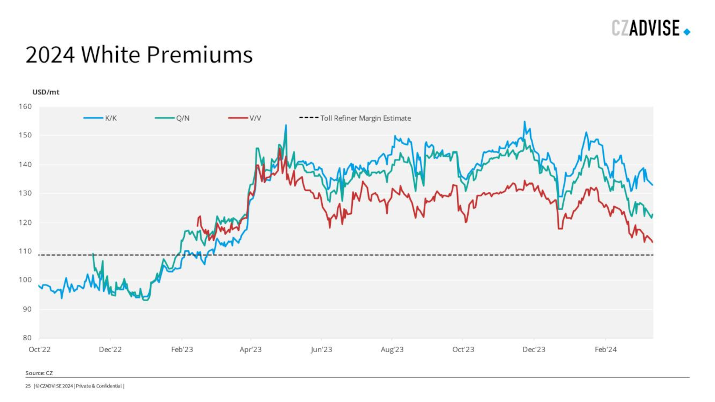

2024’s white premiums remain above $100/mt, giving toll refiners the signal to keep throughput going.

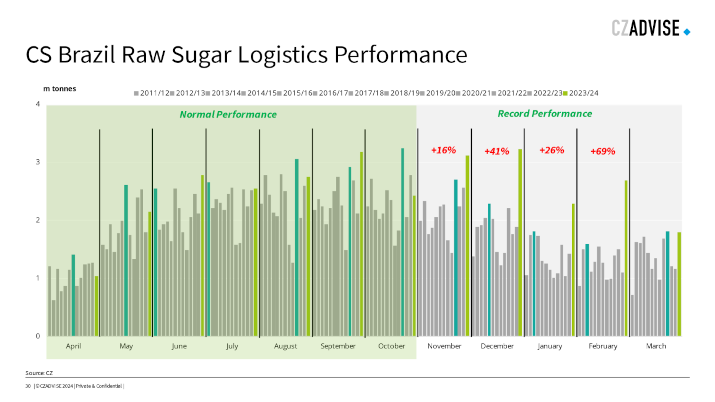

This has fed through to the raw sugar market. Offtake of raw sugar from Brazil has been huge in the first quarter of this year. It’s hard to overstate how big. Here I’ve put the record previous month in dark green and this year’s performance in light green.

Nov, Dec, Jan, Feb were all record months for shipments from CS Brazil. Not by a little, but by a lot. >13m was shipped in Nov-Mar. The previous record was 9.7m in 20/21. So that’s 35% more sugar supply across the period.

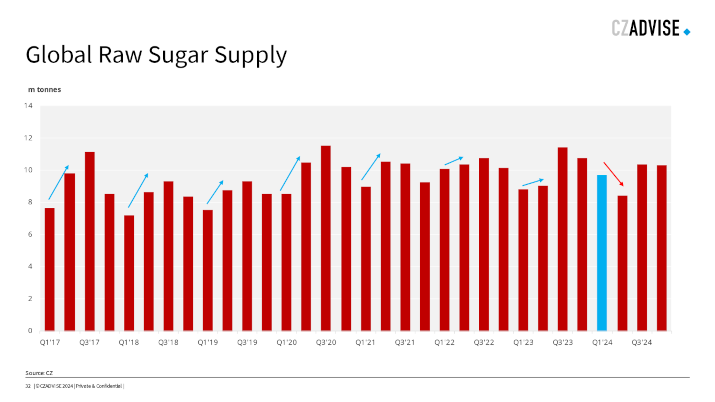

For the first time we can recall, global raw sugar supply in Q1 will exceed supply in Q2.

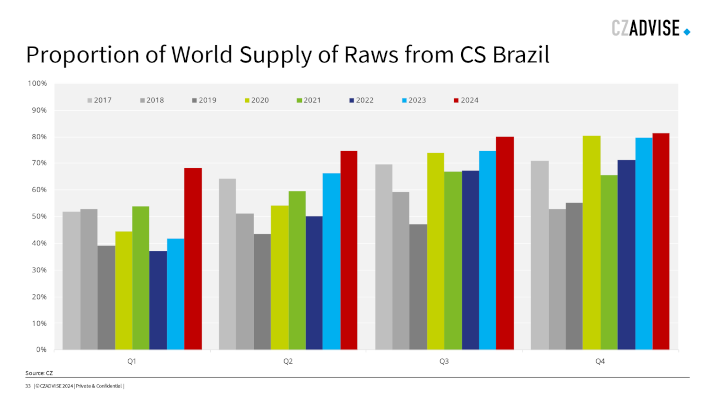

Brazil supplied 68% of world’s raw sugar in Q1. Will only rise through season, peaking above 80% in H2.

