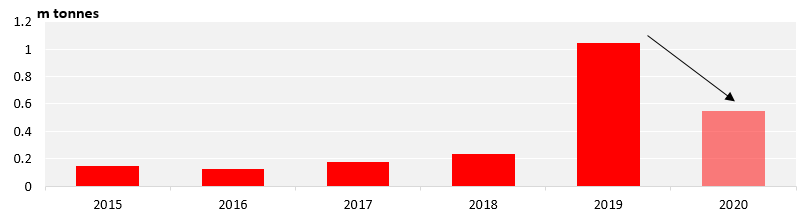

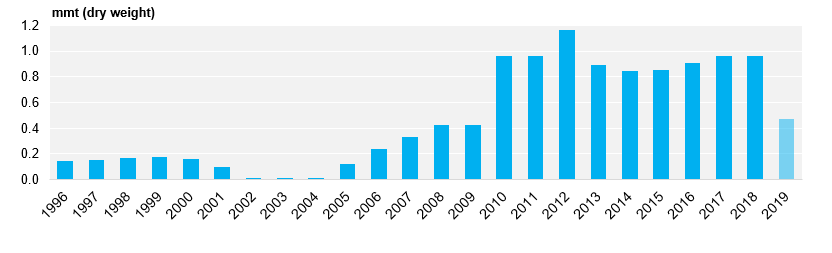

- Mexico looks set to supply 550k tonnes in 2019/20 to the world market.

- This is almost half the 1.04m tonnes supplied in 2018/19.

- This is due to increased access to the US market and drought damaging cane fields.

Production Affected by Drought

- Mexico has suffered a very dry summer and the major sugar growing regions, near Veracruz, have been hit hardest.

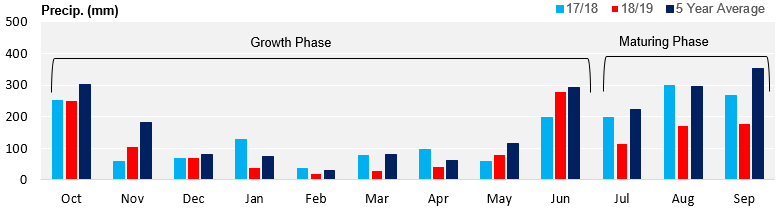

- The maturing phase for sugar cane is from July until October, the period in which rainfall has been very scarce.

Veracruz Rainfall

- Until cane is harvested and we get yield data it will be hard to know the true extent of the damage.

- Cane has proven time and again to be very resilient to short-term weather.

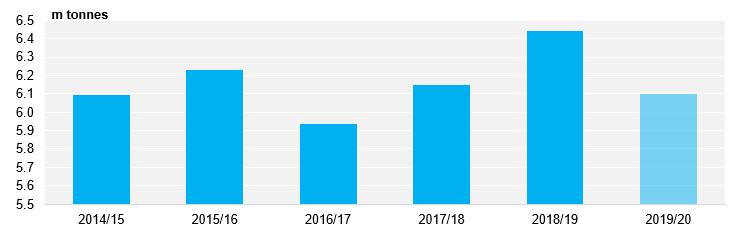

- We had originally hoped sugar production in Mexico would reach 6.6m tonnes in 2019/20; we have now reduced our view to 6.1m tonnes.

- Some alarmists are saying we could see the crop fall to 5.6m tonnes, but this feels premature at the moment.

Mexican Crop Production

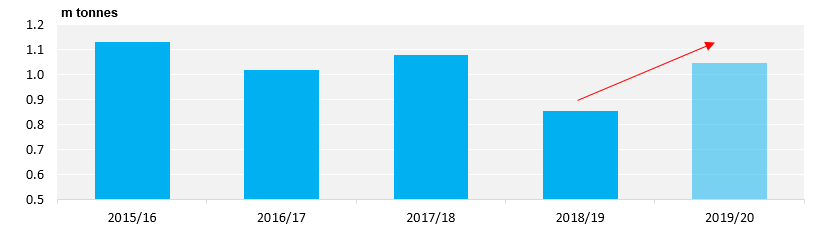

Mexican Exports in 2019/20

- Last season, Mexico made a huge leap into the world market after its access to the US market was reviewed lower.

- This year, early forecasts expect an increase in US quota access up to 1m tonnes.

Mexican Quota Access to the USA

- This access can still be reduced as the US Department of Agriculture reviews American cane and beet harvest progress.

- But as it stands, this means world market exports will fall from 1.04m tonnes to 550k tonnes.

Mexican World Market Export Volumes

- Any downside to the Mexican crop below our 6.1m tonne estimate will directly reduce the world market export volume.

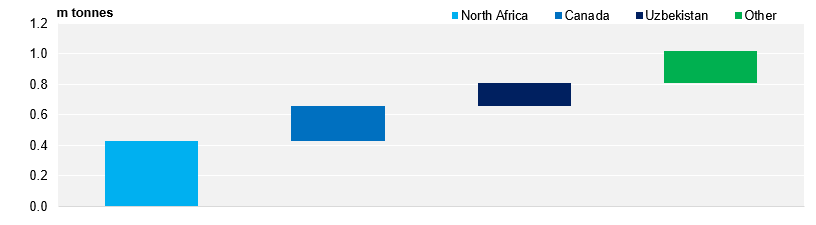

- Mexican exports have been displacing Brazilian VHPs into North Africa, Uzbekistan and Canada.

- We expect these homes to remain the key targets for Mexican sugar exporters, due to freight advantages and quality conditions.

Mexican 18/19 World Market Export Destinations

Going Forward: Farmer Support or HFCS Imports at Risk?

- The domestic industry remains disturbed by the market dynamics and new farmer strikes next season are possible.

- There have been numerous calls by the cane industry to impose a duty on HFCS imports and protect domestic sugar consumption and prices.

- The USA, the HFCS exporter into Mexico, has been an erratic trade partner and HFCS imports remain a hot topic.

- Smaller world market exports and better domestic prices will help this season, but going forward this is a problem that will need to be addressed.

US HFCS Exports to Mexico