Insight Focus

It is no secret that increased competition reduces prices. In the case of the US, we can see that fruit consumers have benefitted substantially from imports, which have kept a lid on domestic prices. Now, with the new tariffs, prices have to go up, particularly given the challenges faced by US orange growers.

Fresh Outpaces Frozen

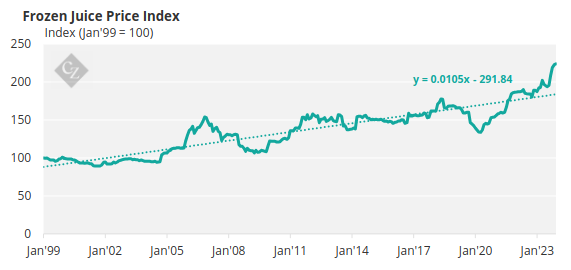

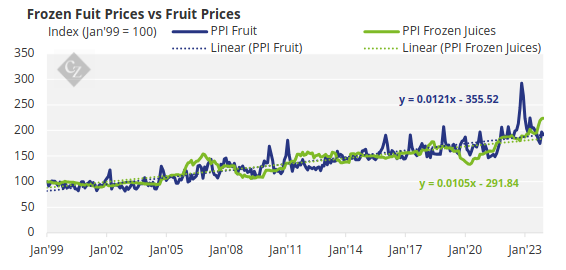

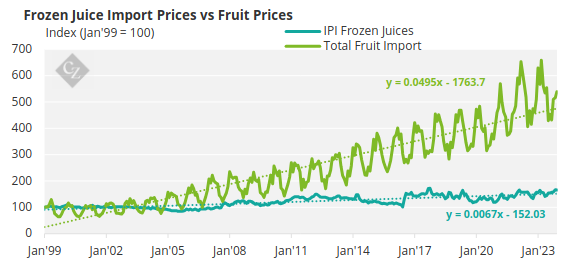

From January 1999 through December 2023, the producer price index for frozen juices (orange) has been rising at a rate of approximately 1.05% per month.

While that seems minor, keep in mind that this is across 300 months. During the same timeframe, the producer price index for fruits and vegetables in the US rose at an ever-so-slightly faster rate of 1.21%.

In other words, the primary input of frozen fruits and juices—fresh fruits and vegetables—have experienced inflation at a faster rate.

Imports Quell Price Rises

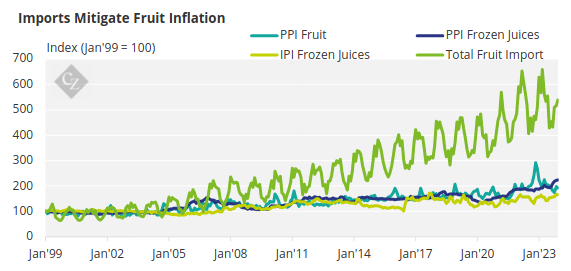

One of the factors that helped to reduce the rate of increase is imports. While total import of fruits (including frozen juices) increased during that time at a rate of 4.95% per month, the import price index during that time only rose by 0.67% per month.

What this means is that imported frozen juices have effectively served as keeping a lid on domestic prices of frozen juices despite cost inflation of our agricultural products.

Tariffs Will Push Up Juice Prices

Some early predictions: import of frozen juices will decrease, particularly from the EU region. US domestic producers will gain greater pricing power. Consumers will see overall higher prices as companies may not pass through more of their costs down to retail.

However, the bigger picture here is that US domestic production of fruits may not keep up with demand, thereby exacerbating inflationary pressure with sporadic shortages.

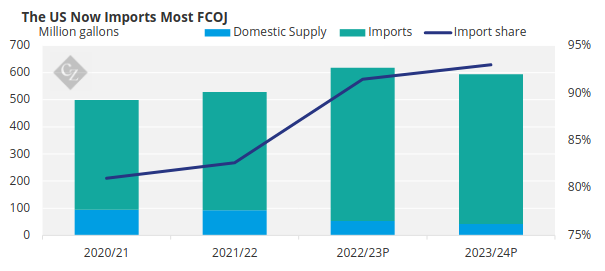

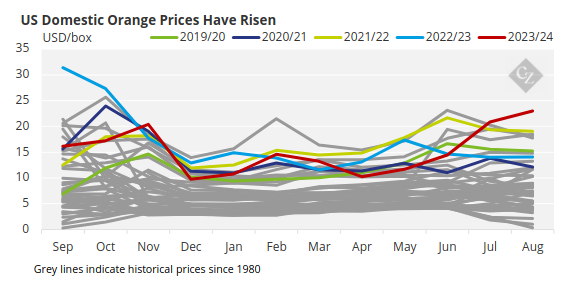

Let’s take the example of oranges. Already, the USDA has warned that imports make up a growing share of US citrus consumption as US growers have experienced challenging conditions and declining production.

As this has happened, domestic orange prices have risen strongly.

Source: USDA

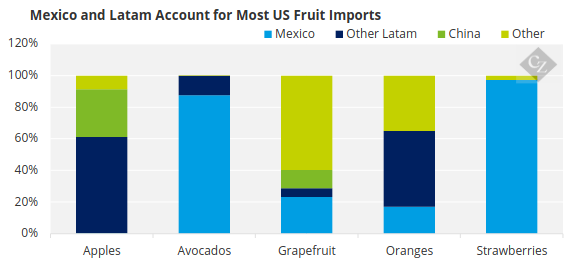

According to USDA data, most fresh fruit imported into the US comes from Mexico and the rest of Latin America. Given that Mexico can still export fruit to the US under the USMCA, these other countries will be at a significant disadvantage.

Source: USDA

Relying on a single country to continue supplying fruit to the US will add to the risk of shortages. And if the shortfall is made up by imports from these other countries, it is likely to be at a price premium.