779 words / 5 minute reading time

- Key players in the Mexican sugar industry have revised their sugar production estimates down from 5.7m tonnes to 5.5m tonnes.

- However, the crop data suggests things could actually be better than they first envisaged.

- Yields have got off to a strong start, so the total acreage remains the main focus.

What Was Expected From The Crop?

- Mexico’s 2019 crop was its second largest in history.

- Comparisons to the 2019 crop are therefore bound to be alarmist.

- It is better to take a look at the crop from a wider perspective.

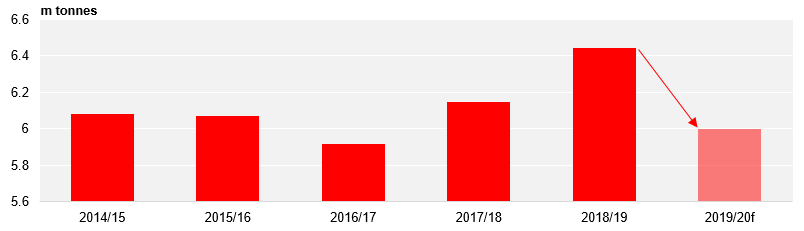

Record Mexican Crop in 2018/19

- We currently forecast a 6m tonne crop for the 2019/20f season.

- We have been constantly monitoring the crop data using our Interactive Data section, and whilst the harvest has been slow, we have found that some important indicators (Ag Yields and Acreage) are better than they were expected to be in the early industry crop estimate.

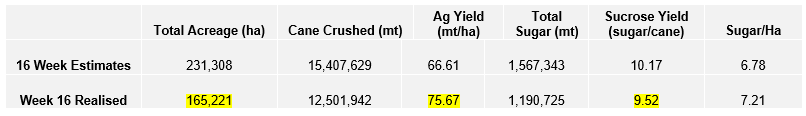

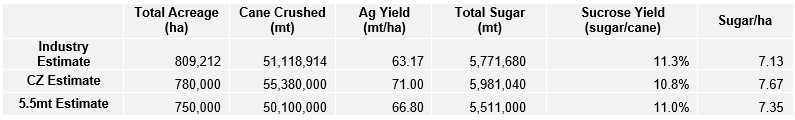

- The industry estimates set the early season benchmark and the overall 5.77m ton crop number was widely accepted.

Mexican Industry Crop Estimates vs. Actual:

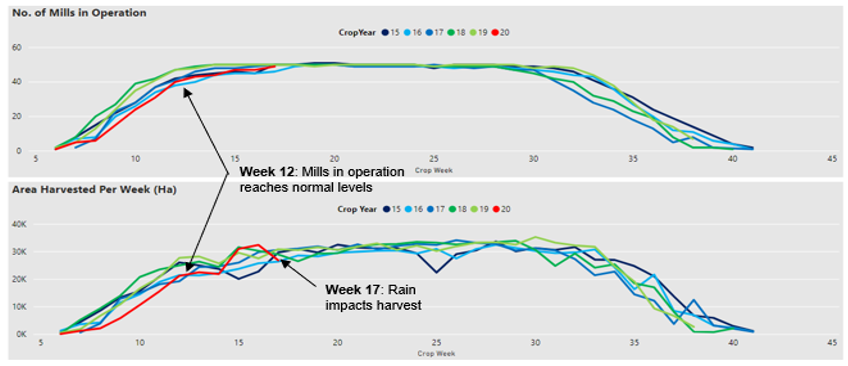

Acreage Development

- The first question is: How many hectares will be harvested?

- The early estimate predicted that 809k ha would be harvested this season; this estimate is produced by the domestic industry from mill surveys.

- Even though this number was publicised after the drought, it seems it was still optimistic.

- The initial results indicated that a much smaller acreage would be harvested, but the numbers were also deceiving.

- The number of mills in operation had been behind the norm until a few weeks ago, but once it normalised, the harvest rate did too.

- It would be very optimistic to think this recovery could carry through to reach 809k tonnes, but between now and week 42 there is plenty of time to harvest more.

- An average of 630k tonnes was harvested from week 16 until the end of the crop in the last five years.

- 795k tonnes could be harvested if we see this average pace again.

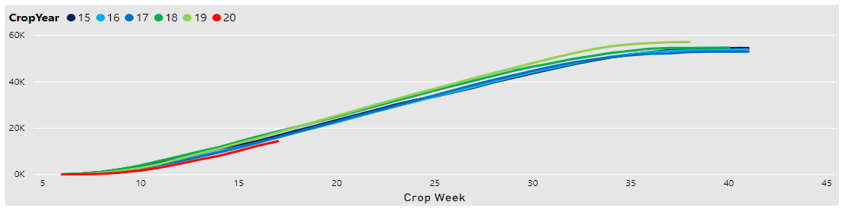

Total Cane Crush (k tonnes)

And How Are the Yields?

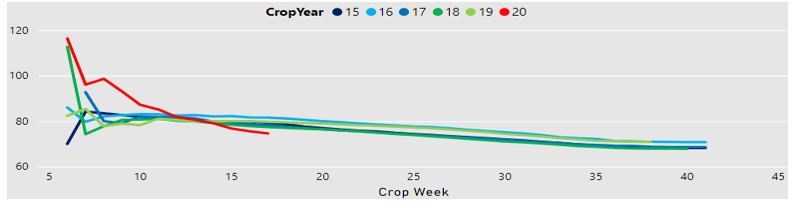

Ag Yields

- The early forecasts expected the cane growth and ag yields to be impacted by the lack of water experienced.

- So far, however, we have seen far stronger ag yields than were anticipated – 8.8% above the weekly estimates.

- As well as this, it seems as though a lot of the cane has been able to recover due to the delayed crop start.

- We accept that the total acreage is likely to fall against estimates because of the drought, however.

- The ag yields are likely to be considerably worse than the historical averages, but they will still be better than the predicted 63.17 (sugar/ha) season average.

Average Ag Yield (mt cane / Ha)

Sucrose Yields

- The lower-than-forecasted sucrose yields indicate that the cane damage from the drought was not as severe as first expected.

- A water-deprived cane stalk cannot grow as tall as usual, but as a result, what has grown has a high sucrose content as the cane continues to produce sugar.

- The industry weekly estimate of 10.17 (sugar/ha) is very high for this stage of the crop. This time last season sucrose yields were 9.86 (sugar/ha).

- Sucrose yields will realistically be below the estimate, but we see this as a result of the better ag yields and crop conditions overall.

So, Do We Have More Clarity Now?

- It is still is too early to tell how the crop will end.

- Whilst yields have been good, the total amount of area harvested is likely to be the biggest risk to our forecast.

- The crop could come to more abrupt end than in previous years if certain fields are deemed too damaged to even attempt harvesting.

- We could also see yields nose-dive as mills may be saving the worst-affected fields for last in the hope that the cane develops as much as possible before it is harvested.

- The development of the crop will have a significant impact on the US’ import expectations.

- With a 5.5m ton crop, it is possible Mexico won’t reach their 1.5m ton US export quota, leaving the USA with a supply shortfall.

You can stay informed on the weekly crop numbers using the Crop Models stored inside Czapp’s Interactive Data section.