This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- At the International Sugar Colloquium last week, limited deals were made.

- The market expects prices to largely remain firm.

- There are question marks over Mexico’s sugar production capabilities.

Prices to Remain Firm

Bulk refined sugar prices were unchanged in the week ended March 1 following the International Sweetener Colloquium in Aventura, Florida, where nearly 700 attendees — a record turnout — gathered to hear insights and market analysis from industry experts.

Some sugar was thought to have been booked during the active sideline meetings at the Colloquium, but it seems that major bookings had yet to occur by the event’s conclusion and a rush to contract immediately after the event was unlikely.

A sizable portion of forward sales (mostly to small and mid-size users) for at least one beet processor had been confirmed ahead of the Colloquium, but many beet and cane sugar sellers did not have large volumes contracted for 2025 ahead of the event, trade sources said.

Frank Jenkins, president of JSG Commodities, said in his domestic sugar market outlook presentation that price relief typically comes after the standard time of procurement for many major US buyers.

“If you can wait until September then great because something may occur that would give you a better opportunity in the No. 11 market, but if your timeframe is between now and spring, then it’s really hard to see what can change to impact pricing,” he said.

The general consensus from presenters at the event was prices for both 2023-24 and for 2024-25 were likely to remain firm.

US Looks to Plug Gaps

The US market will need to rely on high-tier imports, short of a tariff-rate import quota increase, to supplement the expected gap in Mexico’s sugar exports due to a severe drought causing major reduction in the outlook for the country’s 2023-24 sugar production. Mexico is the primary supplier of imports to the US.

Several presenters at the Colloquium expressed concerns about the Mexican sugar cane crop. One analyst noted the aging cane and lack of fertilisation were detrimental to the crop’s production, along with adverse weather.

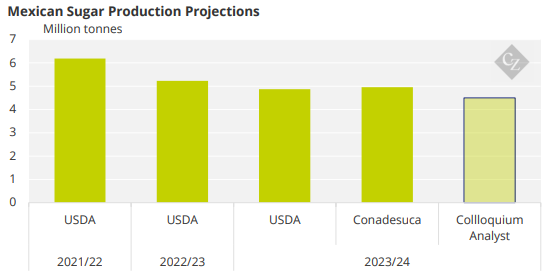

One analyst at the colloquium forecast Mexico’s 2023-24 sugar production at 4.5 million tonnes, actual weight, down from the recent Conadesuca outlook of 4.959 million tonnes and even below the US Department of Agriculture’s February projection at 4.875 million tonnes. The USDA previously estimated Mexican sugar production at 5.224 million tonnes in 2022-23 and 6.185 million tonnes in 2021-22.

The agreements that suspend countervailing and antidumping duties on Mexico’s sugar exports to the US prohibits Mexico from importing sugar from third countries to fill its export quota to the US. However, the practice is contentious as Mexico contends it has the right to import high-tier sugar just as the US does under the agreements.

One analyst surmised the US would be able to import only 390,000 short tons (353,000 tonnes) from Mexico and would need 1.2 million short tons (1.1 million tonnes) from high-tier suppliers this year to achieve the USDA baseline 13.5% ending stocks-to-use ratio.

The corn sweetener market was quiet. Craig Ruffolo, vice president and commodity specialist, McLeany-Flavell Co. Inc., told the Colloquium audience he expects corn sweetener prices to remain mostly flat throughout 2024. But Ruffolo said there was potential for some price relief due to the stable US corn market.