Insight Focus

The impacts of April frosts on the European apple crop are now becoming clear. Production volumes are now concerningly low, forcing the European Commission to consider aid for struggling farmers.

Prices React to Low Stocks

Apple stocks in Europe have decreased rapidly in the last six months due to unusually low production levels, which has pushed up prices. For instance, last year Polish Apple Juice Concentrate of 70 Brix, with 2%/2.5% acidity was priced at around EUR 1,550/tonne. For the same period this year, prices are starting at EUR 2,500 EUR/tonne for the lower acidity 1.5%/2.2% product.

This is unusual. Although prices can typically be volatile at the beginning of the crop, they tend to balance out as the crop develops. However, this year, prices are expected to remain elevated, even for the lower acidity product, due to chronic global shortages.

It is also worth noting that apple products with lower acidity tend to attract lower prices. As crops advance, acidity levels tend to drop, weighing on prices.

Across the board, fruit prices have been rising this year. A very small berry crop in Europe, a pineapple shortage in Asia and a structurally declining orange market mean that prices of fruit globally remain high. Now, a bad apple crop and very high prices of apple byproducts are adding more pressure.

The result of all this is that processors are not rushing to close long term contracts for 2025 due to pricing uncertainty for the next few months. Considering the high prices in Europe, it is possible that buyers will wait for the market to stabilize and reach to a more reasonable price.

Cold Snap Decimates EU Apple Crop

This April was colder than normal, which farmers worried would impact summer harvests. In mid-April, a cold snap set in across the continent, with some areas in Poland facing frosts of up to -8 degrees Celsius.

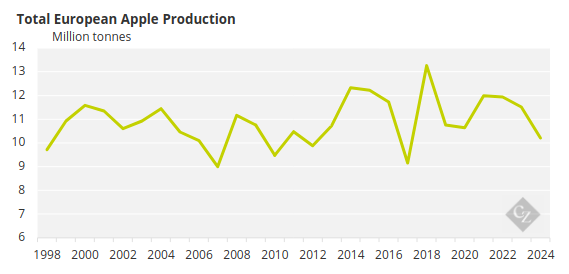

Now, it has become apparent that the frosts have jeopardized fruit crops across Europe. According to the most recent data, the European apple crop this year is expected to be over 10% lower than that of 2023.

The main apple producing countries such as Poland, Germany, Italy and France are expected to experience a drop of 1.3 million tonnes. This production year is forecasted to be the lowest in the last six years.

Only a few European countries this year are anticipating higher year-over-year apple production – and even these are the smaller producers that won’t be able to compensate for the losses. Others expect declines of up to 76%.

Other European producing regions, such as Spain, will begin their crop years soon. At least initially, prices will correlate with the Polish product, remaining higher than usual. However, a strong crop from Spain might ease the pressure in the market.

Other sources such as South Africa and South America might be an option, but considering the last crop ended a few months ago, stocks are very low, and the options are extremely limited.

What to Expect

Price increases in Europe have even made it as far as China – a market that typically offers a lower-cost, lower-acidity product. However, Chinese farmers are now offering at higher prices than normal due to high demand from the US, the EU and South America.

Additionally, with rising labour costs, cash flow is a constraint for processors. High interest rates and limited credit lines from banks mean processors in China will be looking for clients willing to ship promptly and with favourable payment terms such as advance payment or Cash Against Documents.

Although prices are higher than normal in China, this product is still more affordable than others. However, given that farmers and processors will be able to demand favourable terms due to high demand, this might cause headaches for buyers. Additionally, the high freight rates and low availability of containers are still causing delays in shipments.