350 words / 2 minute reading time

- The US market will be very reliant on the Mexican crop to cover their domestic production shortfall.

- The crop is just starting but early yield results could alleviate short term supply fears in the USA.

- All the Mexican Crop Data is now available for you in our Interactive Data section.

Production Estimate Range: 5.6 to 6.1m tonnes

- Our Mexican crop model is now available for anyone to see and interact with here!

- The range of production estimates have varied. We are currently modelling a 6.1m tonne crop, but the local cane industry is predicting a crop of 5.8m tonnes.

- We have also heard that some are predicting a 5.6m tonne crop.

- The crop has only fallen below 6m tonnes once in the last five seasons; this happened in 2017.

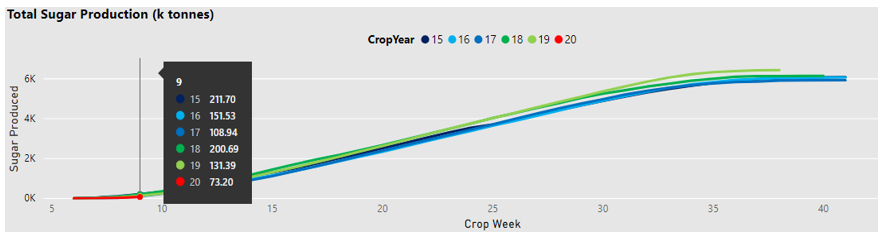

- So far, the crop is slightly behind the usual pace, but it is still very early in the season.

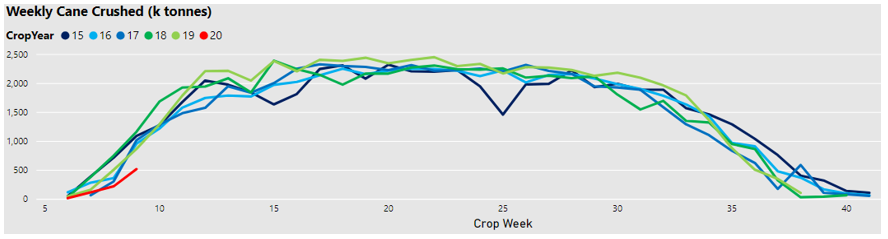

- Very little cane has been crushed so far and so it is not surprising to see the sugar volume behind the norm.

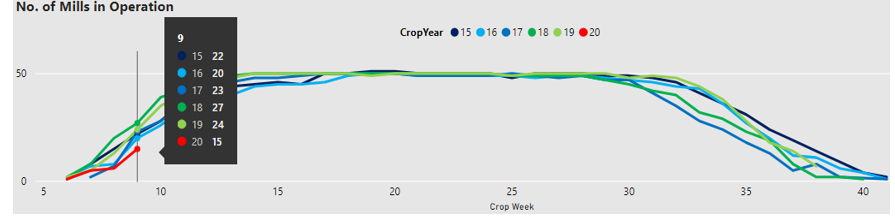

- Very few mills are yet in operation, only 15 have started harvesting so far.

- Cane volume is expected to fall this season as the summer drought takes its toll on cane weight.

- The official domestic forecast expects 51m tonnes of cane to be crushed (1m tonnes less than in 2017, the previous low).

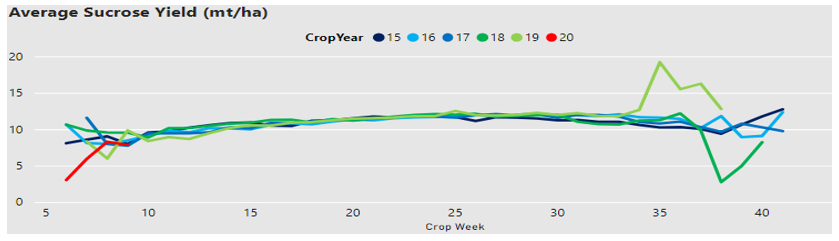

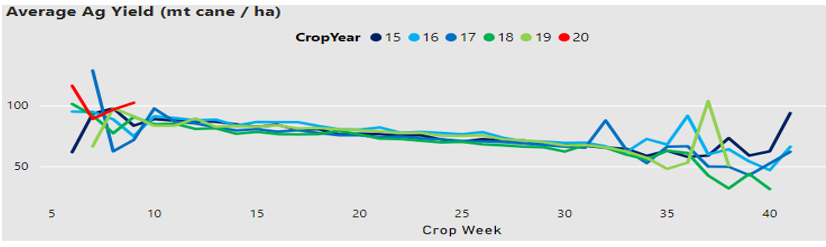

- Agricultural yield returns (tonnes of cane per hectare) will be followed closely to see if the damage to the cane is as dramatic as forecast.

Yields Under the Microscope – Good Start

- So far, yields have been good, but again, it is just the start of the season.

- Agricultural yields have outperformed the historical averages. If they continue to perform well, the market will be forced to reconsider the low production estimates.

- Consistently good yields will allow for concerns over the supply of sugar in the US and Mexican market to dissipate.

- This should help prices return to more usual levels.

- Keep updated on the Mexican crop in our Interactive Data Section.