- There is not a lot of deliverable refined sugar available for the coming March’21 futures expiry.

- We think at least one trade house is therefore squeezing shorts ahead of the expiry.

- This means that the H/K spread has been strengthening, giving the wider sugar market a more positive feeling.

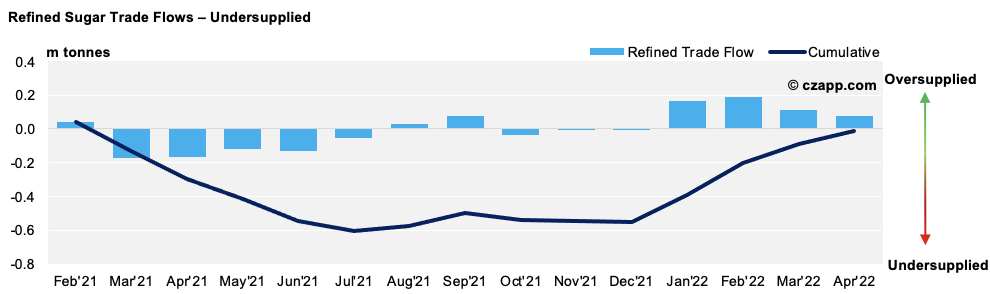

The Refined Sugar Market is Undersupplied

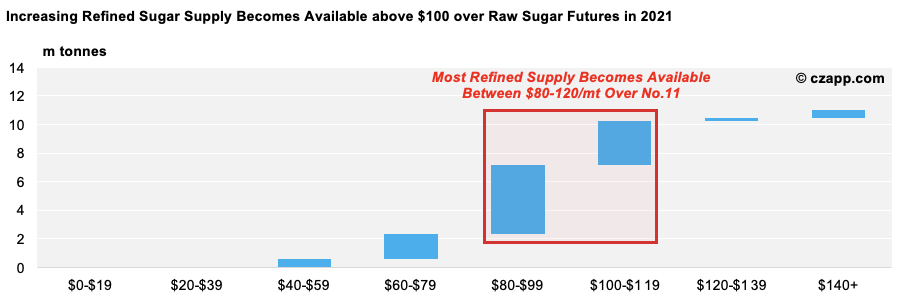

- We think the refined sugar market is undersupplied in H1’21; demand outweighs available supply.

- Supply looks as though it’ll be at its tightest between now and May, and so this period of tightness coincides with the March/April nomination window for the March’21 futures expiry.

- The shortfall in supply follows poor crops in Thailand and the EU, the world’s two dominant low-cost refined sugar origins.

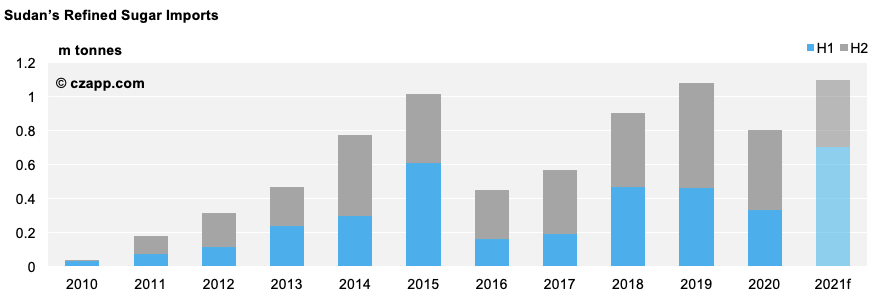

- The tightness is concentrated in the near term in part because spot refined sugar demand from Sudan has been very good; we think they could take up to 700k tonnes of refined sugar in H1’21.

- On top of this, container shipments around the world are still being disrupted by the knock-on effects of COVID lockdowns in 2020: container shortages and delays remain problematic in many ports.

- Refined sugar origins who have access to containers are therefore being incentivised to ship by strong physical values, further reducing deliverable breakbulk supply for the expiry.

- This is the case in Thailand, where containerised refined premiums are $50 over the futures; who would give up this kind of return to deliver against the futures expiry?!

Who Could Deliver?

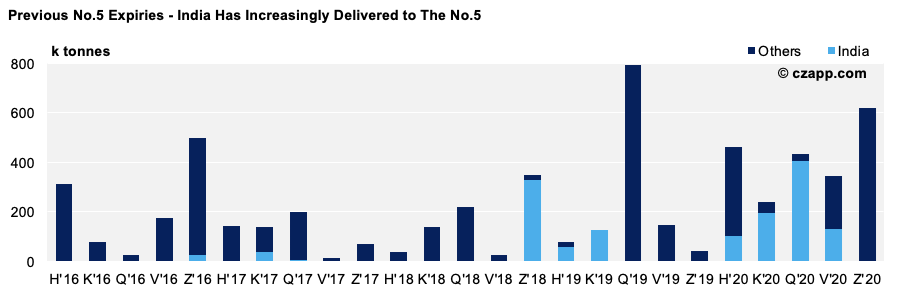

- We think the expiry will be dominated by Indian breakbulk supply.

