Insight Focus

- Mexico’s President announced a ban on GM corn from 2024.

- This could halt USD 3 billion in trade, primarily American corn arrivals.

- Mexican sugar flows to the U.S. could also be halted.

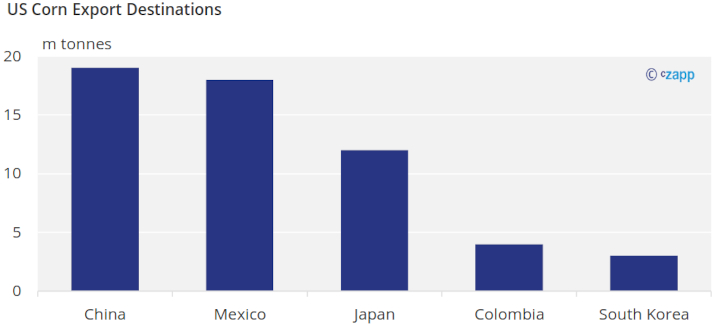

In December 2020, Mexico’s president Andres Manuel Lopez Obrador (AMLO), announced a ban on Genetically Modified (GM) corn and Glyphosate (a pesticide) starting in 2024. This ban worried many American corn farmers since Mexico is their second largest export destination. The ban will stop the flows of American GM yellow (for animal feed) and white (for human consumption) corn to Mexico.

Then in October 2021, the Mexican Minister of Agriculture guaranteed American farmers that this policy would only affect U.S. white corn meant for human consumption. Afterward, in December of 2022, AMLO stated that Mexico would halt the imports of both yellow (animal feed) and white (human consumption) GM corn.

The Mexican import ban has led U.S. Secretary of Agriculture Tom Vilsack to consider all options, including international legal litigation. Vilsack said after meeting with Mexican president AMLO, “the U.S. government would be forced to consider all options, including taking formal steps to enforce our legal rights under the U.S.-Mexico-Canada Agreement.”

U.S. and Mexican officials met in late January, but according to reports, talks have stagnated since both parties are far from an agreement. AMLO recently claimed that he is willing to postpone the ban on yellow GM corn to 2025 to give American farmers time to prepare.

Economic Consequences

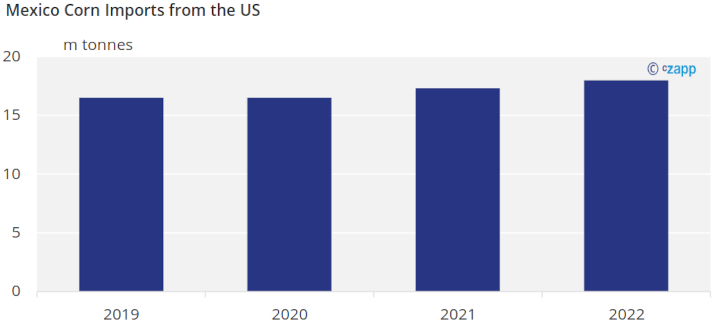

Mexico is a significant importer of American corn. Mexico imported 18 m tonnes of corn from the U.S. in 2022.

Studies show that 90% of U.S. corn is grown from GM seeds. This means that 84% of the corn that the U.S. usually exports to Mexico will have to find a new home. According to the Mexico Institute of Research, this Mexican legislation could halt 3 billion USD in trade and raise the cost of corn in Mexico by 19%.

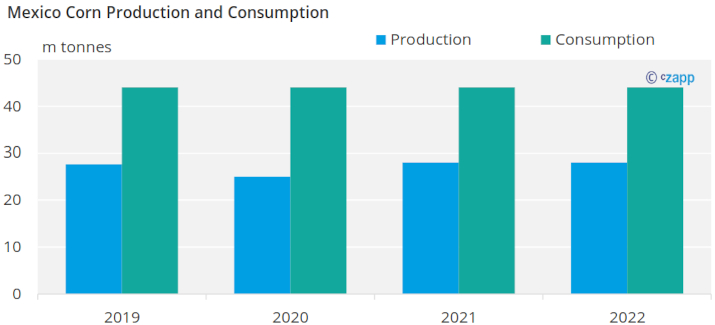

If Mexico were to enact this ban, it would have to find a new potential trade partner or produce more corn. At the moment, Mexico is not self-sufficient in corn. Mexico produced around 28 m tonnes of corn, while its population consumed 44 m tonnes of corn in 2022.

Why is Mexico banning GM Corn?

Mexico is banning GM Corn for two main reasons: to promote self-sufficiency and for health concerns.

Currently, Mexico is self-sufficient in white corn. Even though Mexico can produce enough white corn to satisfy its domestic demand, it still imports around 800 k tonnes from the United States. Approximately 90% of this white corn imported from the United States was genetically modified.

If Mexico bans the importation of yellow GM corn from the United States, replacing those 17 m tonnes will be challenging since Mexico is not self-sufficient in yellow corn. The second reason Mexico is banning GM corn’s importation is health. President AMLO stated, “When deciding between health or trade, we opt for health.” Mexico claims that GM corn can cause damage to health. Officials in Mexico also claim that GM seeds are a danger to wildlife. They claim that these seeds can harm ecosystems through cross-pollination.

Potential Disruption in the US-Mexican Sugar Trade

If Mexico bans American GM corn, then 750 k tonnes of American high-fructose corn will not be allowed to enter Mexico. This could lead to severe repercussions. The U.S. could potentially ban the 1.35 m tonnes of imported Mexican sugar (70% raw vs. 30% white).

A ban by the U.S. on Mexican sugar could lead to severe complications. The U.S. could give more TRQ allocations to Brazil, Dominican Republic, or Central American countries. But the TRQ only accounts for raw sugar. The U.S. still needs to take in consideration around 405 k tonnes of white sugar. The U.S. would need to figure out a new quota system to replace the banned Mexican sugar.