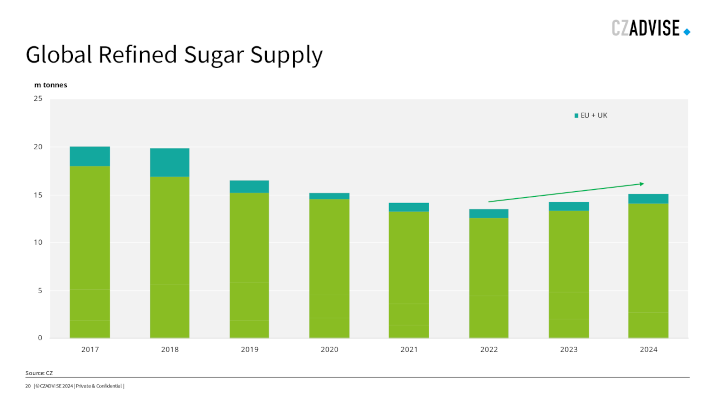

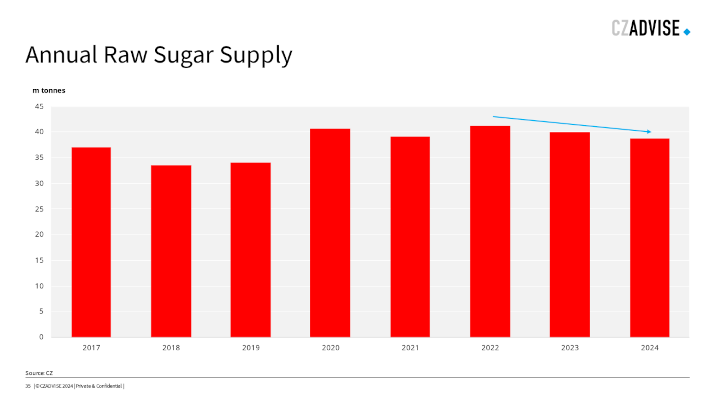

Annual raw sugar supply also falling, at 38.7m it’s the lowest since 2019.

The difference is that stocks now are far lower than they were in 2019, so market far more vulnerable if there’s a problem with supply. Prices will respond more.

This is why the whole world knows that we are one problem in Santos away from the market heading back towards 30c. It’s also extremely unlikely that the weather allows Brazilian ports to repeat the same trick in Q1’25, which is why many analysts think the sugar market will be undersupplied in this time.

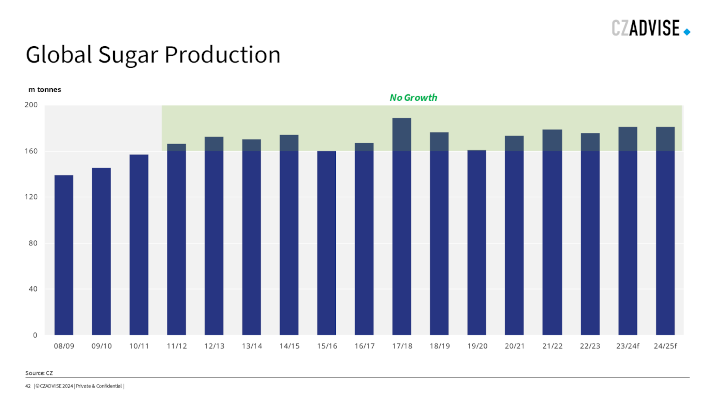

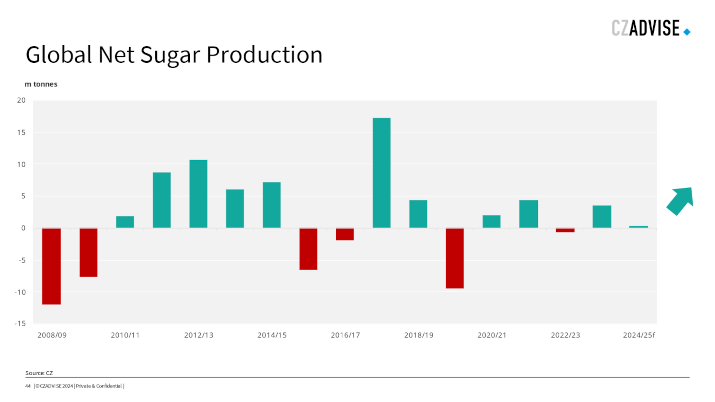

Speaking of the weather, when it normalizes it’s possible that global sugar production finally breaks out of its 13 year range. We need better performance in places like India, Thailand and Mexico, but if they all return towards previous highs we could easily see 190m tonnes sugar being made.