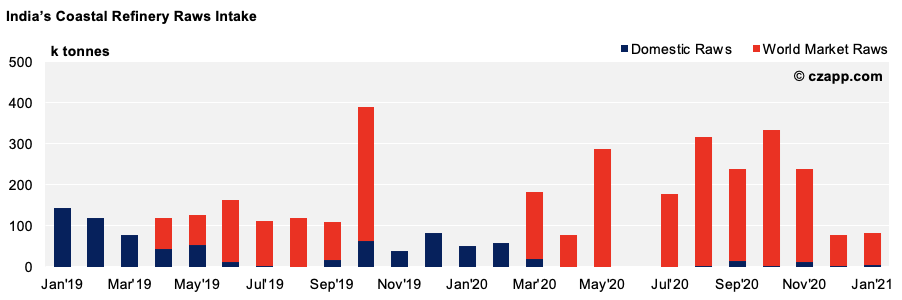

- Indian ports have been heavily affected by congestion caused by a shortage of available containers.

- This has reduced the refiners’ ability to ship refined sugar.

- As we’ve seen in the past, its coastal refiners are happy to use the No.5 to drive their export flow; delivery is a way of ensuring there’s a buyer for their sugar.

- As No.5 deliveries are for breakbulk shipment, delivering may help reduce the impact of the container shortage.

- The coastal refineries’ raw sugar offtake has been strong, so they should be able to supply a large volume, perhaps around 200k tonnes.

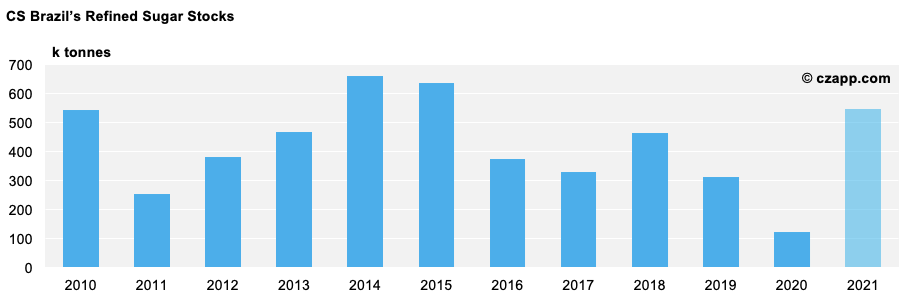

- CS Brazil’s February refined sugar stocks are the highest they have been for five years.

- Therefore, if the H/K spread stays strong, we think some CS Brazilian sugar could be delivered.

- It’s unlikely NNE Brazil will deliver, however, as its refined stocks are low due to strong offtake this season.

- This is also the case in Central America; most refined sugar from the region has already been committed.

- Guatemala delivered most of its refined against the Dec’20 contract (234k tonnes or 4,610 lots).

- If the receivers want more sugar than India or CS Brazil can commit, we could see volume delivered from toll refiners such as Dubai or Algeria.

- However, refined prices would have to encourage these refiners to give up containerised shipments that are currently offering large premiums.

- In this case, the H/K spread and the white premium would need to strengthen further before the contract expires.

Receivers – Short Squeeze

- We think that one or more trade house may be looking to squeeze futures shorts.

- Much of the trade are now bullish and there could be receiver(s) for more than 500k tonnes.

- This tonnage could be against strong regional sales into the Indian Ocean region.

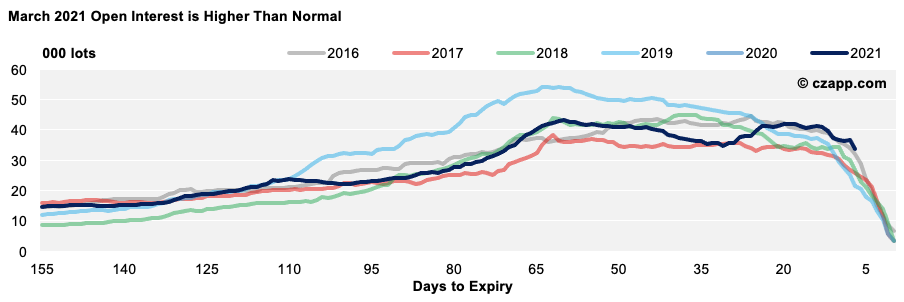

- Open interest remains higher than it has been previous years, meaning there’s plenty of contracts still left to roll.

- After expiry we think that the current stress on the refined market will start to ease.

- Most of the Sudanese offtake will have been shipped, and we hope the container problems will start to reduce.

- However, until the next Thai and EU crops get underway at the end of 2021, refined supply options will remain limited.

Other Opinions You Might Be Interested In…

- Mexico Starts World Market Raw Sugar Exports

- Thai Cane Crop to Rebound in 2021/22

- Guatemalan Refined Exports Start Strong, Despite Harvest Delays