This would be enough to help rebuild global sugar stocks, perhaps from 2025/26, and would probably put an end to the current bull market. But there’s no greenfield in Brazil, no expansion as such in Europe or Thailand, which remain far below capacity. The next bear market won’t be a decade long.

It’s also hard to see how it starts in earnest this year. Never say never, after all in 2010 the market went from 30c to 13c to 36c. It was a bull market, but a vicious one. There’s no reason we couldn’t go to 14c then 30c this year too. It’s possible but not probable, though.

Most buyers would look to buy aggressively for 2024 and 2025 at or below 20c, which could be supportive.

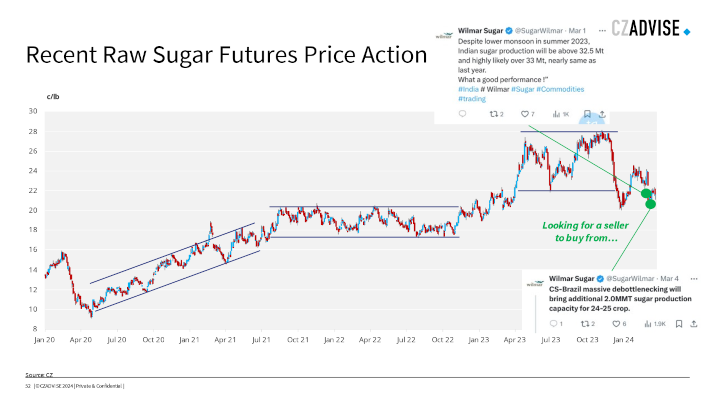

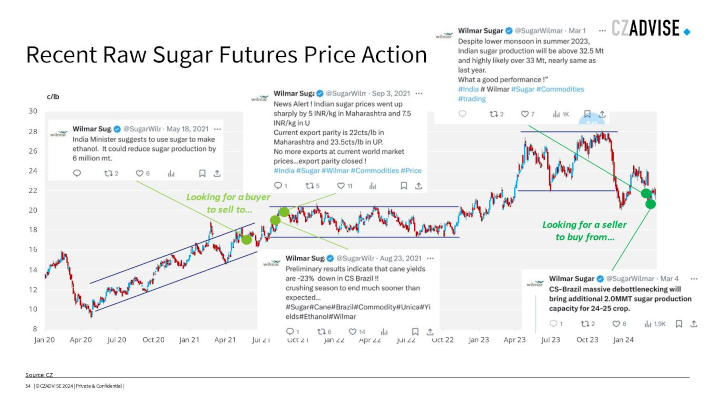

And it’s interesting that people think that one of the world’s largest sugar trade houses is bearish. I take a different view.

Remember that Wilmar don’t tweet out of the kindness of their hearts. The tweets aren’t for information or guidance. They are there to help Wilmar profit from their trading book. This means you should do the opposite of what they say.

They’ve been super-bearish in the tweets, which means they’re looking for someone to sell to them so they can buy. They want to buy cheap sugar following the recent price collapse. In Aug and Sep 21, the last time they tweeted, they were bullish tweets because they needed buyers to sell to after a long rally.

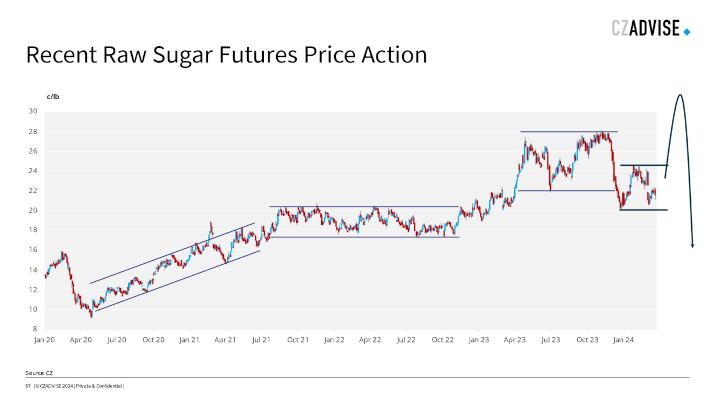

Alright – enough waffle. What does this mean for price? My best guess, and it’s only a guess…there are lots of people in the market far smarter than me with a different opinion, is that the sugar market trades in its current range for a few months yet.

Something somewhere may happen which the world can’t respond to because we’ve all run down sugar stocks. This will give us the final push higher in the already mature bull market, completing the classic commodity U-shape rally before we descend into a bear market brought about by greater production around the world.

Whatever you have to hedge in the market, good luck and we’ll speak again soon.